CBA released their 3Q18 trading update today. They announced an unaudited statutory net profit of approximately $2.30bn, in the quarter and unaudited cash net profit of approximately $2.35bn in the quarter. This is down 9% on an underlying basis compared with 1H18.

We see some signs of rising consumer arrears, and a flat NIM (stark contrast to WBC earlier in the week!). Expenses were higher due to provisions for regulatory and compliance.

The APRA imposed increase Operational Risk regulatory capital by $1 billion (RWA of $12.5 billion) was effective 30 April 2018 and the pro-forma impact on the CET1 ratio as at 31 March 2018 is a decrease of 27 basis points, to 9.8%.

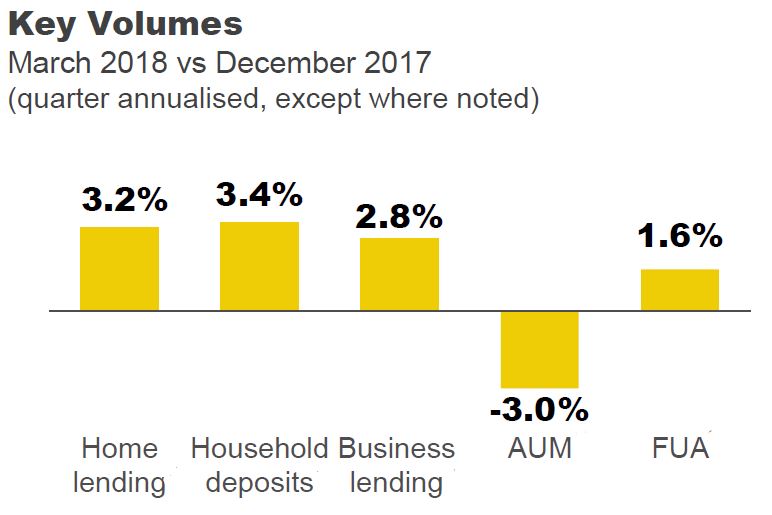

Underlying operating income decreased by 4%. Excluding the impact of two fewer days in the quarter (approximately $100m), net interest income was broadly flat. Volume growth was offset by a slight decline in Group Net Interest Margin due to customer switching from interest only to principal and interest home loans, as well as higher basis risk. Other banking income was lower driven by lower treasury and trading performance, and seasonally lower card fee income.

Underlying operating expense increased by 3%, driven by increased provisions for regulatory and compliance project spend.

Underlying operating expense increased by 3%, driven by increased provisions for regulatory and compliance project spend.

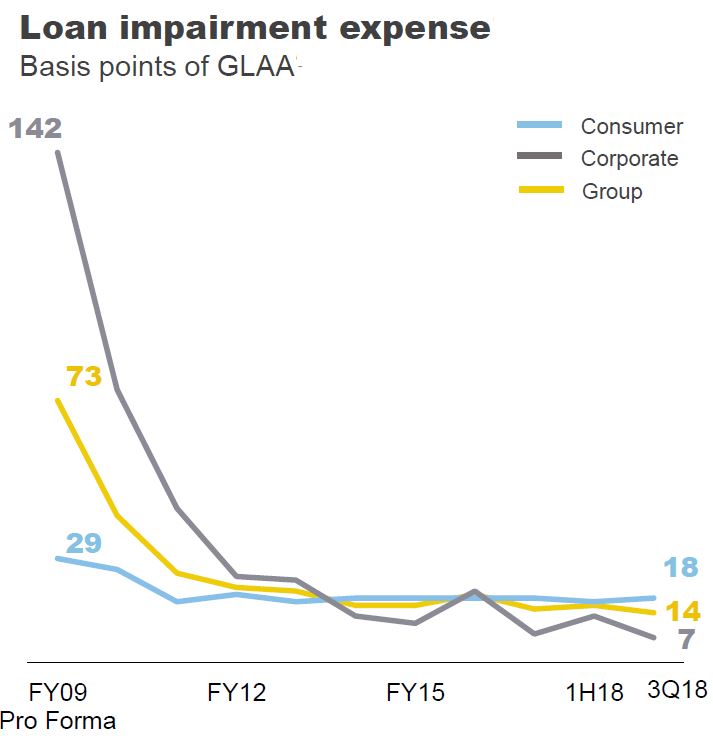

CBA says the credit quality of the Group’s lending portfolios remained sound. Loan Impairment Expense of $261 million in the quarter equated to 14 basis points of Gross Loans and Acceptances, compared to 16 basis points in 1H18.

