New DFA research shows that women who are most vulnerable and under the most significant financial pressure are most likely to access payday services. Those that do are quite likely to take multiple loans.

DFA, in conjunction with Monash University published a report on households in financial stress last year using data from our household surveys. It was cited by ASIC in their review of debt advice services, published yesterday.

We have now completed an extension to the analysis, commissioned by Good Shepherd Microfinance, looking in particular at how women are using payday loans. This analysis is relevant to the SACC review currently underway. Payday lending is defined as loans of $2,000 or less for terms between 16 days and 12 months, in accordance with the National Consumer Credit Protection Act 2009 definition of a small amount credit contract.

Our analysis reveals that women are increasingly using payday loans, at growth rates above system. This is explained partly by a low initial penetration rate, greater financial need and autonomy, and greater availability and ease of online loans. We expect these growth rates to continue.

Not all women are equally likely to access payday loans. Those in challenging financial situations, with sole charge of children are most likely to use this form of credit, and often do so as a form of emergency cash for household expenses. Solo women without children are less likely to use payday loans, and when they do, it tends to be for a specific purpose such as car repairs. Finally, the behaviour of women in family units is closely aligned to the general population, and the decision to access payday is often either a joint decision or delegated to another family member.

1. Are women increasingly using payday lending in Australia?

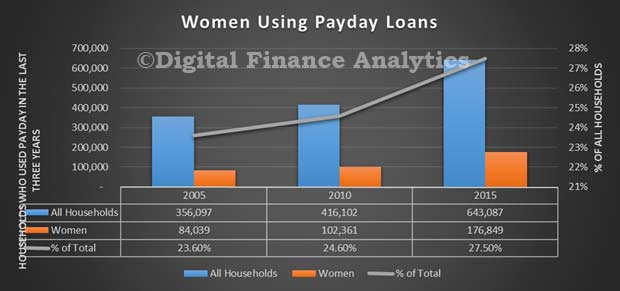

The short answer is “yes”; women are using payday lending more. In 2005 about 84,000 women had used payday lending, but this had grown to 177,000 in 2015, a 110% rise compared to growth in the total industry in Australia of 80% over the same period. Transactions initiated by women as the decision maker, whether in a family or other context, comprised about 27% of all payday loans in 2015.

Our analysis segments Australian households into various groups in order to identify those that are financially stressed (with a subset defined as financially distressed).

Our analysis segments Australian households into various groups in order to identify those that are financially stressed (with a subset defined as financially distressed).

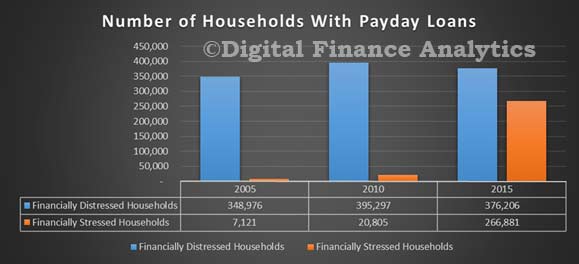

Financially stressed households are generally coping with their current financial situation (even if using unconventional means), while financially distressed households are not. By coping, we mean for example, short term borrowing from family, friends, or payday loans, as well as juggling multiple credit cards, moving debts from one credit source to another and deliberately making late payments. The distinction between financially stressed and financially distressed households is important, because the spectrum of financially stressed households in Australia using payday lending facilities has broadened significantly since 2005. During the period of analysis (and as shown in our original report) the rise in loans to financially distressed households grew only slightly, but there was a significant rise in the volume of loans made to financially stressed households. These classifications of households are, of course, dynamic, with financially stressed households moving into a position of distress and vice versa.

Financially stressed households are generally coping with their current financial situation (even if using unconventional means), while financially distressed households are not. By coping, we mean for example, short term borrowing from family, friends, or payday loans, as well as juggling multiple credit cards, moving debts from one credit source to another and deliberately making late payments. The distinction between financially stressed and financially distressed households is important, because the spectrum of financially stressed households in Australia using payday lending facilities has broadened significantly since 2005. During the period of analysis (and as shown in our original report) the rise in loans to financially distressed households grew only slightly, but there was a significant rise in the volume of loans made to financially stressed households. These classifications of households are, of course, dynamic, with financially stressed households moving into a position of distress and vice versa.

