APRA has released their monthly banking statistics for ADI’s to April 2018. And now we are really seeing the tighter lending standards biting. In fact, Westpac apart, all the majors have reduced their investor property lending.

APRA reports for each lender the net total balance outstanding at the end of each month and by looking at the trends we see the net of loan roll offs and new loans. This is important, as we will see.

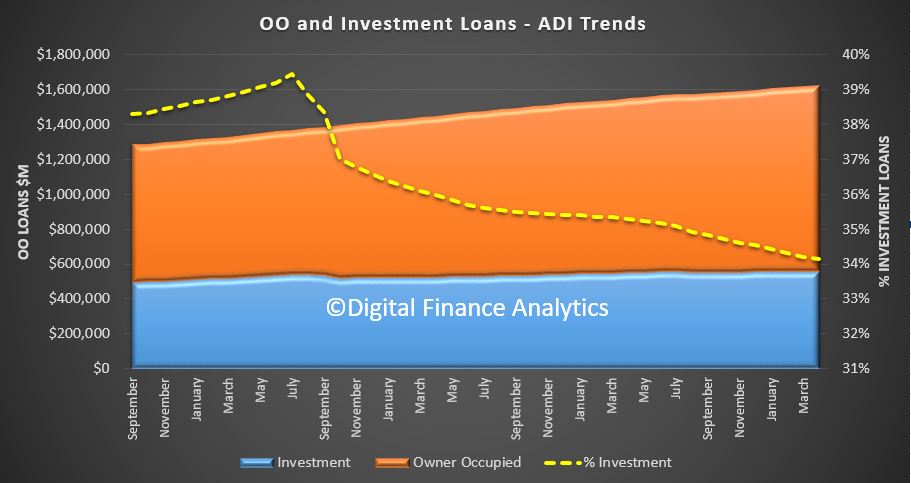

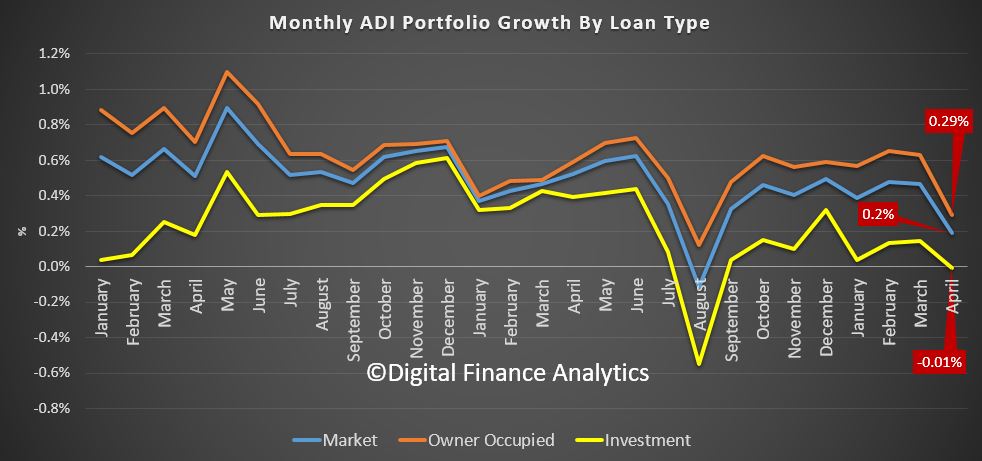

At the aggregate level, total lending for mortgages from ADI’s rose 0.2% in the month, up $3.0 billion to $1.62 trillion. Within that owner occupied loans grew by 0.29% or $3.1 billion to $1.07 trillion while investment loans fell slightly, down 0.01% of $42 million. As a result the relative share of investment loans fell to 34.14%.

The trend movement highlights the significance of the fall (the August 2017 point is an outlier thanks to reclassification), this is the weakest result for years. At an aggregate level, over 12 months this would translate to a rise of just 2.3%, significantly down from the 5-6% range of recent months.

The trend movement highlights the significance of the fall (the August 2017 point is an outlier thanks to reclassification), this is the weakest result for years. At an aggregate level, over 12 months this would translate to a rise of just 2.3%, significantly down from the 5-6% range of recent months.

