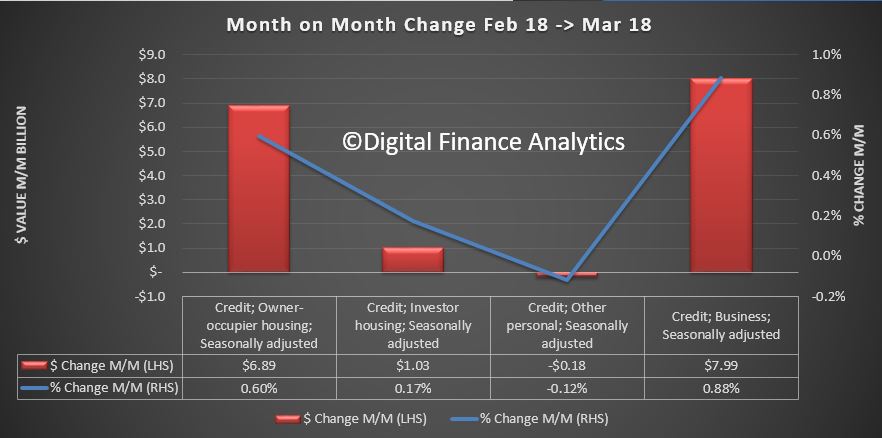

The RBA have released their credit aggregates to March 2018. Looking at the month on month movements, total owner occupied lending rose 0.6%, or $6.89 billion to $1,157.8 billion and investor mortgage lending rose 0.17% or $1.03 billion to $590.2 billion. So overall mortgage lending rose 0.46% in the month, up $7.92 billion (all seasonally adjusted) to $1.75 trillion. A record.

Personal credit fell 0.12%, down $0.18 to $152 billion. Business credit rose 0.88%, or $7.99 billion to $913 billion.

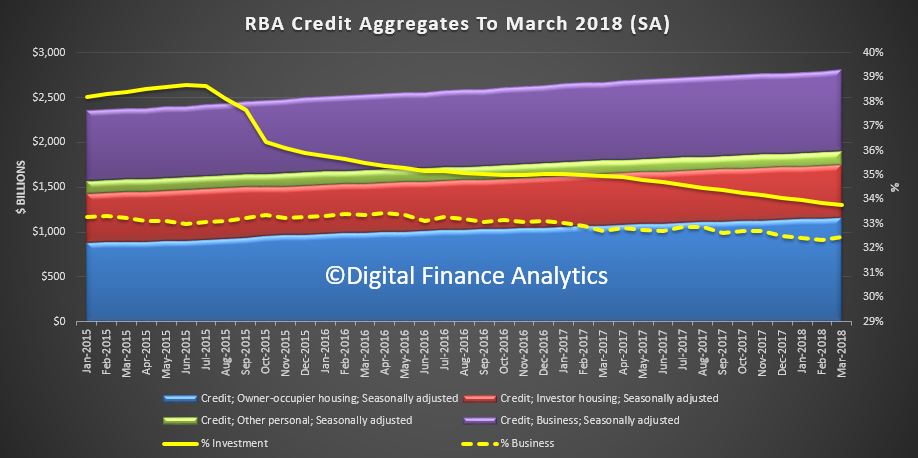

The trends show that the share of investment loans fell a little on the total portfolio to 33.8%, while business lending was 32.5% of all lending, up just a little.

The trends show that the share of investment loans fell a little on the total portfolio to 33.8%, while business lending was 32.5% of all lending, up just a little.

