The Reserve Bank of New Zealand published the results of its consultation on the proposal to vary the capital risk weighting of investment versus owner occupied loans. Stakeholders are invited to provide feedback on the proposed wording changes to the Reserve Bank’s capital adequacy requirements by 19 June 2015, with a view to implemention by October.

They cite considerable evidence that investment loans are inherently more risky:

- the fact that investment risks are pro-cyclical

- that for a given LVR defaults are higher on investment loans

- investors were an obvious driver of downturn defaults if they were identified as investors on the basis of being owners of multiple properties

- a substantial fall in house prices would leave the investor much more heavily underwater relative to their labour income so diminishing their incentive to continue to service the mortgage (relative to alternatives such as entering bankruptcy)

- some investors are likely to not own their own home directly (it may be in a trust and not used as security, or they may rent the home they live in), thus is likely to increase the incentive to stop servicing debt if it exceeds the value of their investment property portfolio

- as property investor loans are disproportionately interest-only borrowers, they tend to remain nearer to the origination LVR, whereas owner-occupiers will tend to reduce their LVR through principal repayments. Evidence suggests that delinquency on mortgage loans is highest in the years immediately after the loan is signed. As equity in a property increases through principal repayments, the risk of a particular loan falls. However, this does not occur to the same extent with interest-only loans.

- investors may face additional income volatility related to the possibility that the rental market they are operating in weakens in a severe recession (if tenants are in arrears or are hard to replace when they leave, for example). Furthermore, this income volatility is more closely correlated with the valuation of the underlying asset, since it is harder to sell an investment property that can’t find a tenant.

Although the Basel guidelines for IRB banks envisage that loans to residential property investors be treated as non-retail lending, the same is not the case for banks operating on the standardised approach. The Basel guidelines consider all mortgage lending within the standardised approach as retail lending within the same sub-asset class. However, the guidelines also provide regulators with ample flexibility to implement them according to the needs of their respective jurisdictions. There are three reasons why any consideration as to whether to group loans to residential property investors in New Zealand should also include standardised banks.

- the different risk profile of property investors applies irrespective of whether the lending bank is a bank operating on the standardised approach or on the internal models approach.

- macro-prudential considerations include standardised banks as well as internal models banks. Prepositioning banks for a potential macro-prudential restriction on lending to residential property investors has to involve all locally incorporated banks.

- risk weights on housing loans are comparatively high in New Zealand and, more crucially, the gap in mortgage lending risk weights between standardised and IRB banks is not as high as it might be in many other jurisdictions. In order to maintain the relativities between the two groups of banks for residential investment property lending, it would be useful to also include standardised banks in the policy considerations.

So the bank is proposing to impose different risk weightings on investment and owner occupied loans, for both IRB and standard capital models.