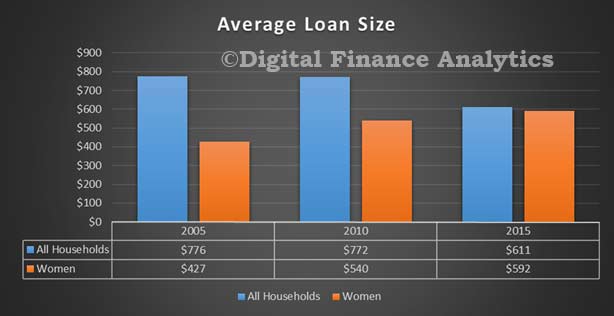

Across the general population, the average size of an individual payday loan fell between 2005 and 2015 from $776 to $611. Yet if we look at payday loans to women, the average loan made rose significantly from $427 in 2005 to $592 in 2015.

There are a number of reasons that may explain this. First, the proportion of loans to women has increased between 2005 and 2015. Second, more independent women are getting loans. Third, lenders have changed their lending criteria. Fourth, women have greater need of financial assistance and are borrowing more. Further research would be required to determine which of these factors have been most influential.

We conclude that women are more likely to use a payday loan today. They are able to access funds on-line, with lenders using on-line channels to attract households in less severe financial difficulty.

We conclude that women are more likely to use a payday loan today. They are able to access funds on-line, with lenders using on-line channels to attract households in less severe financial difficulty.

Some women in financial need have limited alternate options. We explore this later.

2. What are the household characteristics of women who use payday lending in Australia?

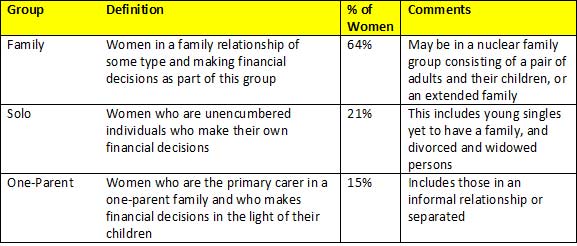

To answer this question, we have identified three discrete groups within which women may reside. Each has different drivers and needs, and uses payday lending to different degrees. This segmentation is based on analysis from our household surveys and is tailored specifically for this paper.

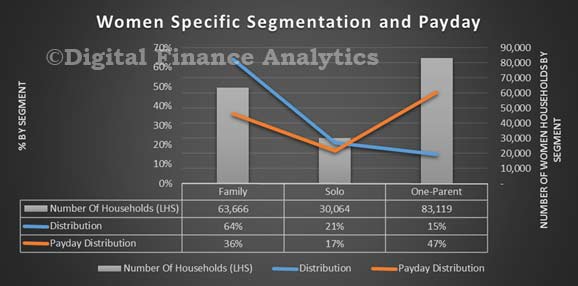

Using this segmentation, we can now overlay the payday lending data statistics from our surveys.

Using this segmentation, we can now overlay the payday lending data statistics from our surveys.

Of those women using payday lending in 2015, 47% came from the one-parent family segment, a much higher level than the 15% distribution of households with a single female parent across the general population. Conversely, while 64% of the general population falls within the family segment, the percentage of women using payday loans from this segment was only 36%.

Of those women using payday lending in 2015, 47% came from the one-parent family segment, a much higher level than the 15% distribution of households with a single female parent across the general population. Conversely, while 64% of the general population falls within the family segment, the percentage of women using payday loans from this segment was only 36%.

3. How are women using payday lending in Australia?

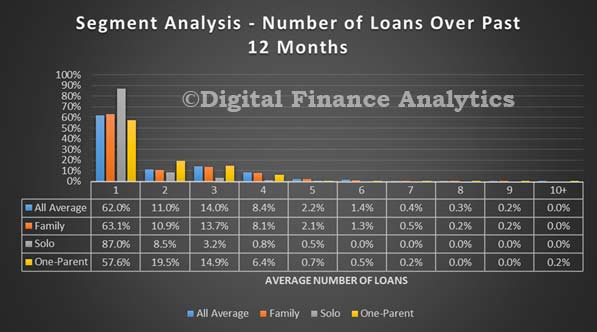

Segmental analysis shows that one-parent women are more likely to have multiple loans over the last twelve months, compared with other female segments and the general population. Conversely, single women without children are most likely to have just one loan (87%), compared with general population (62%).