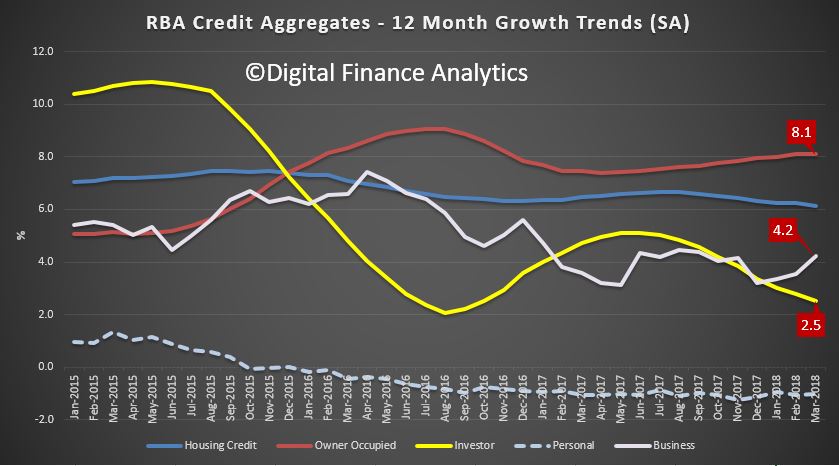

The 12 month average growth rates show that owner occupied loans rose 8.1%, while investment loans grew 2.5%. Business rose 4.2%, and personal credit fell again. Overall growth rates of credit for housing slide just a little to 6.1%. This is 3 times the rate of inflation and wage growth! Household debt therefore is still rising.

The 12 month average growth rates show that owner occupied loans rose 8.1%, while investment loans grew 2.5%. Business rose 4.2%, and personal credit fell again. Overall growth rates of credit for housing slide just a little to 6.1%. This is 3 times the rate of inflation and wage growth! Household debt therefore is still rising.

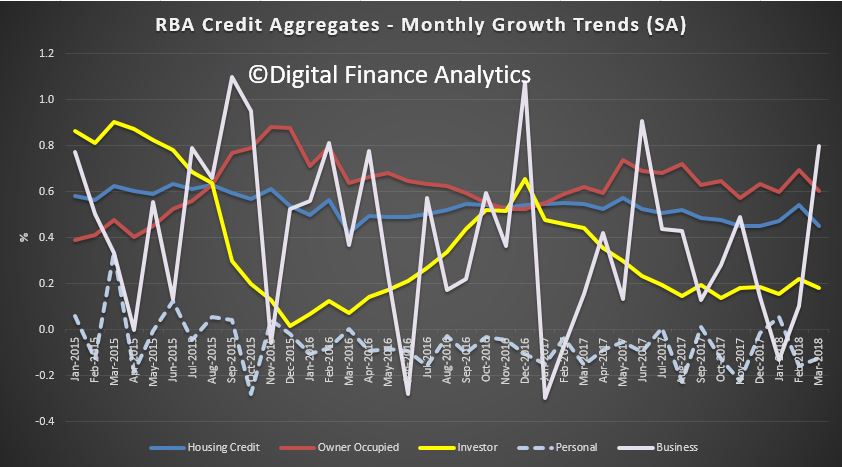

The noisy monthly data highlights how volatile the business lending trends are.

The noisy monthly data highlights how volatile the business lending trends are.

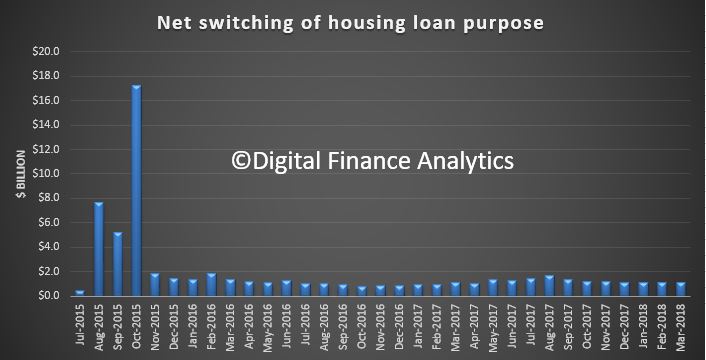

They also reported that the switching between investor and owner occupied loans continues to run at similar levels, after the hiatus in 2015.

They also reported that the switching between investor and owner occupied loans continues to run at similar levels, after the hiatus in 2015.

