Mortgage Choice reported their FY18 1H results yesterday and gave us a good snapshot of their diversification from just a mortgage provider to a broader financial service provider, across car loans, personal loans, credit cards, commercial loans, asset finance, deposit bonds, and risk and general insurance.

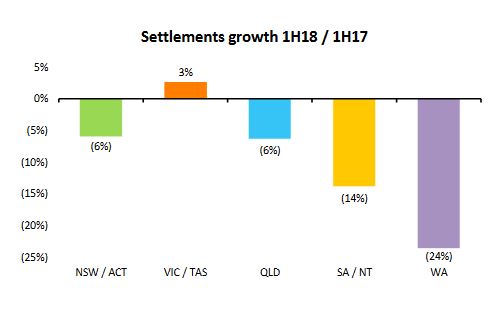

On one hand profit was up 7% on a cash basis reached $12.5 million, up from $11.7 million in 1H17. Net profit after tax was $11.4 million, consistent with the result in 1H17. They grew their total loan book $54.0 billion, up 3.2% from $52.4 billion in 1H17, but they settled $6.0 billion in home loans 1H18, down 6% from $6.4 billion in 1H17. All states except Vic/Tas saw a fall. with the largest drop in WA (24%).

Then again, financial planning Funds Under Advice climbed 49.9% from 1H17 to $634.2 million in 1H18.

Then again, financial planning Funds Under Advice climbed 49.9% from 1H17 to $634.2 million in 1H18.

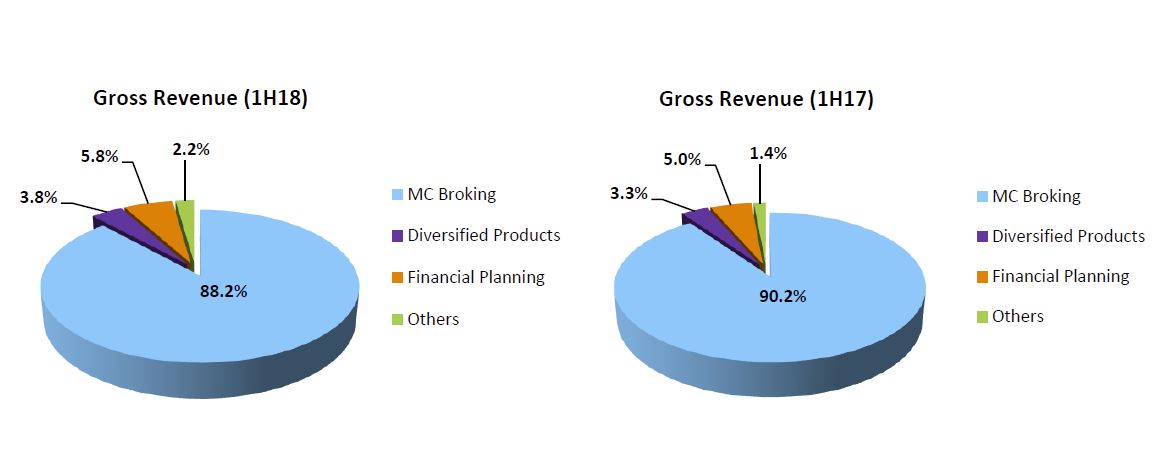

Broking accounted for 88.2% of the company’s gross revenues in the first half of FY18, down from 90.2% in the same period of FY17, while the proportion of gross revenue from non-residential lending went up to 11.8%.