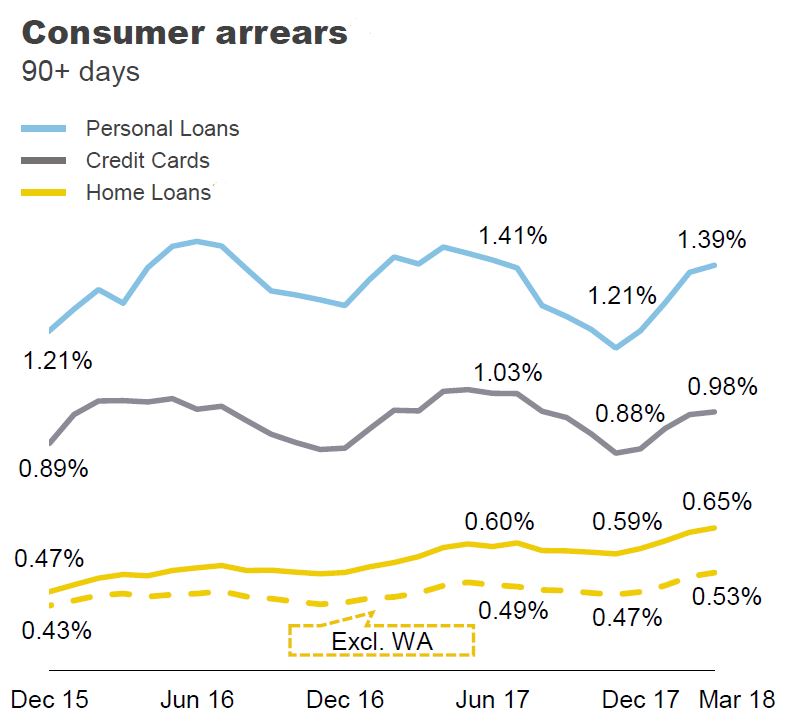

Consumer arrears were seasonally higher in the quarter. There has been an uptick in home loan arrears, influenced by a small number of customers experiencing difficulties with rising essential costs and limited income growth.

Consumer arrears were seasonally higher in the quarter. There has been an uptick in home loan arrears, influenced by a small number of customers experiencing difficulties with rising essential costs and limited income growth.

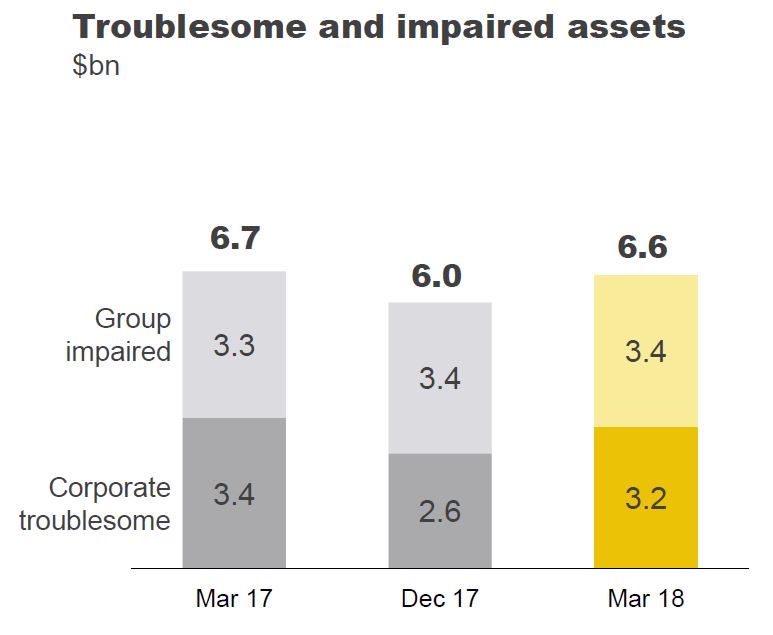

Troublesome and impaired assets increased to $6.6 billion. A small number of credits drove the increase in troublesome exposures over the quarter, with impaired assets stable.