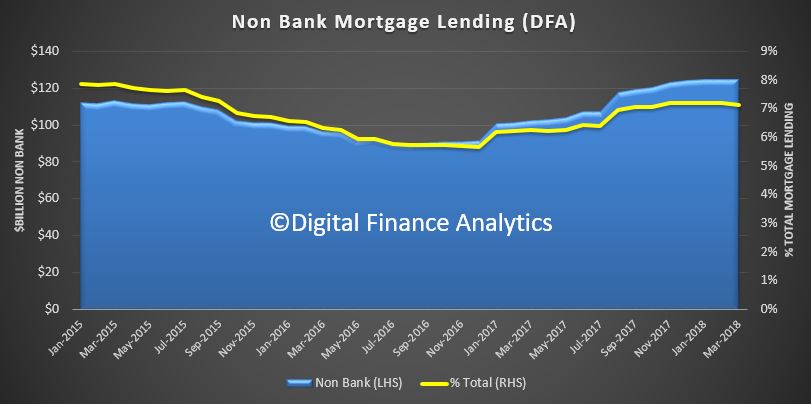

Now, we can also make comparisons between the total loan pool, and those loans written by the banks (ADS’s) by combining the APRA bank data and the RBA data. There are a few catches, and the ABS suggests that not all the non-banks are captured.

Now, we can also make comparisons between the total loan pool, and those loans written by the banks (ADS’s) by combining the APRA bank data and the RBA data. There are a few catches, and the ABS suggests that not all the non-banks are captured.

But set that aside, we have plotted the relative value of the mortgage pools at the total level, and the ADI level (not seasonally adjusted). The trend shows around 7% of lending is non-bank, up from 5.7% in 2017. In value terms this equates to $124 billion, up from $90 billion in 2016.

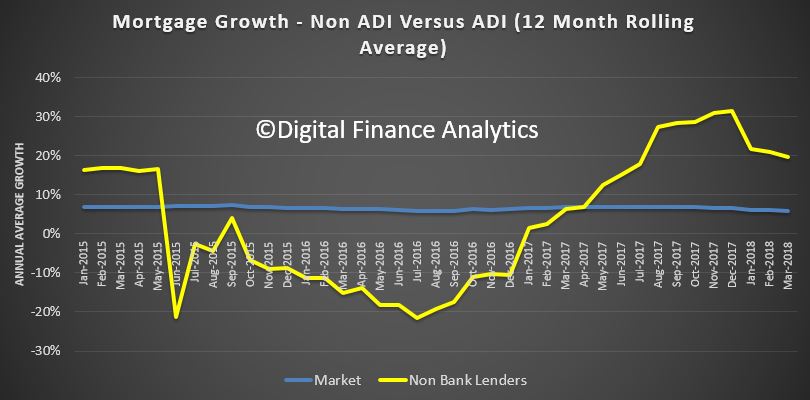

Another way to show the data is to look at the rolling 12 month growth trend. This shows that non-bank lending has been growing at up to 30% and significantly higher than the market at 5.94%.

Another way to show the data is to look at the rolling 12 month growth trend. This shows that non-bank lending has been growing at up to 30% and significantly higher than the market at 5.94%.

This is highly relevant given Bluestone’s recent announcement and Peppers recent $1 billion securitisation issue.

This is highly relevant given Bluestone’s recent announcement and Peppers recent $1 billion securitisation issue.

So this is all playing out as expected. As the majors throttle back on new mortgage lending under tighter controls, the non-bank sector continues to pick up the slack. This is a concern as the regulatory environment for these lenders is weaker, with both ASIC and APRA now involved, ASIC from a responsible lending perspective and APRA from new supervision on the non-bank sector, despite their failure in the core banking sector. So we expect to see significant non-bank lending growth, ahead, which will stoke the current massively high household debts even higher.

The total loan mortgage growth is still significantly higher than income growth. This is not sustainable, and will lift mortgage stress higher again – our new data will be out in a few days.