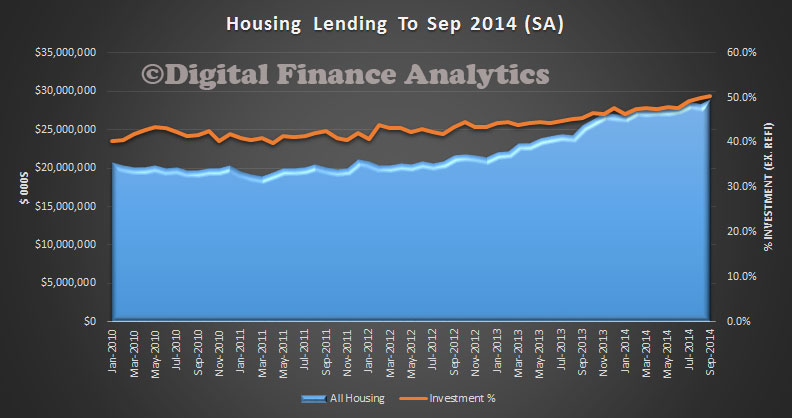

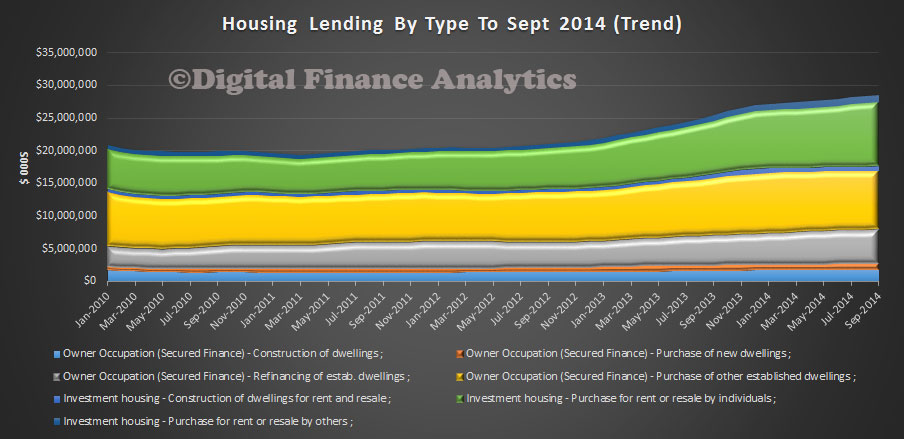

The latest ABS housing finance data to September 2014 has just been released. We broke more records, as more than half the loans written, excluding refinance, were for investment purposes.

First time buyers continue to languish, especially in the hot Sydney market. Further evidence of the market being out of kilter, per the RBA’s recent comments. In seasonally adjusted terms, the total value of dwelling finance commitments excluding alterations and additions rose 2.3%.

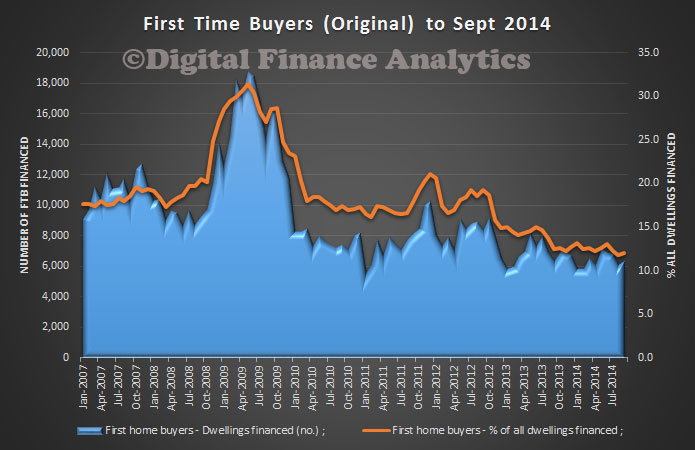

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 12.0% in September 2014 from 11.8% in August 2014. Still near the lowest on record.

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 12.0% in September 2014 from 11.8% in August 2014. Still near the lowest on record.

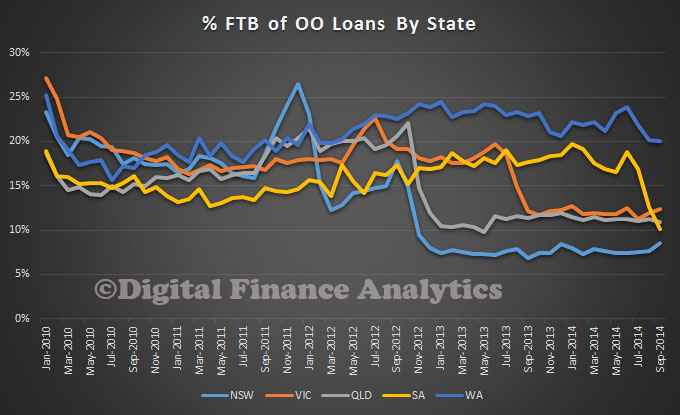

NSW first time buyers continues at the lowest levels, though with a slight uplift this month. WA data flatters the Australia-wide averages for first time buyer finance. It is not just a Sydney thing.

NSW first time buyers continues at the lowest levels, though with a slight uplift this month. WA data flatters the Australia-wide averages for first time buyer finance. It is not just a Sydney thing.

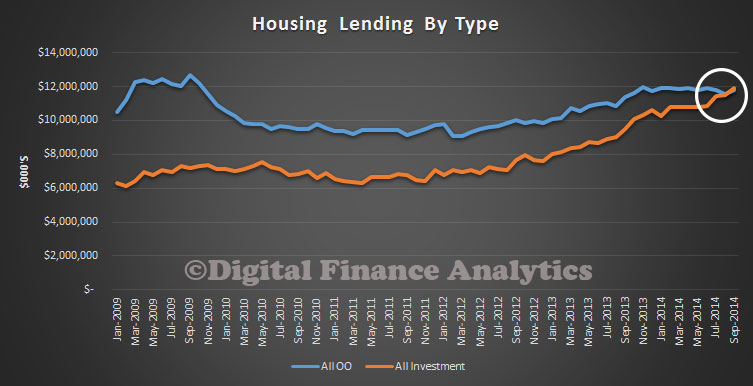

In trend terms, the number of commitments for owner occupied housing finance fell 0.2% in September 2014. In trend terms, the number of commitments for the purchase of established dwellings fell 0.3%, while the number of commitments for the purchase of new dwellings rose 1.2% and the number of commitments for the construction of dwellings rose 0.2%.

In trend terms, the number of commitments for owner occupied housing finance fell 0.2% in September 2014. In trend terms, the number of commitments for the purchase of established dwellings fell 0.3%, while the number of commitments for the purchase of new dwellings rose 1.2% and the number of commitments for the construction of dwellings rose 0.2%.

One thought on “Over 50% Investment Loans In September”