According to Moody’s, on 10 April, Bank of Ireland Group plc, the holding company of Bank of Ireland, announced that it had entered a securitization agreement involving €370 million of legacy nonperforming buy-to-let mortgages. The transaction, which is scheduled to close on 18 April, is credit positive because it will reduce the bank’s problem loans ratio and modestly

improve asset risk, which remains a constraint on the bank’s standalone credit strength.

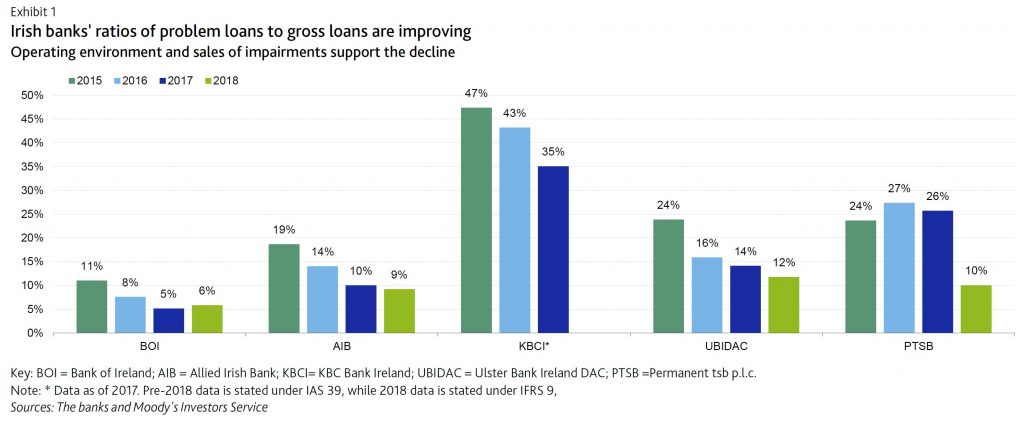

They estimate that following the transaction, the bank’s ratio of problem loans to gross loans will improve to 5.4% from 5.9% as of year end 2018, a step closer to European Central Bank guidance of 5%. The bank is on track to achieve the 5% nonperforming exposure target by end of this year. As of year-end 2018, the bank’s domestic peers reported problem loan ratios of 5.9%-11.9%, with BOI having the strongest ratio.

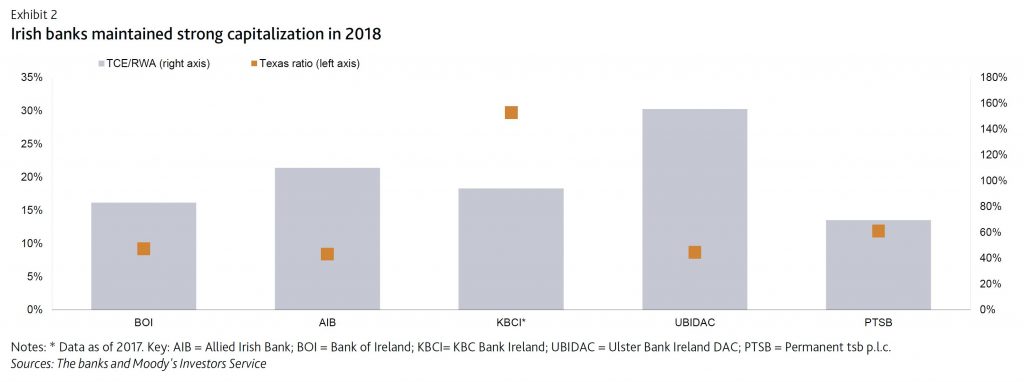

The transaction will boost BOI’s ratio of tangible common equity (TCE) to risk-weighted assets (RWAs) by 30 basis points from the 18.3% it reported for 2018 owing to the reduction in RWAs. The transaction will also improve the bank’s Texas ratio, the ratio of problem loans to loan-loss reserves and TCE, to 40% from 44% in 2018, which is one of the strongest among its peers.

Overall, these improvements strengthen BOI’s solvency and provide an improved base to support new lending. Moody’s expecst Ireland’s operating environment to remain supportive over the next 12-18 months, and that new lending will outweigh bad loan sales, leading to modest growth in the bank’s overall loan book this year.

The securitization of the impaired loans is an alternative to a direct sale, and allows BOI to maintain the customer relationship as the mortgage servicer. So far, in other impaired-loan securitizations, the originator has not stayed on as mortgage servicer. The BOI assets are notionally impaired performing loans which generate good predictable cashflows, and will typically not require active management, making them suitable for securitization.

In Ireland, banks must give borrowers at least 60 days’ notice before a change of servicer can can take place, and the transaction cannot close until this period has elapsed. During this period, the bank retains the assets on its balance sheet. However, since BOI is continuing to service the securitized loans, this notice period is not required, and NPL reduction is recognized the day the deal closes.

The sale of owner-occupied nonperforming mortgage loans has attracted close political scrutiny in Ireland amid claims that debt purchasers have taken a more aggressive approach to borrowers in arrears, including repossessing properties, than traditional banks.

However, Permanent tsb p.l.c. and Ulster Bank Ireland DAC last year each successfully completed sales of NPL portfolios backed by residential mortgages that helped reduce their legacy impairments. Allied Irish Banks,

p.l.c. recently announced an agreement to sell a pool of nonperforming mortgages that are primarily investment properties. Irish banks have been taking solid steps to reduce their impaired assets we expect this to continue, resulting in improving asset risk for the sector.