The 2018 results from the Federal Reserve bank stress testing are out, and as normal they include the results for all 35 named institutions, a laudable degree of transparency compared with the Australian version!

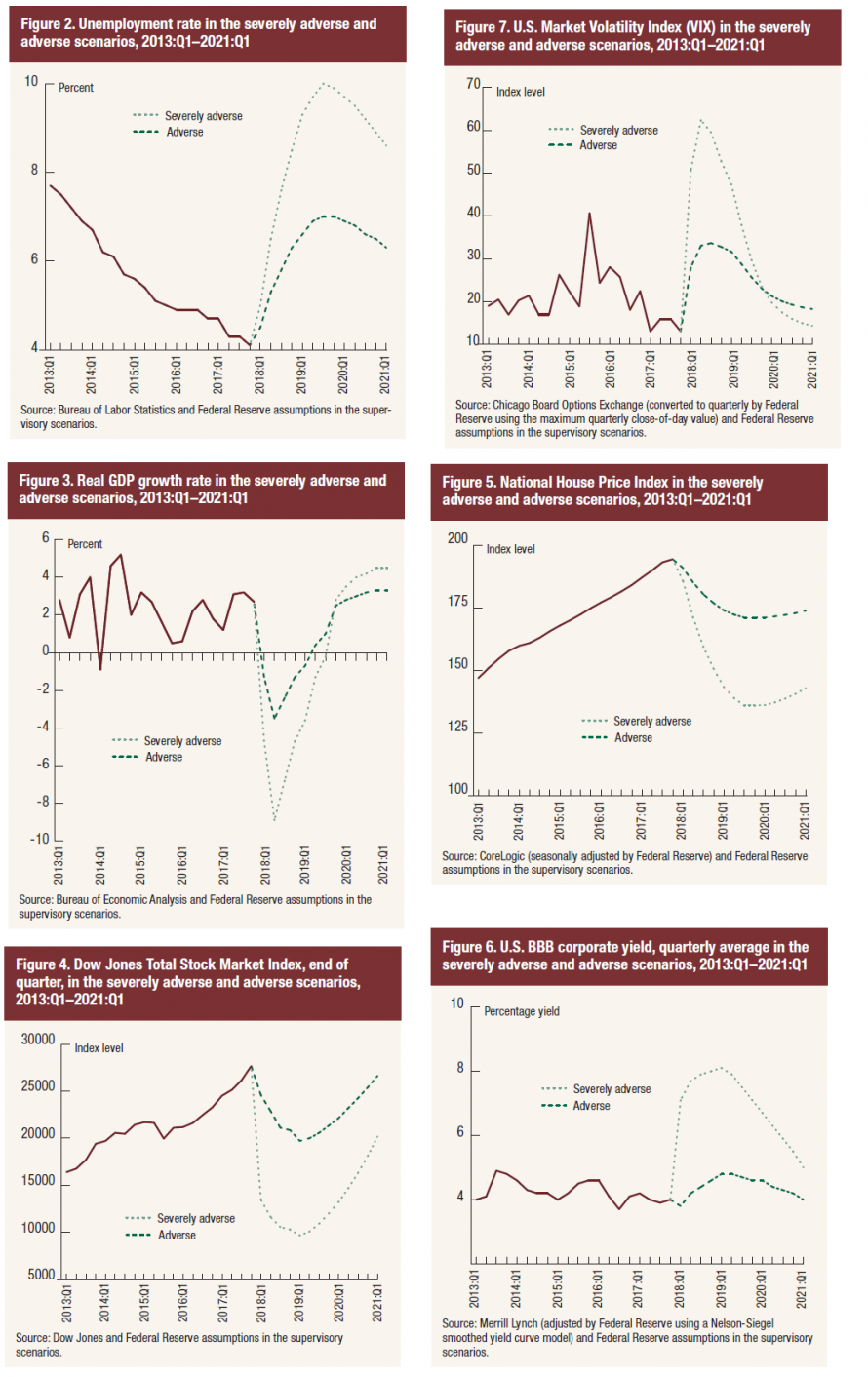

The Fed says that all 35 Banks will be fine, even if stocks crash by 65%, the volatility index reaches 60, home prices fall 30% and commercial real estate drops 40% all at the same time.

The Fed says that all 35 Banks will be fine, even if stocks crash by 65%, the volatility index reaches 60, home prices fall 30% and commercial real estate drops 40% all at the same time.