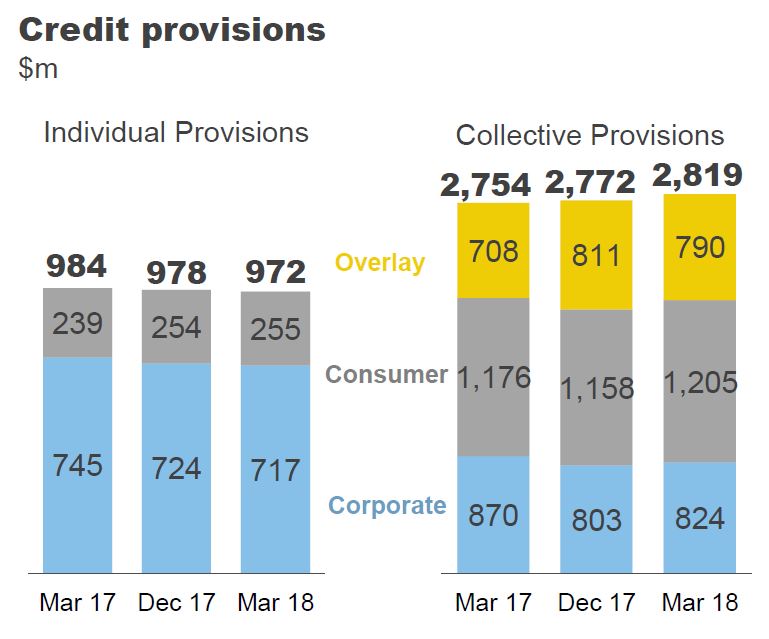

Prudent levels of credit provisioning were maintained, with Total Provisions at approximately $3.8 billion. Overall collective provisions rose.

Prudent levels of credit provisioning were maintained, with Total Provisions at approximately $3.8 billion. Overall collective provisions rose.

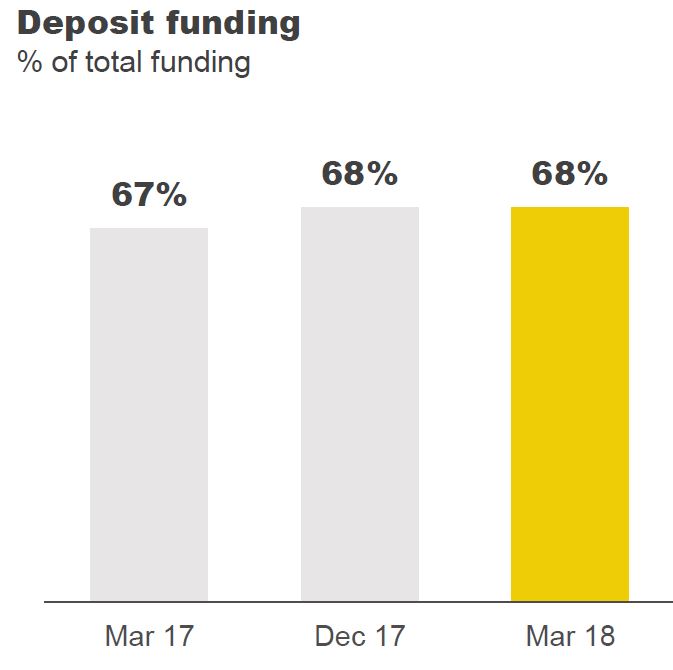

Funding and liquidity positions remained strong, with customer deposit funding at 68%

Funding and liquidity positions remained strong, with customer deposit funding at 68%

