The New Zealand Reserve Bank has released its May Financial Stability Report

The New Zealand financial system remains resilient to a broad range of economic risks. However, financial system risks remain elevated, and ongoing effort is necessary to bolster system soundness and efficiency.

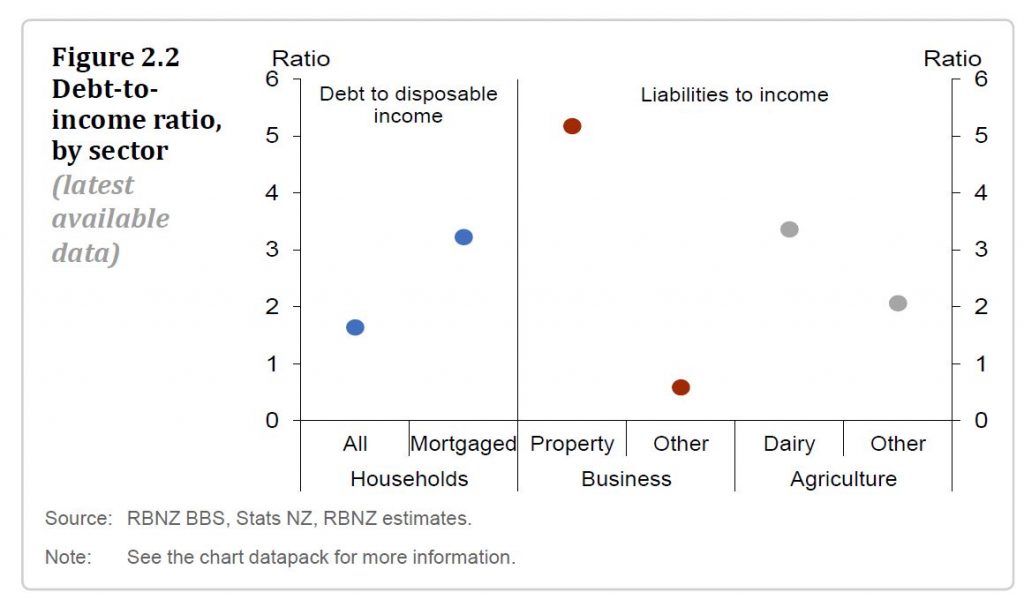

Domestically, debt levels are high in the household and dairy sectors, leaving borrowers and lenders exposed to unanticipated events. Similar challenges exist globally, given current high public and private debt levels, and stretched asset prices in many of New Zealand’s trading partners.

