The Federal Reserve’s and the Office of the Comptroller of the Currency’s proposed changes to the enhanced supplementary leverage ratio (eSLR) and total loss-absorbing capacity (TLAC) ratio, would provide the most capital relief to trust and custodial banks relative to other U.S. global systemically important banks (GSIBs), Fitch Ratings says.

These changes are unlikely to result in near-term rating implications, though this proposal and the impact of other recently proposed rules that reduce capital requirements are credit negative for the sector. The ultimate ratings impact will depend on how individual US GSIBs respond to potentially looser regulatory standards and lower capital requirements.

The proposal would change how the US GSIBs’ eSLR and TLAC ratios are calculated to include half of their respective GSIB capital surcharge as a percentage of risk-based capital, providing the most relief to firms with the lowest relative capital risk. The Fed estimates the proposed changes would reduce the required amount of Tier 1 capital of the US GSIBs by four basis points, or approximately $400 million, and would reduce the amount of Tier 1 capital required across the lead IDI subsidiaries of the GSIBs by approximately $121 billion.

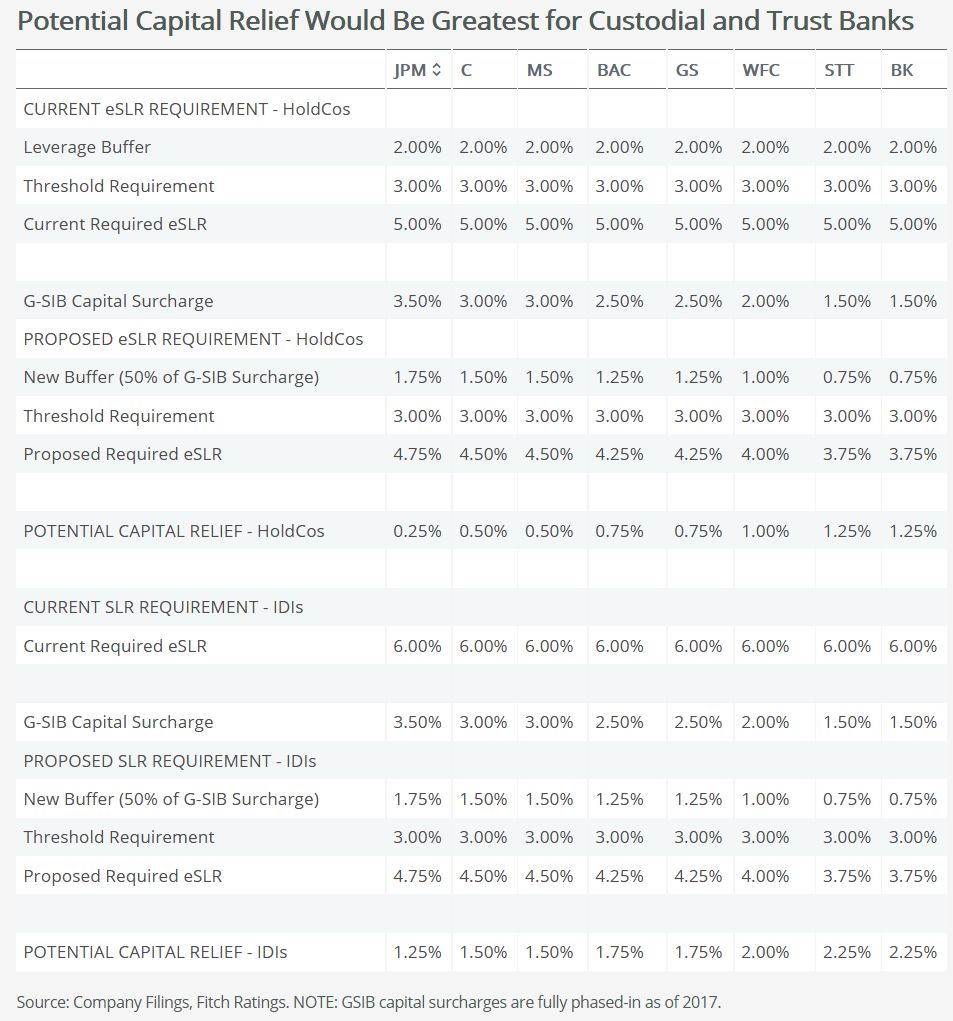

Currently, GSIBs must meet an eSLR of at least 5% at the holding company level, comprised of a minimum 3% base requirement plus a 2% standard buffer, while GSIB insured depository institution (IDI) subsidiaries need a minimum of a 6% SLR to be deemed “well capitalized.” Under the new proposals, eSLR ratios would be adjusted lower to the sum of the 3% required minimum plus 50% of the respective banks’ GSIB surcharge, instead of the prior standard. The same application of the proposed rule would apply for IDIs, replacing the 6% required minimum to be deemed well capitalized.

Amendments to the eSLR calculation, which apply to U.S. GSIBs and their IDIs, would benefit custody and trust banks the most. State Street and Bank of New York Mellon have the lowest GSIB risk-based capital surcharge of 1.5%, which could potentially result in lowering their eSLR by 1.25% at the holding company and up to 2.25% at the IDI level. The proposed amendments don’t incorporate the changes presented in the Senate bill to ease Dodd-Frank Act requirements, which would allow the trust and custody banks to remove certain safe assets such as Fed deposits from their leverage ratios if the bank was predominantly engaged in custodial banking.

Under the proposed legislation, the amount of required eligible debt required for total loss absorbing capital (TLAC) would also fall. The bank holding company TLAC leverage buffer, like the SLR calculation, would be also modified to 50% of the GSIB risk-based capital surcharge buffer, instead of a fixed 2% leverage buffer. The leverage component of the long-term minimum debt requirement would be cut to 2.5% from 4.5% previously.