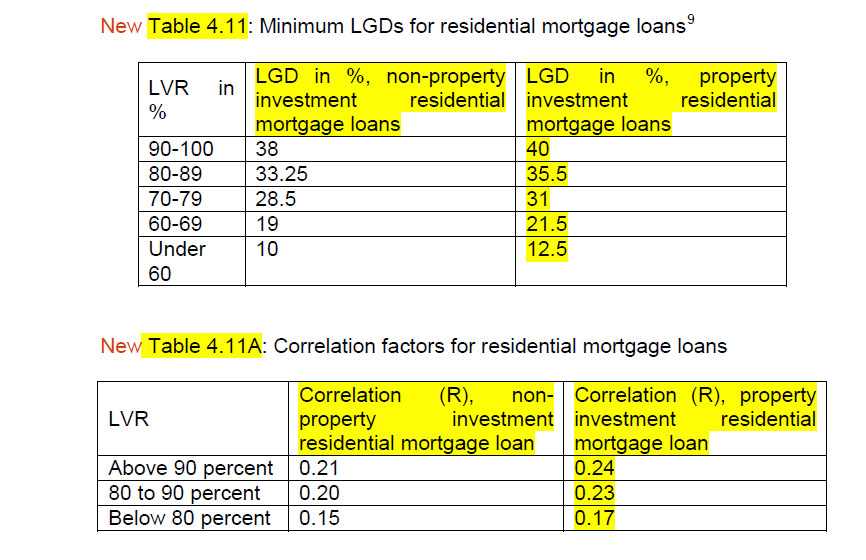

The Reserve Bank would expect banks to continue to use their current PD models until such time that new models have been developed or banks have been able to verify that the current models can also be applied to property investment loans. Through the cycle PD rates appear broadly similar to those of owner-occupiers if the evidence from overseas also holds for New Zealand, although it is not clear whether the risk drivers are the same between the two groups of mortgage borrowers. The Reserve Bank would therefore expect banks to assess in due course whether their current PD mortgage models can be used for the new asset class or whether new or amended versions of the current models should be used.

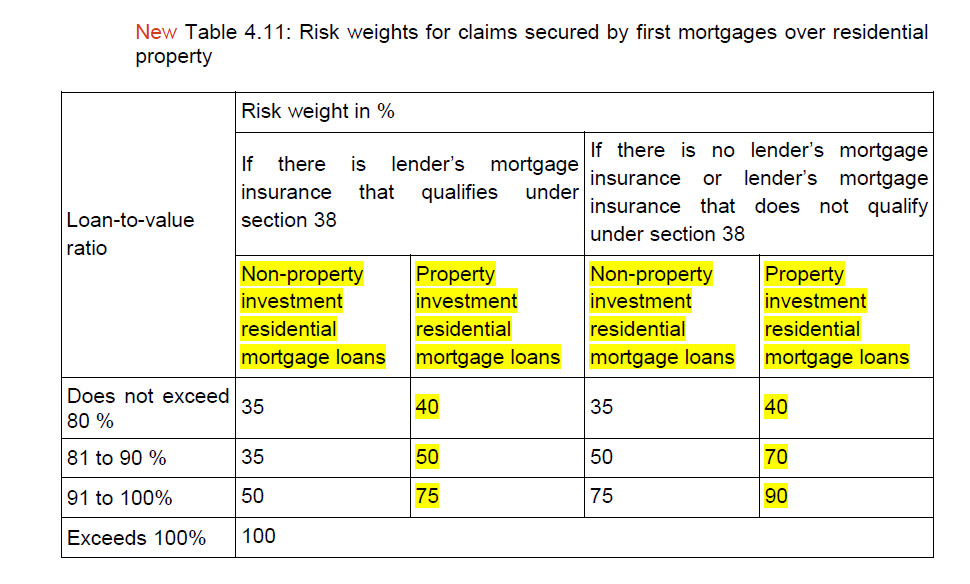

For standardized banks, the Reserve Bank has to prescribe the risk weights as per the relevant capital adequacy requirements. Those requirements currently link a loan’s risk weight to its LVR at origination. Maintaining that link, the Reserve Bank proposed higher risk weights per LVR band

For standardized banks, the Reserve Bank has to prescribe the risk weights as per the relevant capital adequacy requirements. Those requirements currently link a loan’s risk weight to its LVR at origination. Maintaining that link, the Reserve Bank proposed higher risk weights per LVR band

These calibrations would lead to a higher capital outcome for residential property investment mortgages compared to owner-occupier loans. However, the capital outcome would be below that of using the income producing real estate asset class and, in the Reserve Bank’s opinion, reflect the mix of property investment borrowers that the new asset class would entail.

These calibrations would lead to a higher capital outcome for residential property investment mortgages compared to owner-occupier loans. However, the capital outcome would be below that of using the income producing real estate asset class and, in the Reserve Bank’s opinion, reflect the mix of property investment borrowers that the new asset class would entail.

Stakeholders are invited to provide feedback on the proposed wording changes to the Reserve Bank’s capital adequacy requirements by 19 June 2015.

This further tilts the playing field away from property investment loans.

2 thoughts on “RBNZ Moves Closer To Changing Capital Rules For Investment Loans”