It’s being described as a “mortgage mirage”. It’s an offer from the bank that looks too good to be true and, as it turns out, for many it is; via ABC.

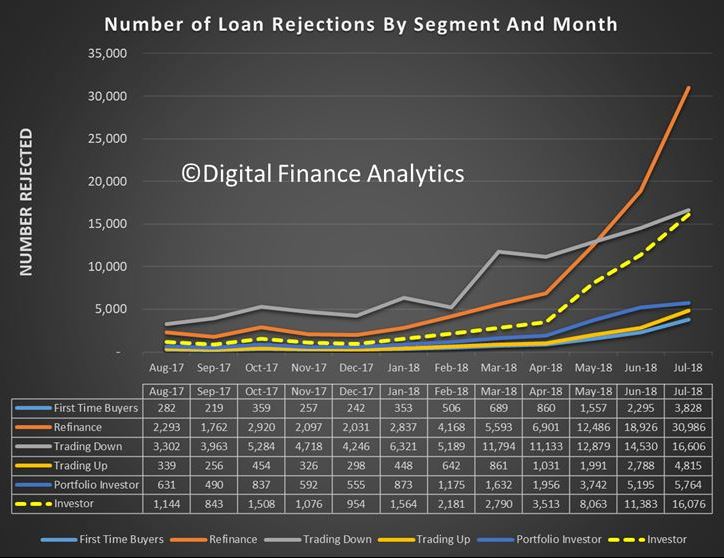

“About 40 per cent of people who tried to refinance were unable to do so,” Digital Finance Analytics principal Martin North said. “If you go back a year it was 5 per cent.”

Data from DFA and investment bank UBS show there has been a spike in the number of failed mortgage refinancing applications.

The reason this is occurring is that, while those applicants cleared the bar for their original loans, that bar has now become a lot higher, following years of banking reform and the fallout from the banking royal commission.

So, now, they simply don’t qualify for the same amount of debt they once did.

“When people took out the loans there was a lot of widespread fudging of the numbers,” chief investment officer with funds management firm, Forager Funds, Steve Johnson said.

“People were getting loans on the basis of a four person family having $30,000 a year of living costs living in Sydney.

“And it’s quite clearly impossible to live in Sydney on that much money a year.

“The biggest issue is that people have borrowed too much money relative to their income and that is a very difficult problem to unwind.”

But, Mr Johnson said, it is not just the banks that have messed up.

Thousands of Australians are either stuck with their current bank or need to move to a “shadow lender” due to tighter lending rules.

“I think the banks have done a lot of unconscionable things, and I think credit has been far too easy to come by, but there is also an element of personal responsibility here in terms of people saying, ‘well, the bank offered to lend me $1.5 million but I don’t really think that is a sensible amount of money for me to borrow’.”Mr North has calculated there are now close to one million Australians on the edge of mortgage stress – defined by Digital Finance Analytics as borrowers who are going further into debt or eating into savings because their expenses are greater than their income.

Given that, it’s understandable that when the big four banks advertise discounted mortgage rates, financially stressed-out households flock to the banks to bag a better deal.

“And then they’re stuck, because suddenly they find that that wonderfully alluring low rate that’s being hung out to them is inaccessible,” Mr North said.

He calls these borrowers “mortgage prisoners” because they go home empty-handed, trapped in a financial squeeze.

Royal commission behind loan approval lull

While Forager Funds’ Steve Johnson sympathises with these borrowers, he said he is not in the least bit surprised there has been a recent spike in the number of loan refinancing rejections.

“It’s a perfectly natural consequence of more conservative lending standards,” he observed.

“You just can’t have one of those things without the other.”

Mr Johnson said the banking royal commission is behind the loan approval lull.“It has accelerated it, and made it a lot more dramatic than it otherwise would have been,” he argued.

But it seems the royal commission has also inspired aggressive sales tactics and interest rate discounting from the banks – for the right customers.

“The banks are seeking out low risk, low LVR [loan to value ratio] borrowers, and are trying to hook them” Mr North said.

“Because without them they are pretty much out of profits.”

Big four play down 40 per cent figure

CBA, NAB and ANZ confirmed to RN Breakfast they had reached out to new customers with lower rates.

But how many of the moths drawn to this low interest rate light have been burned in the process by having their applications rejected?

CBA and NAB say they don’t have any data on that, but questioned the accuracy of Mr North’s figures.

ANZ did appear to have such a database and said: “We have seen a small increase in the number of unsuccessful applications for internal refinance since March, but it is much lower than the 40 per cent figure that has been referred to.”

Westpac responded to the ABC by saying that, “No matter the market appetite, we take our responsible lending obligations seriously, ensuring good outcomes for customers”.

Mr North said he sympathised with borrowers who have become ineligible for lower rate loans.

“The typical saving could be up to $150 a month,” he observed.

“They see this mirage of a lower rate opportunity and then it’s snatched away from them when they don’t actually meet the standards.”

Concerns for the rest of the economy

Mr Johnson wanted to use the new data to highlight how serious Australia’s record level of personal debt has become.

“We are in a position now where all those people owe extraordinary amounts of money to the bank and it’s not an easy situation to unwind or extract ourselves from,” he said.

Independent banking analyst Brett Le Mesurier warned there are also important implications for the economy. “There are certainly signs of deterioration,” he said.

“I suspect the issue is not so much their ability to service those loans, it’s more the other spending they don’t make anymore and the broader impact that has on the economy.

“I therefore expect that to push downward pressure on economic growth.”

As for the extent of Australian home loan stress?

The nation’s biggest lender said it simply isn’t an issue.

The Commonwealth Bank said it has seen a slight uptick in 90-day home loan arrears.

But, as noted in its recent results, the uptick in arrears rates reflected “pockets of stress as some households experienced difficulties with rising essential costs and limited income growth”.