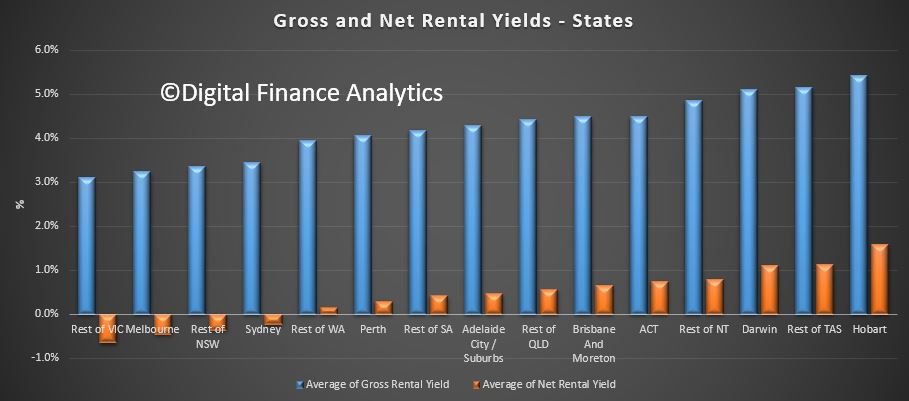

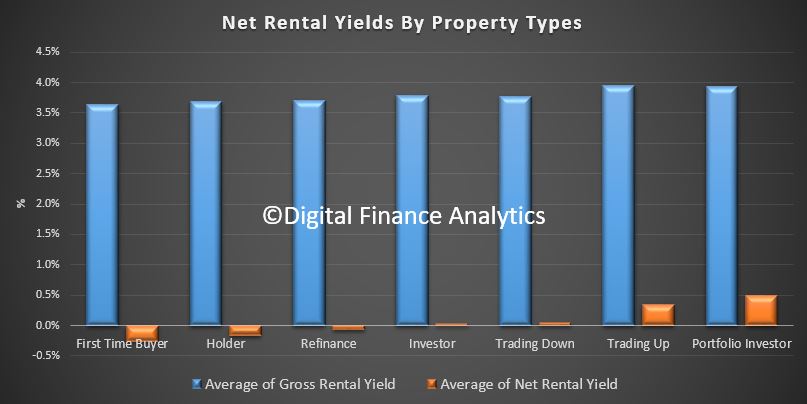

We track gross and net rental yields on investment properties via our household surveys. Gross yield is the actual rental stream to property value, net rental is rental payments less the costs of funding the mortgage, management fees and other expenses. This is calculated before any tax offsets or rebates. The latest results were featured in an AFR article today.

The results are pretty stark, and shows that many property investors are underwater in cash flow terms – not good when capital values are also sliding in some places.

This shows the gross and net rental returns by states – Hobart and Darwin are the winners, Melbourne, and the rest of Victoria, then Sydney and the rest of NSW the loosers.

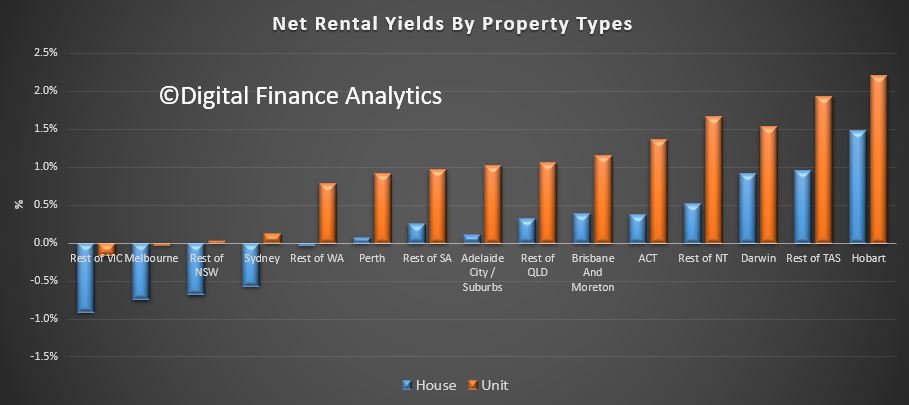

The returns vary between units and houses, with units doing somewhat better.