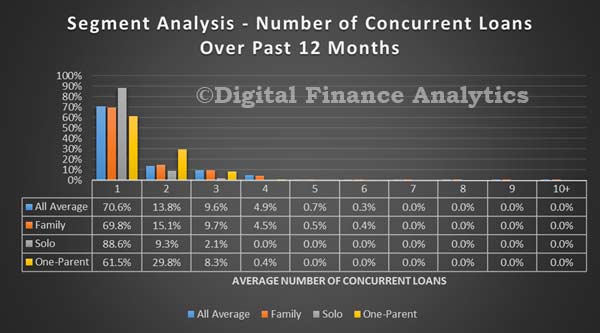

We find that one-parent women are more likely to have multiple concurrent loans, compared with other female segments and the general population.

We find that one-parent women are more likely to have multiple concurrent loans, compared with other female segments and the general population.

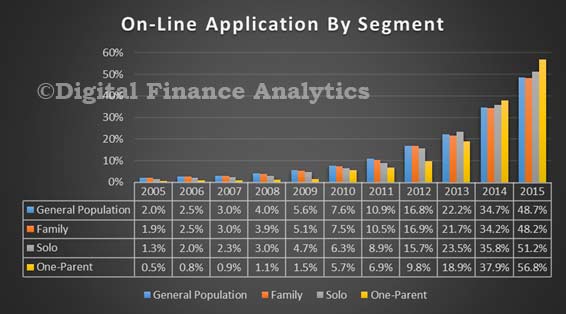

On-line origination has become a predominant industry feature, and one-parent women are now the most likely segment to use this channel, thanks to the emergence of easy to use on-line apps.

On-line origination has become a predominant industry feature, and one-parent women are now the most likely segment to use this channel, thanks to the emergence of easy to use on-line apps.

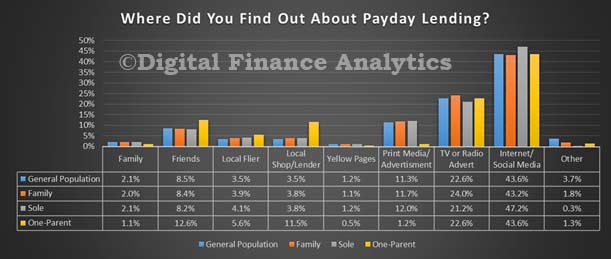

We found broadly similar patterns of awareness of payday lending across the various segments, although families with a single female parent were far more likely to use a local shop or lender than the average, and were significantly more influenced by friends.

We found broadly similar patterns of awareness of payday lending across the various segments, although families with a single female parent were far more likely to use a local shop or lender than the average, and were significantly more influenced by friends.

4. What are the motivations and drivers of women using payday lending in Australia?

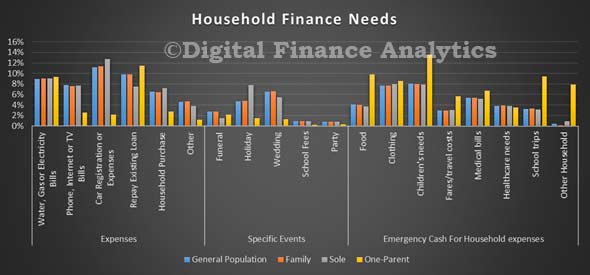

Our segmental analysis highlights that families with a single female parent are more likely to use payday loans to cover emergency cash for household expenses compared with the general population, or other female segments. Solo women are more likely to use payday loans for car expenses and other one-off items rather than emergency cash scenarios. The family segment mirrors the broader population.

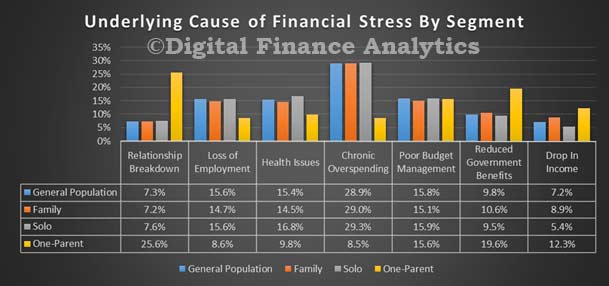

We now turn to the underlying reason why a household is in financial difficulty. A range of drivers is found in the sample. Once again, women in one-parent roles stand out from the general population, as they are more likely to get into difficulty because of a relationship breakdown (25%) and are experiencing a reduction in available government benefits. These women are less impacted by loss of employment than other segments and the general population.