Lets be clear, all this talk about mortgage tightening has only had marginal impact on overall mortgage lending growth, judging by the APRA monthly stats, released today to end March 2018. These of course do not include the non-bank sector which we think has been quite active – and the RBA data, out later today, will help to triangulate this.

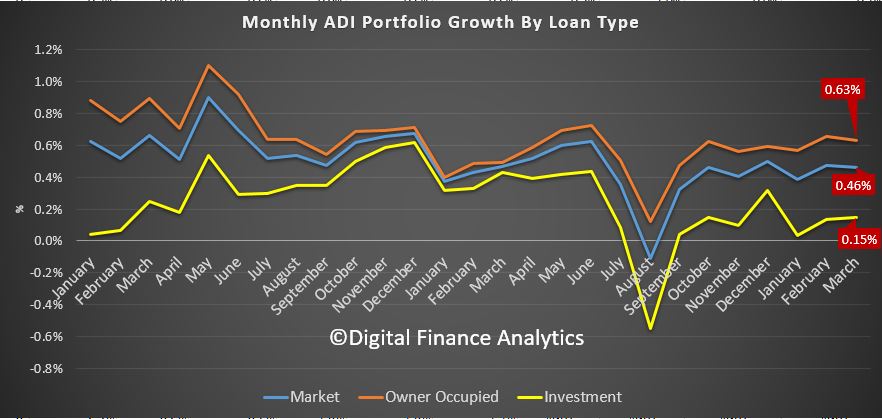

Anyhow, according to the APRA stats the ADI mortgage book rose 0.46% over the month, to $1.62 trillion, up $7.9 billion in the month. Within that owner occupied loans were worth $1.06 trillion, up 0.63% compared with last month, and investment loans rose 0.15% to $554.8 billion. Investment loans were 34.3% of all loans. The annual growth rate on the book would equate to 5.6% which is still well above inflation and wage growth (~2%) which means that in absolute terms household debt is still rising.

The monthly trends show the relative movements nicely with owner occupied loans still above investment loans, and just a slight fall in growth rates, but nothing to write home about. Investor lending was up a little.

The monthly trends show the relative movements nicely with owner occupied loans still above investment loans, and just a slight fall in growth rates, but nothing to write home about. Investor lending was up a little.

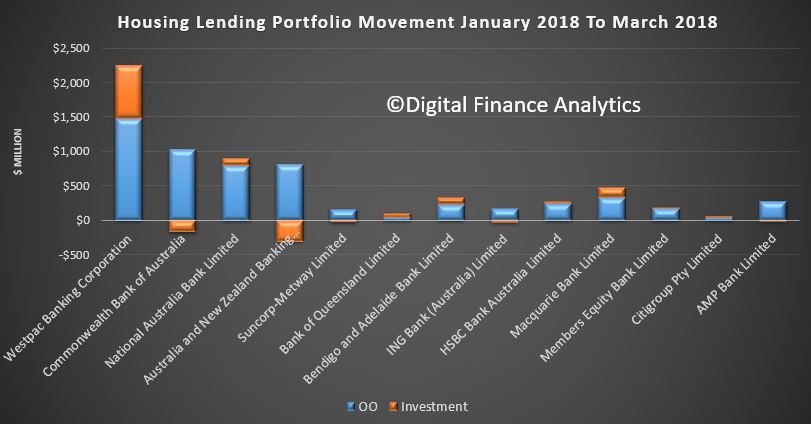

We continue to see significant variations across lenders as to how they have managed their portfolio growth, with Westpac continuing to stand out (that’s the bank which UBS suggested last week had issues with their portfolio, was a risk!), while CBA and ANZ appear to be reducing their Investor Loan book. Macquarie is also growing their book, as is Bendigo and Adelaide Bank.

We continue to see significant variations across lenders as to how they have managed their portfolio growth, with Westpac continuing to stand out (that’s the bank which UBS suggested last week had issues with their portfolio, was a risk!), while CBA and ANZ appear to be reducing their Investor Loan book. Macquarie is also growing their book, as is Bendigo and Adelaide Bank.

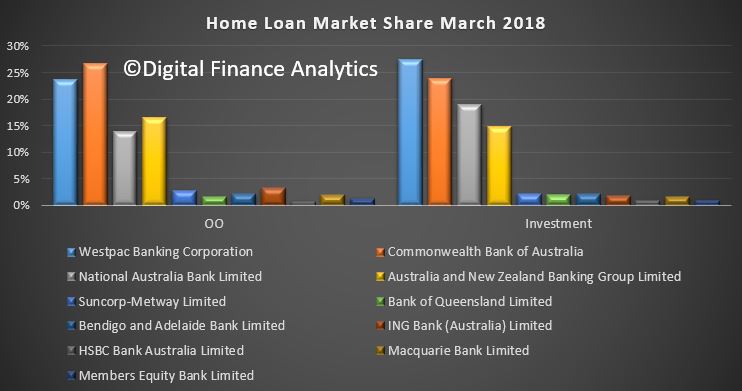

Overall loan shares are pretty static, with CBA the largest owner occupied lender and Westpac the biggest investor loan provider (and recently we found out that 50% of their loans were interest only).

Overall loan shares are pretty static, with CBA the largest owner occupied lender and Westpac the biggest investor loan provider (and recently we found out that 50% of their loans were interest only).

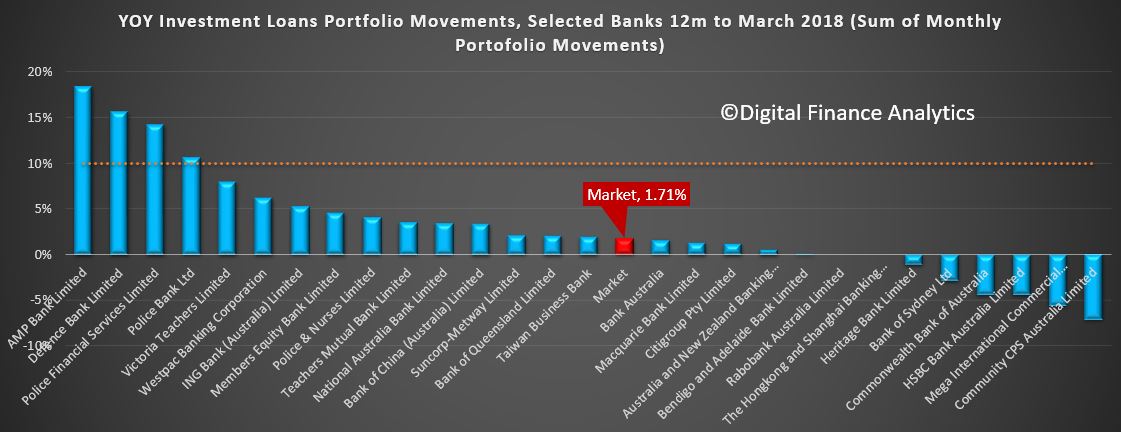

Whilst APRA has removed the 10% speed limit, we will continue to to report the annual movements by lender. A number of the smaller players are still growing quite fast.

Whilst APRA has removed the 10% speed limit, we will continue to to report the annual movements by lender. A number of the smaller players are still growing quite fast.

We still think the over reliance on mortgage debt to grow the economy will create significant problems ahead. We need to see credit start to shrink, because incomes won’t catch up anytime soon.

We still think the over reliance on mortgage debt to grow the economy will create significant problems ahead. We need to see credit start to shrink, because incomes won’t catch up anytime soon.