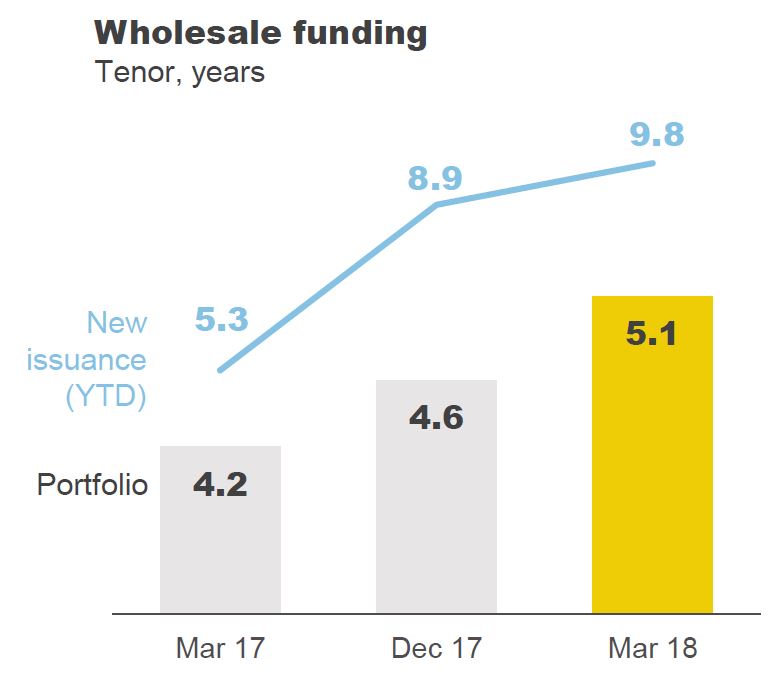

The average tenor of the long term wholesale funding portfolio at 5.1 years. The Group issued $10.2 billion of long term funding in the quarter.

The average tenor of the long term wholesale funding portfolio at 5.1 years. The Group issued $10.2 billion of long term funding in the quarter.

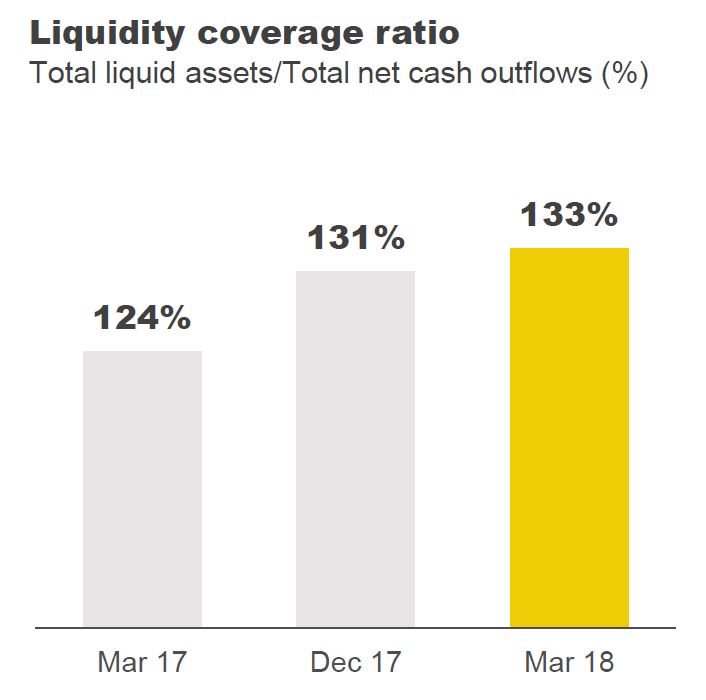

The Net Stable Funding Ratio (NSFR) was 111% at March 2018, up from 110% at December 2017. The Liquidity Coverage Ratio (LCR) increased to 133% as at March 2018, driven by higher liquid assets (up approximately $5 billion in the quarter to $144 billion13).