They say that in the aggregate, the 35 firms would experience substantial losses under both the adverse and the severely adverse scenarios but could continue lending to businesses and households, due to the substantial accretion of capital since the financial crisis. So that’s alright then…

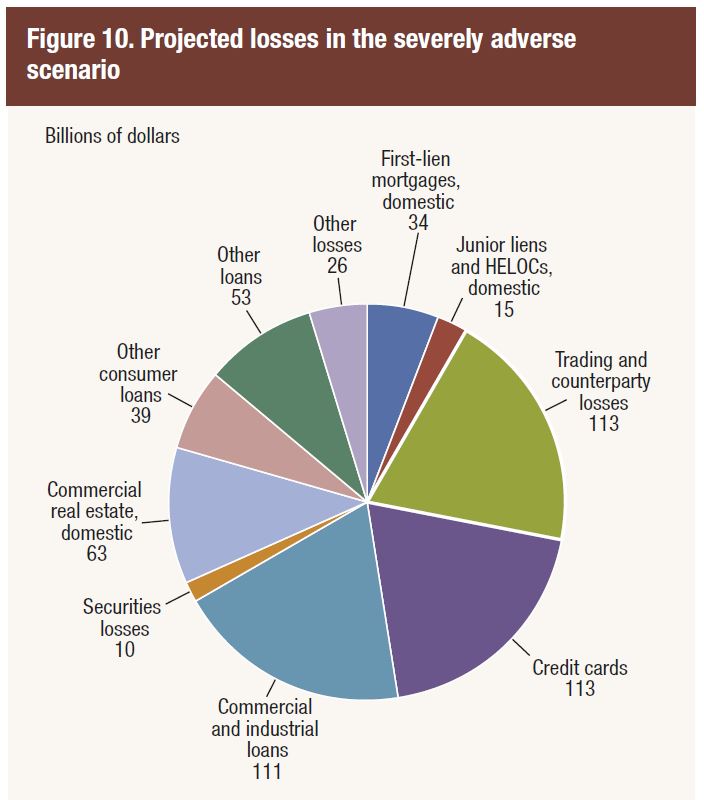

Aggregate losses at the 35 firms under the severely adverse scenario are projected to be US$578 billion and the net income before taxes is projected to be −US$139 billion.

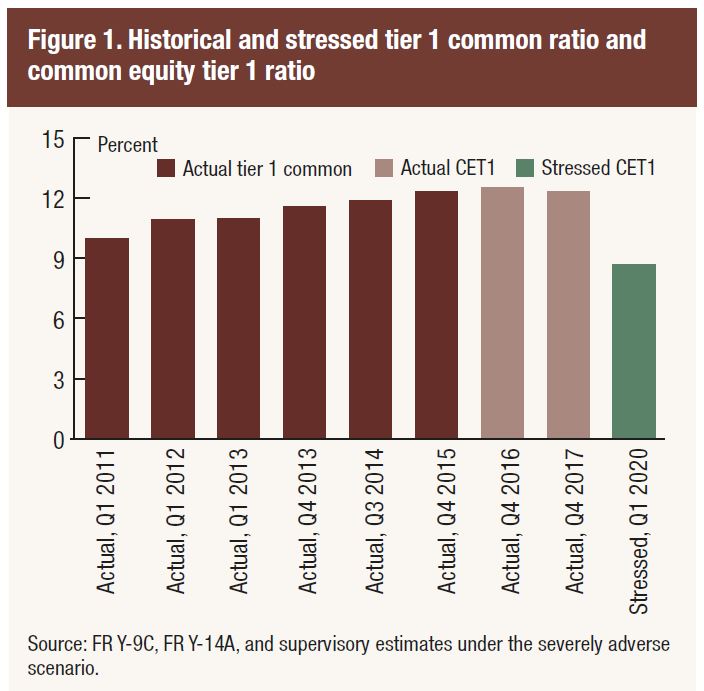

The aggregate Common Equity Tier 1 (CET1) capital ratio would fall from an actual 12.3 percent in the fourth quarter of 2017 to its minimum of 7.9 percent over the planning horizon. Since 2009, the 35 firms have added about $800 billion in common equity capital.

The aggregate Common Equity Tier 1 (CET1) capital ratio would fall from an actual 12.3 percent in the fourth quarter of 2017 to its minimum of 7.9 percent over the planning horizon. Since 2009, the 35 firms have added about $800 billion in common equity capital.

