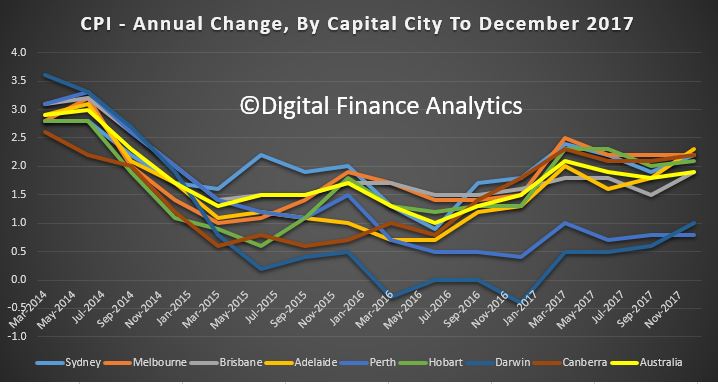

The Consumer Price Index (CPI) rose 0.6 per cent in the December quarter 2017, the latest Australian Bureau of Statistics (ABS) figures reveal. Annual inflation in most East Coast cities rose above 2.0 per cent, due in part to the strength in prices related to Housing.

This follows a rise of 0.6 per cent in the September quarter 2017. However, there were some changes in methodology which may have impacted the results.

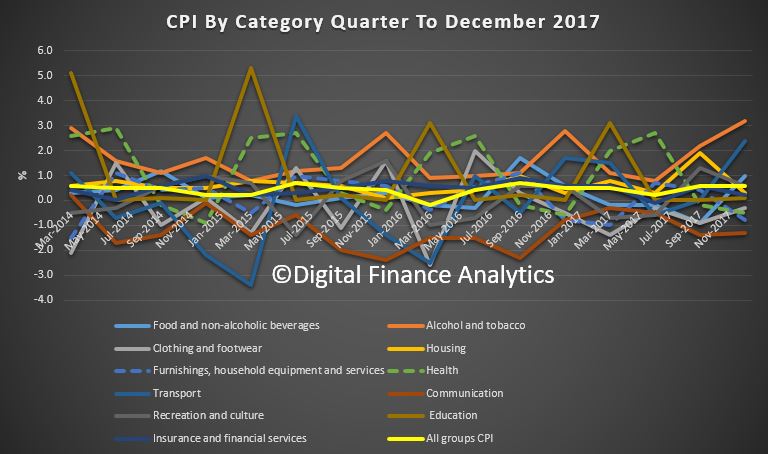

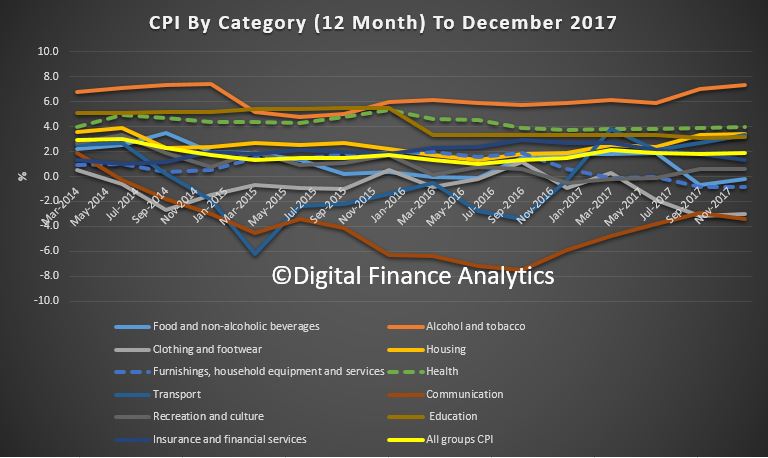

The most significant price rises this quarter are automotive fuel (+10.4%), tobacco (+8.5%), domestic holiday travel and accommodation (+6.3%) and fruit (+9.3%). These price rises were partially offset by falls in international holiday travel and accommodation (-1.7%), audio visual and computing equipment (-3.5%) and telecommunication equipment and services (-1.4%).

The CPI rose 1.9 per cent through the year to December quarter 2017 having increased 1.8 per cent through the year to September quarter 2017.

Chief Economist for the ABS, Bruce Hockman, said “While the annual CPI rose 1.9 per cent, annual inflation in most East Coast cities rose above 2.0 per cent, due in part to the strength in prices related to Housing. Softer economic conditions in Darwin and Perth have resulted in annual inflation remaining subdued at 1.0 and 0.8 per cent respectively.”

The ABS periodically reviews the CPI expenditure weights to ensure they are representative of household spending patterns on goods and services. This quarter the ABS has introduced new expenditure weights based on information sourced from the ABS Household Expenditure Survey.

In addition, this quarter the ABS has also implemented methodological changes to maximise the use of transactions data to compile the CPI. Implementation follows a period of extensive research and expert peer review, including from Professor Kevin Fox of UNSW Sydney. Professor Fox said “I strongly support the ABS decision to implement new CPI methods for the treatment of transactions data. The ABS has made a convincing case for implementation following an extended period of research. These new methods will enhance the accuracy of the Australian CPI, provide additional analytics and better inform policy formulation.”