The Net Stable Funding Ratio (NSFR) was 111% at March 2018, up from 110% at December 2017. The Liquidity Coverage Ratio (LCR) increased to 133% as at March 2018, driven by higher liquid assets (up approximately $5 billion in the quarter to $144 billion13).

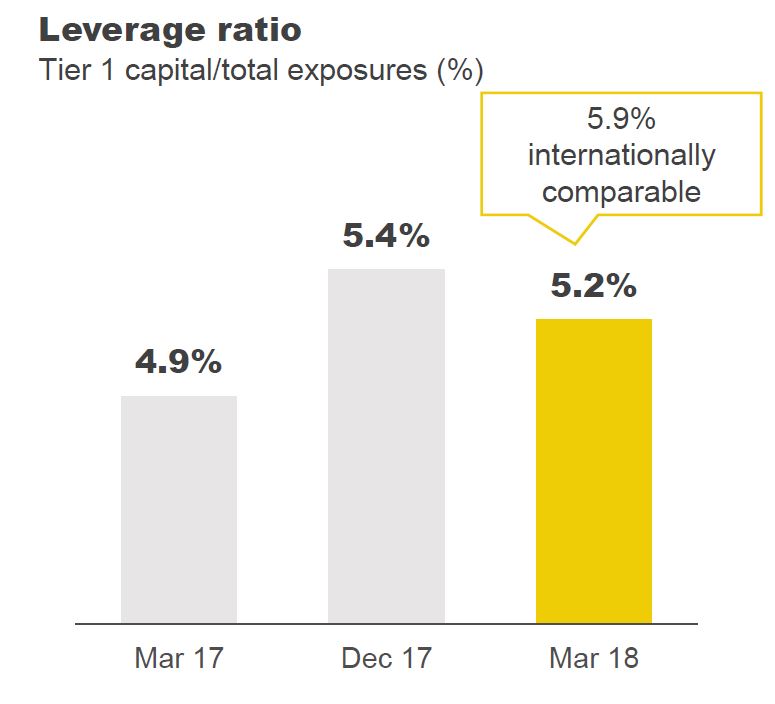

The Group’s Leverage Ratio was 5.2% on an APRA basis and 5.9% on an internationally comparable basis, 20 basis points lower than December 2017, primarily reflecting the impact of the 2018 interim dividend.

The Group’s Leverage Ratio was 5.2% on an APRA basis and 5.9% on an internationally comparable basis, 20 basis points lower than December 2017, primarily reflecting the impact of the 2018 interim dividend.