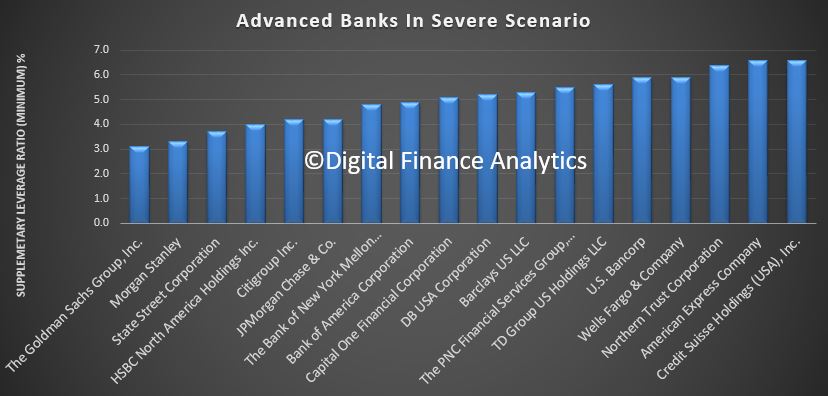

Goldman Sachs ended up with a Tier 1 minimum supplementary leverage ratio (SLR) of 3.1, just exceeding the required 3.0 minimum the Fed set for its annual capital plan, the lowest among participating banks. However, Morgan Stanley was next, at 3.3, then State Street at 3.7. The others were above 4.

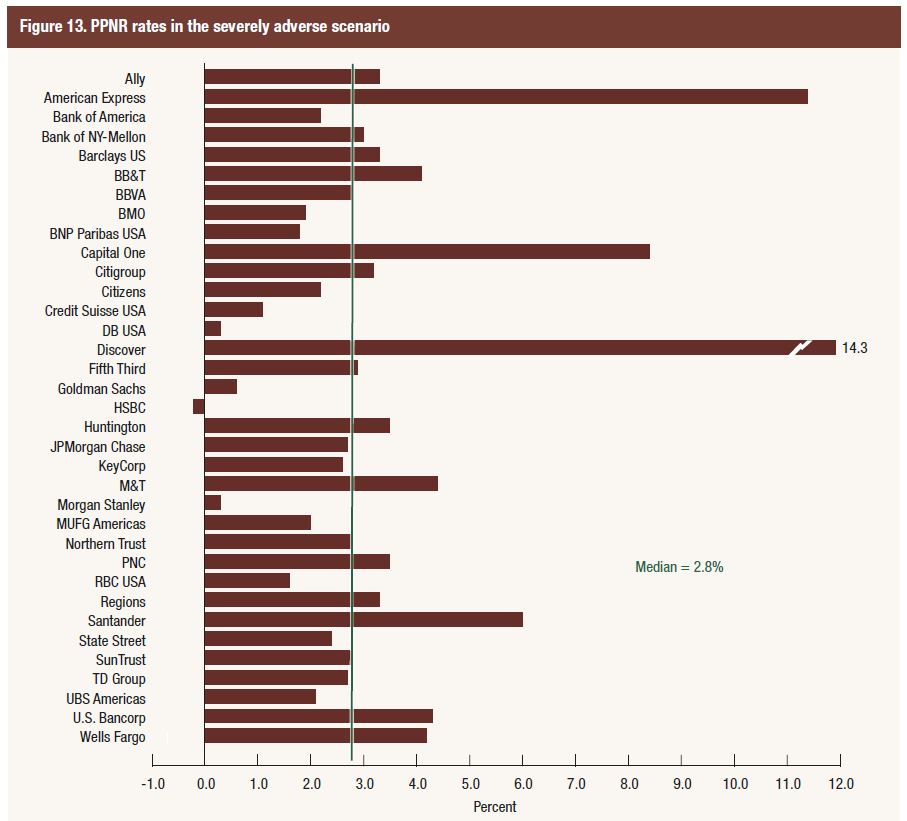

Projected aggregate pre-provision net revenue (PPNR) is $492 billion, and net income before taxes is projected to be −$139 billion.

Projected aggregate pre-provision net revenue (PPNR) is $492 billion, and net income before taxes is projected to be −$139 billion.

Some US outposts of European banks are most at risk in this analysis, together with some of the big investment banks.

First, losses from trading and counter-party losses were estimated at $133 billion, stemming from 9 institutions, including $17.3 billion from Bank of America Corporation, $16.3 billion from Citigroup, $13.3 billion from Goldman Sachs, $29.4 billion from JP Morgan $29.4 billion, Morgan Stanley $11.7 billion and $12.2 billion from Wells Fargo.