The returns vary between units and houses, with units doing somewhat better.

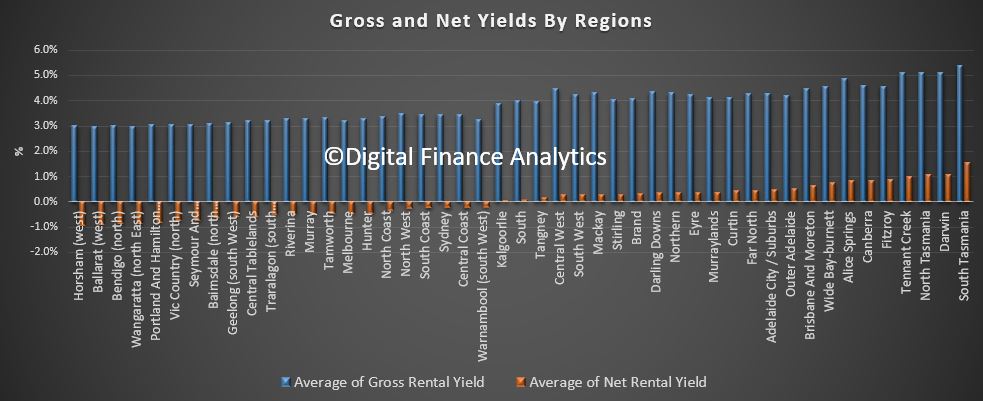

We find that portfolio property investors (those with multiple investment properties) are doing the best, whilst new investor buyers are doing the worse, not least because they have larger mortgages to service, and interest rates are higher, and no capital growth.

We find that portfolio property investors (those with multiple investment properties) are doing the best, whilst new investor buyers are doing the worse, not least because they have larger mortgages to service, and interest rates are higher, and no capital growth.

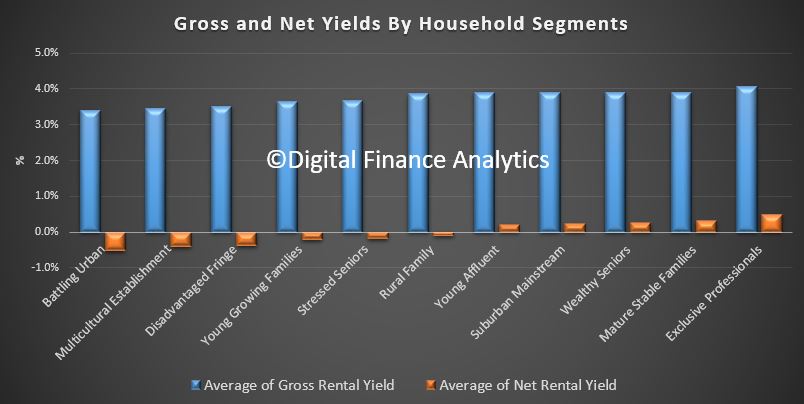

Finally, here is the killer slide. More affluent households are doing significantly better in terms of net rental returns, compared with those in more financially pressured household groups. Batting Urban households, those who live in the urban fringe on the edge of our cities are doing the worst. This is explained by the types of properties people are buying, and their ability to select the right proposition. Running an investment property well takes skill and experience, especially in the current rising interest rate and low capital growth environment. Another reason why prospective property investors need to be careful just now.

Finally, here is the killer slide. More affluent households are doing significantly better in terms of net rental returns, compared with those in more financially pressured household groups. Batting Urban households, those who live in the urban fringe on the edge of our cities are doing the worst. This is explained by the types of properties people are buying, and their ability to select the right proposition. Running an investment property well takes skill and experience, especially in the current rising interest rate and low capital growth environment. Another reason why prospective property investors need to be careful just now.