The Bank of England is poised to raise interest rates for the first time since July 2007. Its monetary policy committee (MPC) will meet to decide on November 2. The MPC’s last vote on the issue was a 7-2 majority for maintaining current rates, but it’s only a matter of time before rates rise.

Initially, the rise will likely be from 0.25% to 0.5%. This may not sound like much, but it could have significant implications for the UK economy. Mark Carney, the bank’s governor, is facing an uncomfortable trade-off, mulling priorities of curbing inflation versus financial stability.

The reason for the rate rise is inflation, which has risen to its highest level since April 2012 (3%) – beyond the government’s target figure of 2%. This is a result of the Brexit vote in June 2016, which saw a precipitous drop in the pound, making imports more expensive and pushing up prices of everyday items.

A rise in interest rates should help stem this by boosting the value of the pound. For example, expectations of a rate increase last month prompted a temporary jump in the value of the pound of 1.5%. Plus, the central bank will be hoping that higher interest rates will encourage people to save – another method of curbing inflation – although any increases on savers’ rates will be negligible.

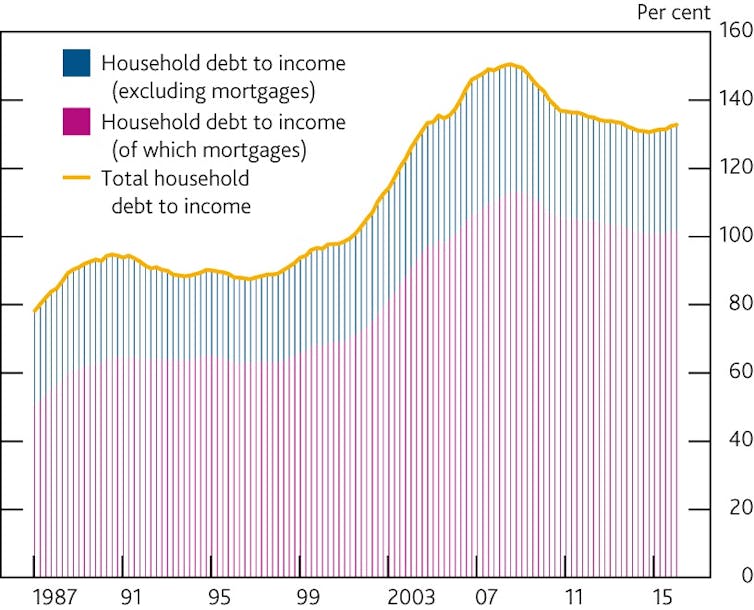

But, despite hints of a rise from Carney, the situation is not that simple. The long period of low interest rates has been accompanied by a worrying surge in consumer borrowing. Household debt exceeds 100% of household income and house prices are on an upward trajectory, climbing back to 2007 crisis levels.

Clearly, an interest rate increase would harm borrowers and may even harm financial stability if monthly repayments are no longer manageable and defaults rife.

UK household debt to income ratio. ONS and Bank of England calculations

With the average outstanding balance on a mortgage in the UK estimated to be close to £120,000 and, assuming repayment will take 15 years, the next graph shows estimated annual repayments for a variety of possible interest rate hikes.

What is worrying is that the Taylor rule (a popular interest rate forecasting tool) suggests that interest rates should be approximately 2% higher than they currently are. This would further squeeze household budgets and push the average repayments above £11,000 per year.

Stopping a car crash

Another area the Bank of England is keeping a close eye on is the way cars are financed. Many new cars are purchased on personal contract plans (PCPs) whereby they are paid for via monthly repayments – usually with zero or low upfront payments. A rise in interest rates could result in an awkward situation for car financiers if owners are unable to keep up with payments and decide to return their keys early.

With a glut of cars returning to the forecourt, as people reallocate resources to increasing mortgage and debt payments, the estimated residual values of the cars may prove inaccurate, leaving financiers (banks and car firms) with heavy losses. And it doesn’t stop there. The loans have been syndicated so there could be ripple effects through the financial system.

Headed for a crash? John Stillwell/PA Archive/PA Images

All in all, this sounds rather reminiscent of 2007, with the difference being that the asset here is a car that is depreciating in value as opposed to a house. Not surprisingly, the Bank of England is trying to reign in car financing to engineer a soft landing.

Slow and steady

On top of all this, there is the notably gloomy outlook for the UK economy to contend with. To keep growth on an upward trajectory, keeping interest rates low is still seen by some as a necessity, and some economists (notably Danny Blanchflower, a former MPC member) still advocate for this.

Unemployment is now at low levels not seen since the mid-1970s, which is music to the ears of cautious central bankers. Yet wage growth – a measure of longer term inflation – remains subdued, and “underemployment” (such as the part-time worker who really wants to work full time) still has some way to fall to get back to pre-crisis levels not withstanding recent drops.

This will ensure that any hikes in interest rates will be a drawn out process – to avoid frightening financial markets, which have grown accustomed to cheap central bank funds and loose monetary policy over the past decade.

Author: Johan Rewilak, Lecturer, Aston University