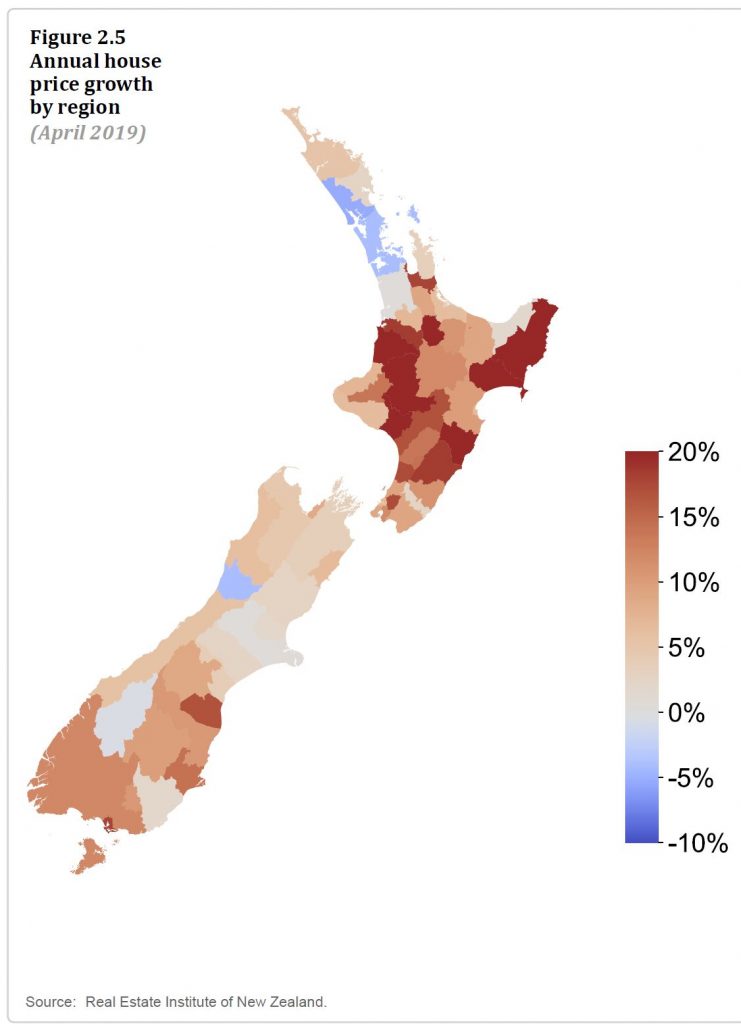

Some regions have recently had high house price growth. This is not an

immediate financial stability concern as those regions have smaller and

less stretched housing markets than Auckland. But if strong price growth

continued, the financial system would become more exposed to those

regions. The Global Financial Crisis (GFC) showed that house prices can

fall dramatically in small regions.

At a national level, the growth of household debt and house prices has

slowed, but household debt has still grown faster than income in the

past year. Housing market pressures could re-emerge if there is a strong

response to the recent decline in mortgage rates, or reduced uncertainty

about the future tax treatment of property investments.

Given this environment, the financial system’s vulnerability to risks in

the household sector remains elevated, and must continue to be closely

monitored and managed.

The capacity for some foreign governments and central banks to respond to unanticipated negative events is also limited by their current high government debt and low nominal interest rates. It is imperative to improve New Zealand’s financial system resilience while conditions are conducive.

