The Senate will review the regulatory environment surrounding payday lenders and consumer leasing businesses and also buy now, pay later schemes such as Afterpay. The scope will likely also include debt negotiation firms and credit repair agencies, who offer “services” which are unregulated and often costly.

Given the high and rising levels of household debt and mortgage stress, and the fact that this area is not caught within the current Royal Commission, it makes sense for it to be examined, assuming appropriate regulatory intervention follows.

This is the latest in a string of reviews which seem to go nowhere. After the previous inquiry, the Small Amount Credit Contract and Consumer Lease Reforms bill from 2015 would have introduced a cap on leases equal to the base price of the good plus 4 per cent a month and only allow leases and short-term loans to account for 10 per cent of a customer’s net income. The recommendations were broadly accepted in 2016. But five ministers and more than 1000 days later, nothing has changed. People are getting more into debt, and the growth in the alternative lending sector continues.

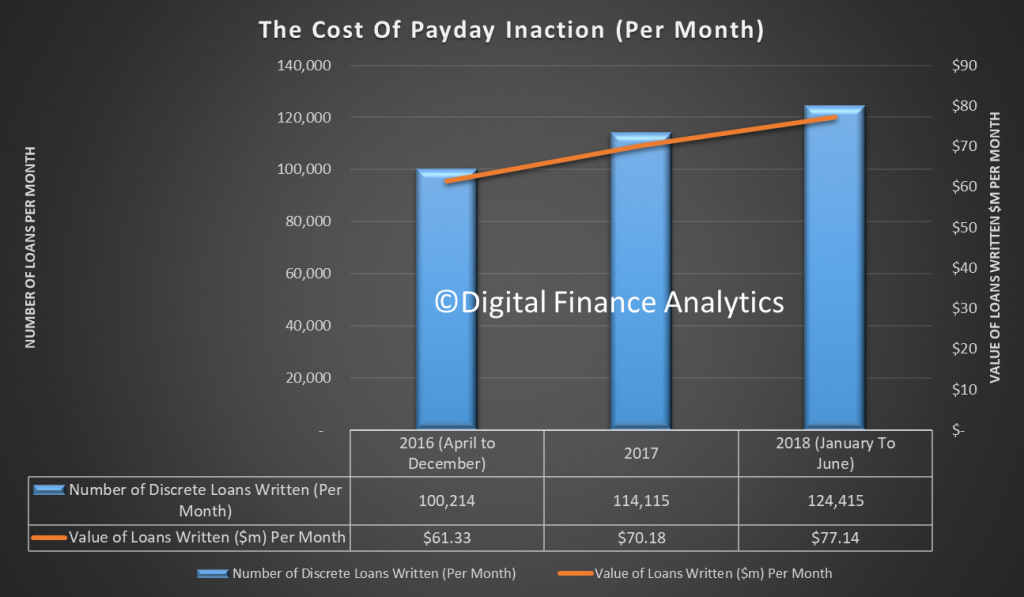

We estimated the cost of this inaction in an earlier post.

Since the Government released the report of the Independent Panel’s Review of the Small Amount Credit Contract Laws in April 2016, three million additional loans have been written, worth an estimated $1.85 billion and taken by some 1.6 million households.

In that time, around one fifth of borrowers or around 332,000 households, were new payday borrowers.