The Australian Financial Review featured some of our recent research on the problem of refinancing interest only loans (IO). Many IO loan holders simply assume they can roll their loan on the same terms when it comes up for periodic review. Many will get a nasty surprise thanks to now tighter lending standards, and higher interest rates. Others may not even realise they have an IO loan!

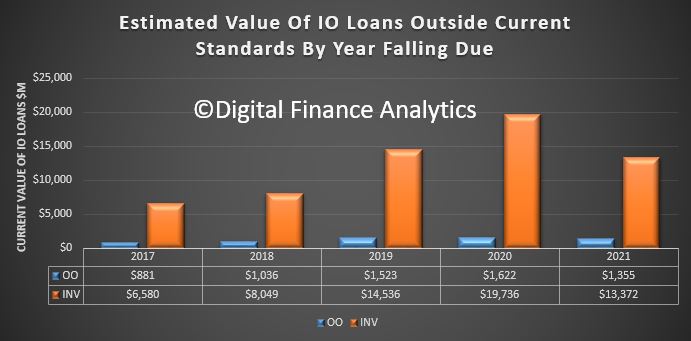

Thousands of home owners face a looming financial crunch as $60 billion of interest-only loans written at the height of the property boom reset at higher rates and terms, over the next four years.

Monthly repayments on a typical $1 million mortgage could increase by more than 50 per cent as borrowers start repaying the principal on their loans, stretching budgets and increasing the risk of financial distress.

DFA analysis shows that over the next few years a considerable number of interest only loans (IO) which come up for review, will fail current underwriting standards. So households will be forced to switch to more expensive P&I loans, assuming they find a lender, or even sell. The same drama played out in the UK a couple of years ago when they brought in tighter restrictions on IO loans. The value of loans is significant. And may be understated.

A few observations. ASIC in 2015, released a report that found lenders providing interest-only mortgages needed to lift their standards to meet important consumer protection laws. They identified a number of issues relating to bank underwriting practices. We would also make the point that despite the low losses on interest-only loans to date in Australia, in a downturn they are more vulnerable to credit loss.

A few observations. ASIC in 2015, released a report that found lenders providing interest-only mortgages needed to lift their standards to meet important consumer protection laws. They identified a number of issues relating to bank underwriting practices. We would also make the point that despite the low losses on interest-only loans to date in Australia, in a downturn they are more vulnerable to credit loss.

In April this year we addressed the problem of IO loans.

Lenders need to throttle back new interest only loans. But this raises an important question. What happens when existing IO loans are refinanced?

Less than half of current borrowers have complete plans as to how to repay the principle amount.

Interest-only loans may seem like a convenient way to reduce monthly repayments, (and keep the interest charges as high as possible as a tax hedge), but at some time the chickens have to come home to roost, and the capital amount will need to be repaid.

Many loans are set on an interest-only basis for a set 5-year or 10-year term, at which point the lender is required to reassess the loan and to determine whether it should be rolled on the same basis. Indeed, the recent APRA guidelines contained some explicit guidance:

For interest-only loans, APRA expects ADIs to assess the ability of the borrower to meet future repayments on a principal and interest basis for the specific term over which the principal and interest repayments apply, excluding the interest-only period

There is a strong correlation between interest-only and investment mortgages, so they tend to grow together. Worth reading the recent ASIC commentary on broker originated interest-only loans.

But if households are not aware they have IO loans in the first place, then this raises the systemic risks to a whole new level. The findings from the follow-up study by UBS, after their “Liar-Loans” report (using their online survey of 907 Australians who recently took out a mortgage – they claim a sampling error of just +/-3.18% at a 95% confidence level) are significant.

They say their survey showed that only 23.9% of respondents (by value) took out an interest only loan in the last twelve months. This compares to APRA statistics which showed that 35.3% of loan approvals in the year to June were interest only.

They believe the most likely explanation for the lack of respondents indicating they have IO mortgages is that many customers may be unaware that they have taken out an interest only mortgage. In fact, around 1/3 of interest only borrowers do not know that they have this style of mortgage.