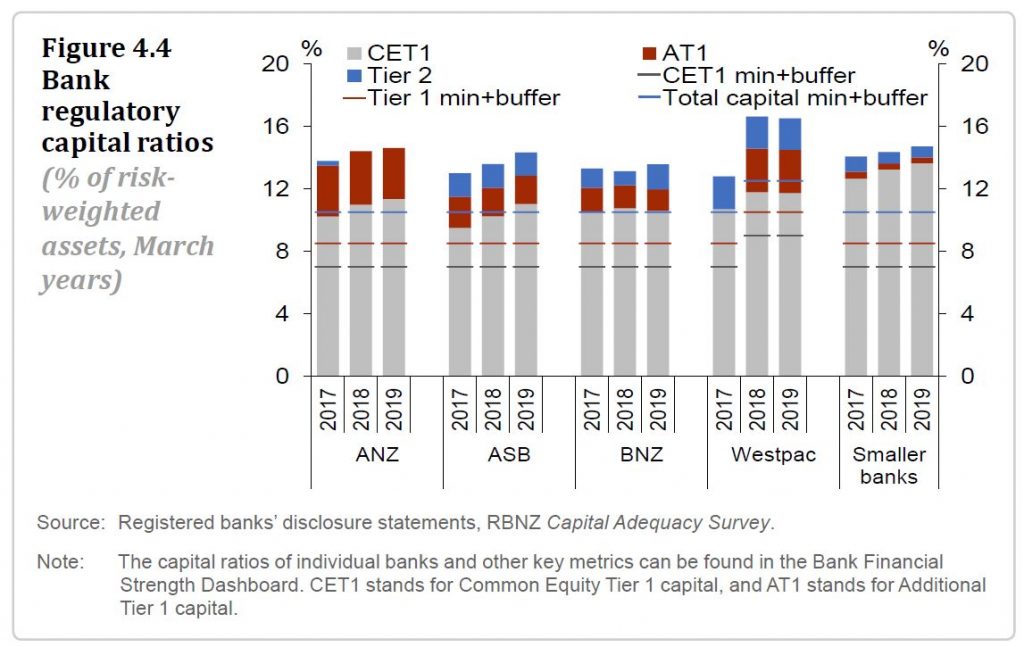

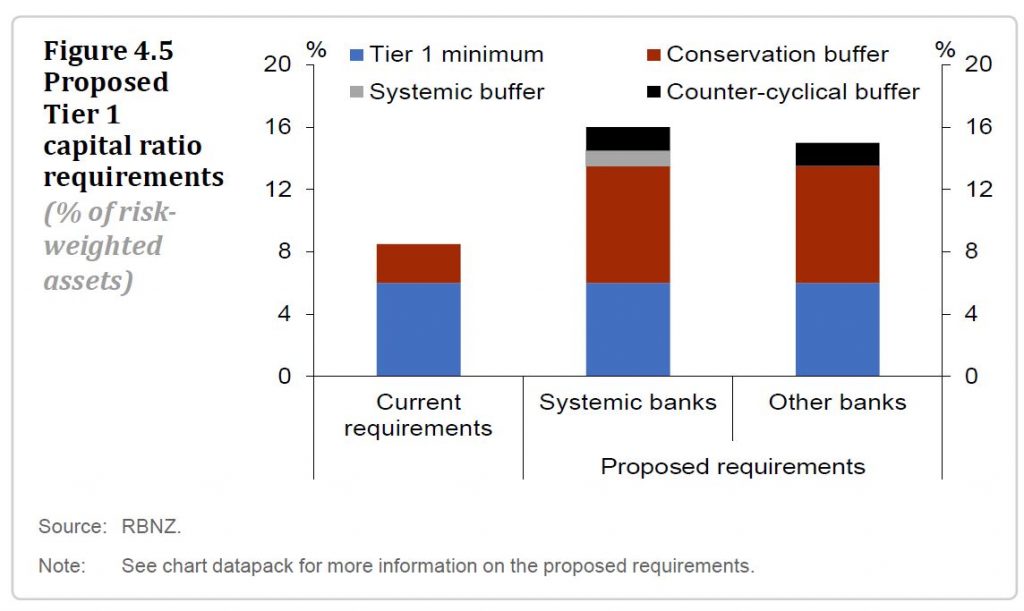

Increasing financial institutions’ capital positions is central to ensuring that they can withstand severe shocks. We have proposed higher capital requirements for banks, and are currently reviewing public submissions on this proposal.

There is also a need for some insurers and non-bank deposit takers to improve their capital buffers. We will be reviewing insurer solvency standards in the months ahead.

Financial resilience also includes service providers taking a long-term customer outcome focus, to both maintain confidence and promote sound resource allocation. We will ensure banks and insurers respond to the issues identified in our recent review of their conduct and culture.

A longer-term focus is also necessary for financial firms to adapt to the changing competitive, regulatory, and natural environment.

Insurers are changing how they manage their exposure to natural disaster events, which is altering affordability. Risks associated with climate change are also impacting on the accessibility of insurance, with potential flow-on effects on bank lending. These risks must be appropriately identified and priced, so as to best ensure a stable transition over coming years.

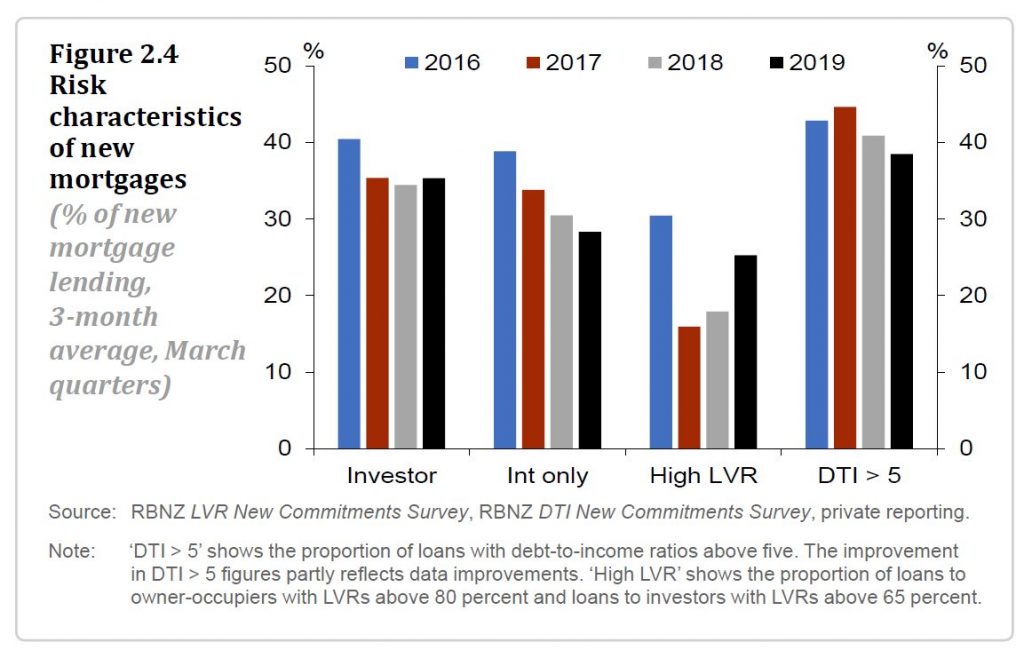

The Reserve Bank’s loan-to-value ratio (LVR) restrictions have been successful in reducing some of the risk associated with high household indebtedness. The current LVR settings remain appropriate for now, with any further easing subject to continuing subdued growth in credit and house prices and banks maintaining prudent lending standards.