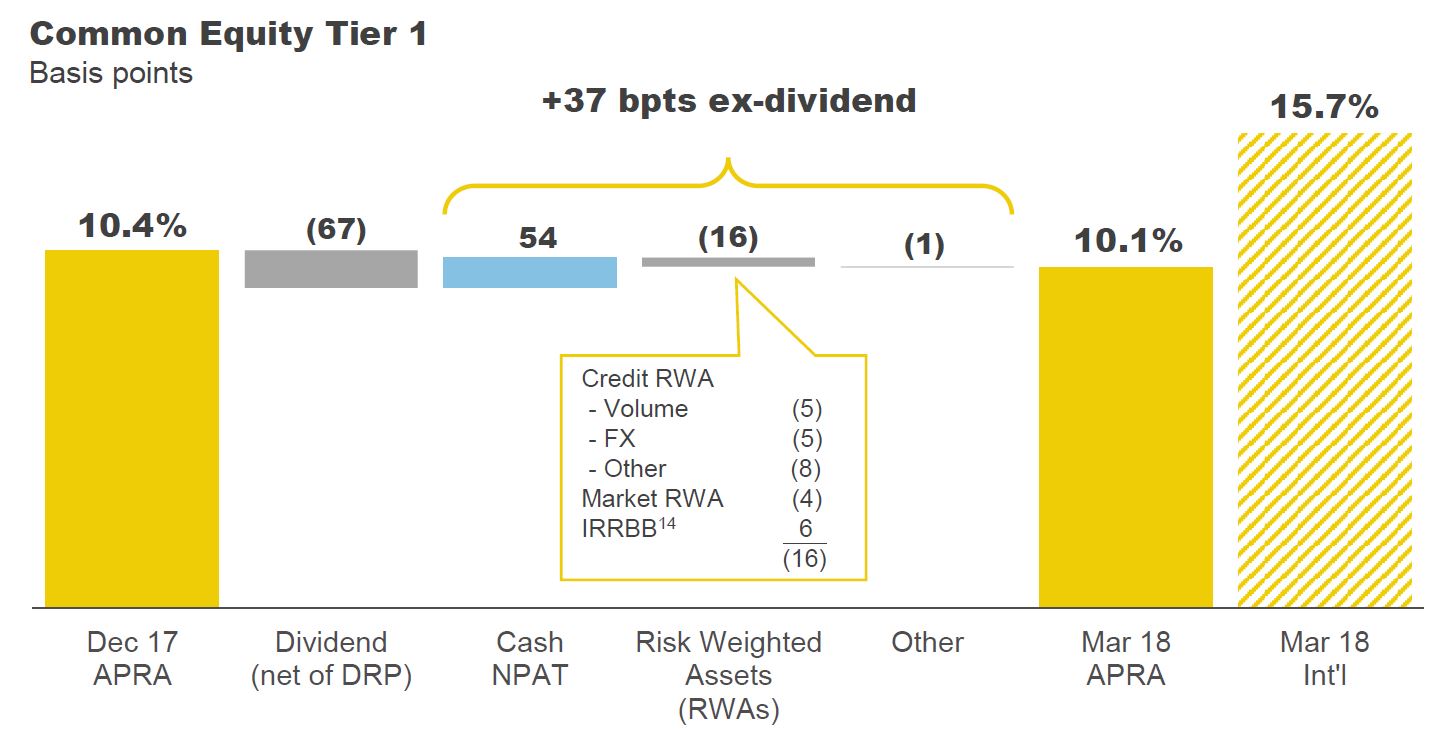

CET1 (APRA) ratio at 10.1%, up 37 bpts since Dec 17 after allowing for payment of the 2018 interim dividend

CET1 (APRA) ratio at 10.1%, up 37 bpts since Dec 17 after allowing for payment of the 2018 interim dividend

After allowing for the impact of the 2018 interim dividend (which included the issuance of shares in respect of the Dividend Reinvestment Plan), CET1 increased 37 basis points in the quarter. This was driven by capital generated from earnings, partially offset by higher Risk Weighted Assets.

After allowing for the impact of the 2018 interim dividend (which included the issuance of shares in respect of the Dividend Reinvestment Plan), CET1 increased 37 basis points in the quarter. This was driven by capital generated from earnings, partially offset by higher Risk Weighted Assets.

Credit Risk Weighted Assets were higher in the quarter (-18 basis points), reflecting a combination of volume and foreign exchange movements, credit quality and regulatory changes.

The final tranche of Colonial debt ($315m) is due to mature in the June 2018 quarter, with an estimated CET1 impact of -7 basis points.

The Group will adopt AASB 9 on 1 July 2018. The impact will be recognised in opening retained earnings. The Group’s estimate of the pro-forma impact of AASB 9 as at 1 January 2018 is an increase in collective provisions of approximately $1,050 million (before tax) and a reduction in the CET1 ratio of approximately 26 basis points. This reflects the revised treatment of the General Reserve for Credit Losses as advised by APRA.

On 1 May 2018, APRA released the findings of the Prudential Inquiry into CBA. APRA requires CBA to increase Operational Risk regulatory capital by $1 billion (RWA of $12.5 billion). This adjustment is effective 30 April 2018, being the date the Group entered into an Enforceable Undertaking with APRA which states that CBA may apply for the removal of the adjustment only on meeting certain conditions. The pro-forma impact on the CET1 ratio as at 31 March 2018 is a decrease of 27 basis points, to 9.8%.

The sale of the Group’s Australian and New Zealand life insurance operations is expected to be completed in the December 2018 half year (subject to regulatory approvals) resulting in an uplift to the CET1 ratio of approximately +70 basis points.