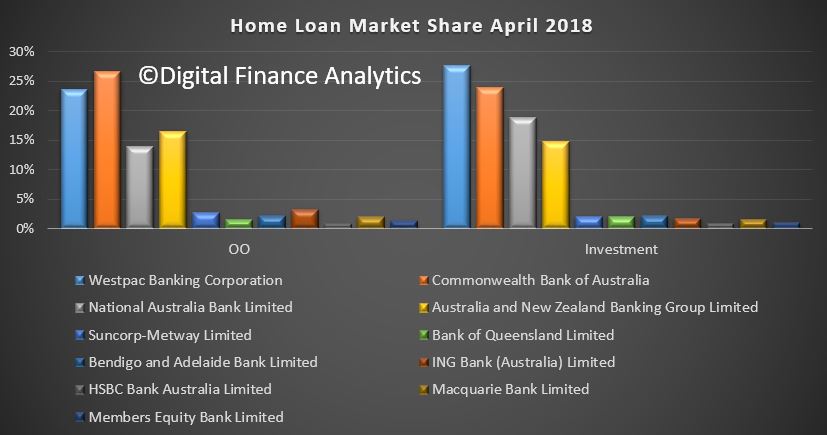

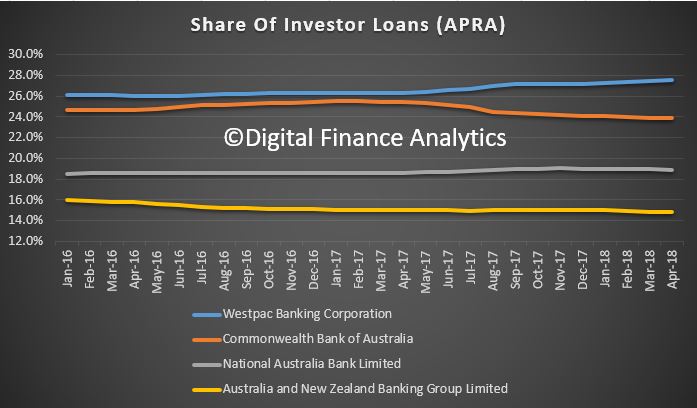

Turning to the individual market shares, at the aggregate level there was little change, other than Westpac’s share of investor loans grew to 27.6%, up from 26.1% in January 2016

Turning to the individual market shares, at the aggregate level there was little change, other than Westpac’s share of investor loans grew to 27.6%, up from 26.1% in January 2016

Here is the trends from the big four. Westpac has continued to increase share of investor loans. CBA has fallen away the most significantly.

Here is the trends from the big four. Westpac has continued to increase share of investor loans. CBA has fallen away the most significantly.

There has been almost no shift in owner occupied loan shares.

There has been almost no shift in owner occupied loan shares.

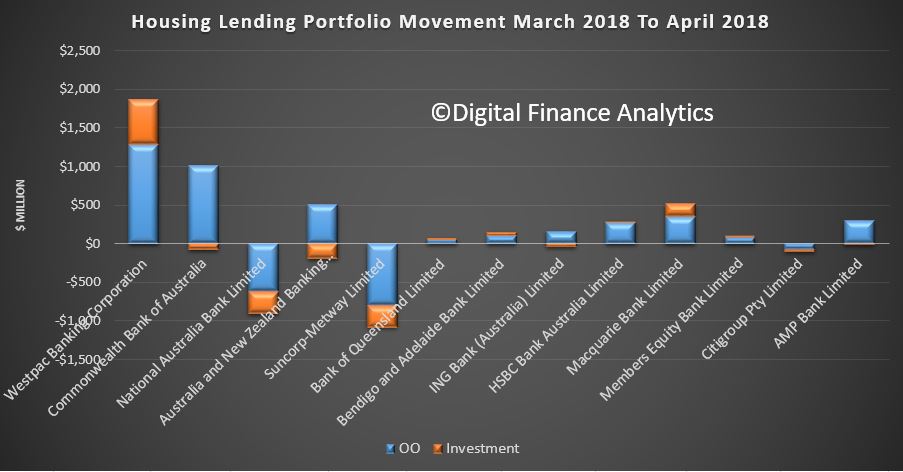

The monthly changes in value tell the story, with Westpac and Macquarie growing the value of their portfolios, across both owner occupied and investment lending. We see falls in net investor lending elsewhere.

We conclude that Westpac executed a different strategy in terms of mortgage origination compared with its competitors. They may be offering selective discounts to attract particular types of business, or they may have different lending standards, or both.

We conclude that Westpac executed a different strategy in terms of mortgage origination compared with its competitors. They may be offering selective discounts to attract particular types of business, or they may have different lending standards, or both.

It is quite possible we will see other lenders trying to compete relative to Westpac in the investment loan domain ahead, as lending growth is needed to sustain profitability. But demand is also falling, so we expect lending momentum to continue to weaken, with the consequential impact on home prices and bank profitability. We are entering credit crunch territory!