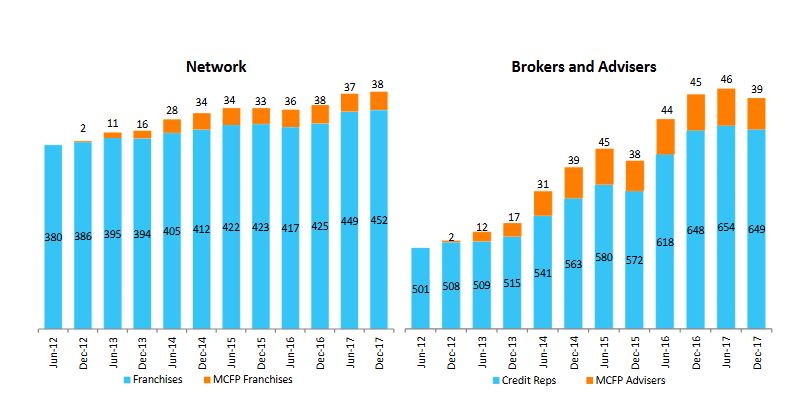

While the company’s number of broking franchises went up to 452 from 449 in the six months to June 2017, its number of brokers or credit representatives was slightly down to 649 by end-December, from 654 six months ago.

While the company’s number of broking franchises went up to 452 from 449 in the six months to June 2017, its number of brokers or credit representatives was slightly down to 649 by end-December, from 654 six months ago.

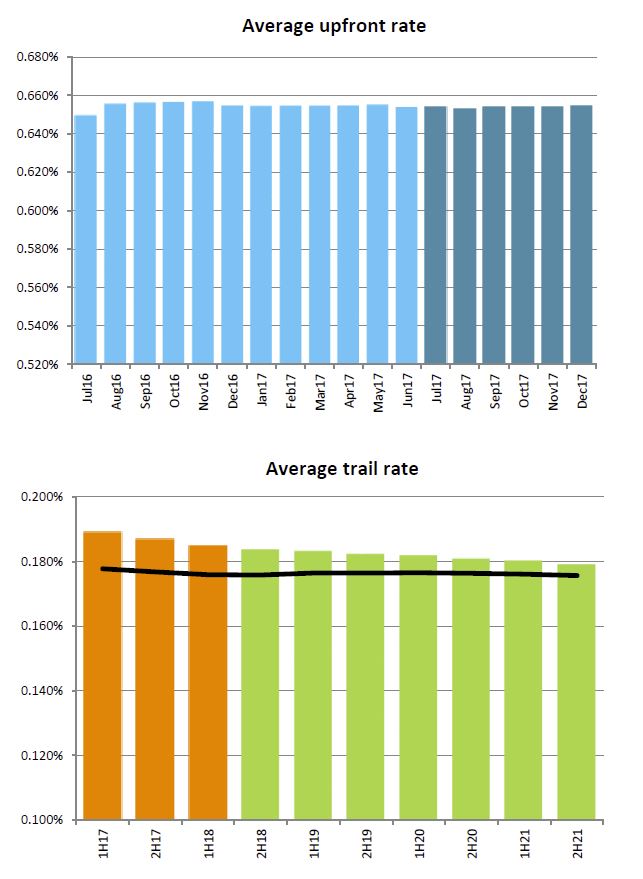

Origination and trail commissions received fell by 3.0% to $84.64m on a cash basis from $87.23m in the first half of FY17. The average upfront rate was 0.6538%. Reduced expected run-offs has lifted trail projections.

Origination and trail commissions received fell by 3.0% to $84.64m on a cash basis from $87.23m in the first half of FY17. The average upfront rate was 0.6538%. Reduced expected run-offs has lifted trail projections.

(The black line represents the average rate of new settlements post GFC changing commissions)

(The black line represents the average rate of new settlements post GFC changing commissions)

Gross revenue growth from financial planning and diversified products, up 15.3% and 12.7% respectively, helped offset the decline in revenue from broking commissions, proving the merit of its diversification strategy.

“Home settlements are down slightly half on half due to changing market conditions, in particular, tightening lending policies, which can impact conversion from approval to settlement,” chief executive John Flavell told Australian Broker.

To increase broker productivity, it launched a new website in January and is launching a new broker platform in phases starting this month. Bolstering its brand presence involves growing the number of its retail shopfronts and launching a new advertising