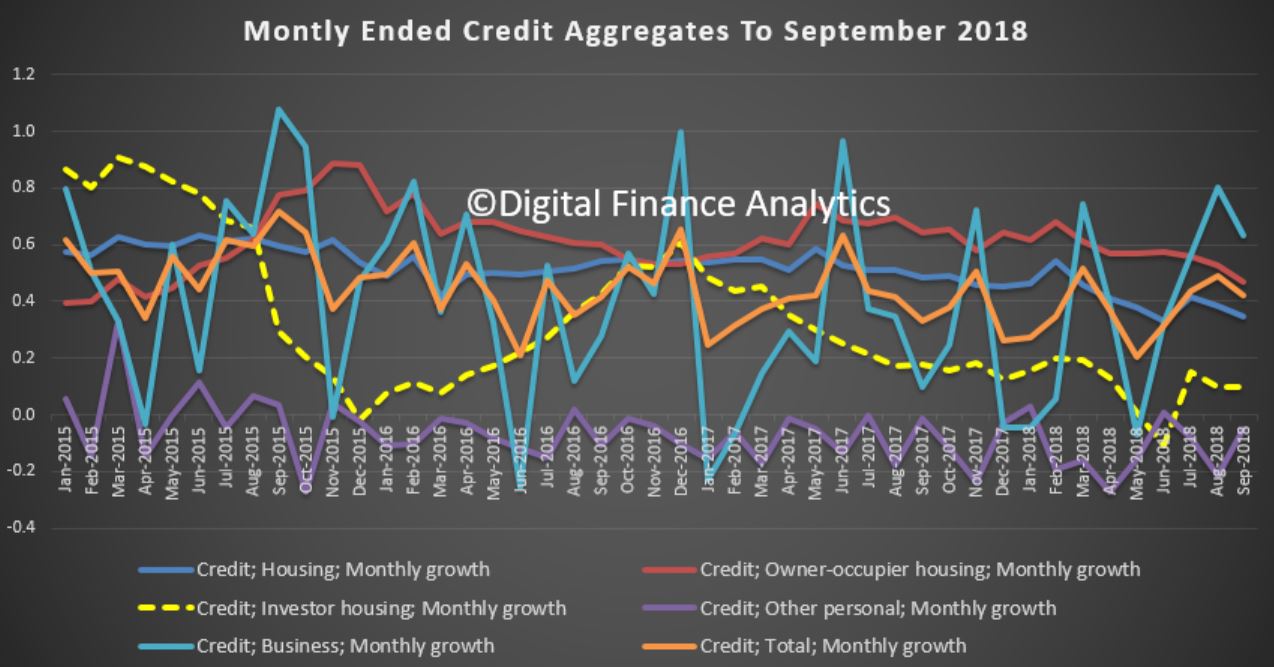

The latest Credit Aggregates from the RBA to September 2018 continues to show an easing of credit growth. Total credit, across all categories rose seasonally adjusted by $14.41 billion or 0.5%, to $2.8 trillion.

Within that owner occupied lending rose 0.5% or $5.5 billion to $1.19 trillion while investment lending rose 0.1% or $0.52 billion to $593 billion. Other personal lending was flat, and business lending rose 0.9% to $943 billion, up $8.4 billion.

Investor loans fell again to 33.1% of all housing lending, while business lending rose a little to 32.7% of all lending.

Investor loans fell again to 33.1% of all housing lending, while business lending rose a little to 32.7% of all lending.

The monthly movements are still noisy…

… but the 12 month ended data shows how investor lending continues to slow, owner occupied lending growth is slowing, and overall lending for housing growth is slowing to 5.2%.

… but the 12 month ended data shows how investor lending continues to slow, owner occupied lending growth is slowing, and overall lending for housing growth is slowing to 5.2%.

This is a problem for the banks in that to maintain profitability as assets grow, they need the rate of growth of housing loans to RISE not slow down. Even at these levels (with some growth) household debt will rise relative to loans, so again it highlights the fundamental problem we have in the system at the moment.

This is a problem for the banks in that to maintain profitability as assets grow, they need the rate of growth of housing loans to RISE not slow down. Even at these levels (with some growth) household debt will rise relative to loans, so again it highlights the fundamental problem we have in the system at the moment.

Lending in the less regulated Non bank sector still appears to be growing more strongly than ADI lending.