These estimate of losses are calibrated based on historical performance, but given the massive size of the derivatives market, this is just a best guess. We discussed the size and shape of the derivatives market recently in the $37 trillion dollar black hole.

These estimate of losses are calibrated based on historical performance, but given the massive size of the derivatives market, this is just a best guess. We discussed the size and shape of the derivatives market recently in the $37 trillion dollar black hole.

Second, its hard to estimate the potential impact of contagion and freezing of the markets as happened into 2007, as each bank is modelled separately. This begs the question as to whether the system level modelling is robust enough. Especially if one major counter-party fell over during a crisis. 2007 showed the problem when trust across the markets falls, and margins widen significantly.

Third the assumptions are that things will revert to normal conditions in a few years – suggesting this is a “blip type crises.” Some of the smaller banks may have performed better in the tests than they would in the real world.

But the bottom line, according to the FED is that the banks can stand on their own two feet in the mother of all crises, so not excuse for any bail-out then… We will see.

That said, the analysis is the most comprehensive in the world. Its worth reading the detail.

The Federal Reserve has established frameworks and programs for the supervision of its largest and most complex financial institutions to achieve its supervisory objectives, incorporating the lessons learned from the 2007 to 2009 financial crisis and in the period since. As part of these supervisory frameworks and programs, the Federal Reserve assesses whether bank holding companies BHCs with $100 billion or more in total consolidated assets are sufficiently capitalized to absorb losses during stressful conditions, while meeting obligations to creditors and counterparties and continuing to be able to lend to households and businesses.

This annual assessment includes two related programs:

- Dodd-Frank Act supervisory stress testing is a forward-looking quantitative evaluation of the impact of stressful economic and financial market conditions on firms’ capital.

- The Comprehensive Capital Analysis and Review (CCAR) consists of a quantitative assessment for all firms, and a qualitative assessment for firms

that are LISCC or large and complex firms.For this year’s stress test cycle (DFAST 2018), which began January 1, 2018, the Federal Reserve conducted supervisory stress tests of 35 firms.

The adverse and severely adverse supervisory scenarios used in DFAST 2018 feature U.S. and global recessions. In particular, the severely adverse scenario is characterized by a severe global recession in which the U.S. unemployment rate rises by almost 6 percentage points to 10 percent, accompanied by a global aversion to long-term fixed-income assets. The

adverse scenario features a moderate recession in the United States, as well as weakening economic activity across all countries included in the scenario.In conducting its supervisory stress tests, the Federal Reserve calculated its projections of each firm’s balance sheet, risk-weighted assets (RWAs), net income, and resulting regulatory capital ratios under these scenarios using data on firms’ financial conditions and risk characteristics provided by the firms and a set of models developed or selected by the Federal Reserve. For DFAST 2018, the Federal Reserve updated the calculation of projected capital to reflect changes in the tax code associated with the passage of the Tax Cuts and Jobs Act (TCJA) in December 2017. As in past years, the Federal Reserve also enhanced some of the supervisory models to incorporate new data, where available, and to improve model stability and performance. The enhanced models generally exhibit an increased sensitivity to economic conditions compared to past years’ models.

The results of the DFAST 2018 projections suggest that, in the aggregate, the 35 firms would experience substantial losses under both the adverse and the severely adverse scenarios but could continue lending to businesses and households, due to the substantial accretion of capital since the financial crisis. Over the nine quarters of the planning horizon, which for DFAST 2018 begins in the first quarter of 2018 and ends in the first quarter of 2020, aggregate losses at the 35 firms under the severely adverse scenario are projected to be $578 billion. This includes losses across loan portfolios, losses from credit impairment on securities held in the firms’ investment portfolios, trading and counterparty credit losses from a global market shock, and other losses.

Projected aggregate pre-provision net revenue (PPNR) is $492 billion, and net income before taxes is projected to be −$139 billion. In the severely adverse scenario, the aggregate Common Equity Tier 1 (CET1) capital ratio would fall from an actual 12.3 percent in the fourth quarter of 2017 to its minimum of 7.9 percent over the planning horizon. The aggregate CET1 ratio is projected to rise to 8.7 percent by the end of the planning horizon.

In the adverse scenario, aggregate projected losses, PPNR, and net income before taxes are $333 billion, $467 billion, and $125 billion, respectively. The aggregate CET1 capital ratio under the adverse scenario would fall to its minimum of 10.9 percent over the planning horizon.