Westpac has announced it will lift mortgage rates on existing variable loans by 14 basis points. This was expected (I had said by September a few months back!). Others will follow now. More pain for households in a rising cost, flat income economy. More downward pressure on home prices.

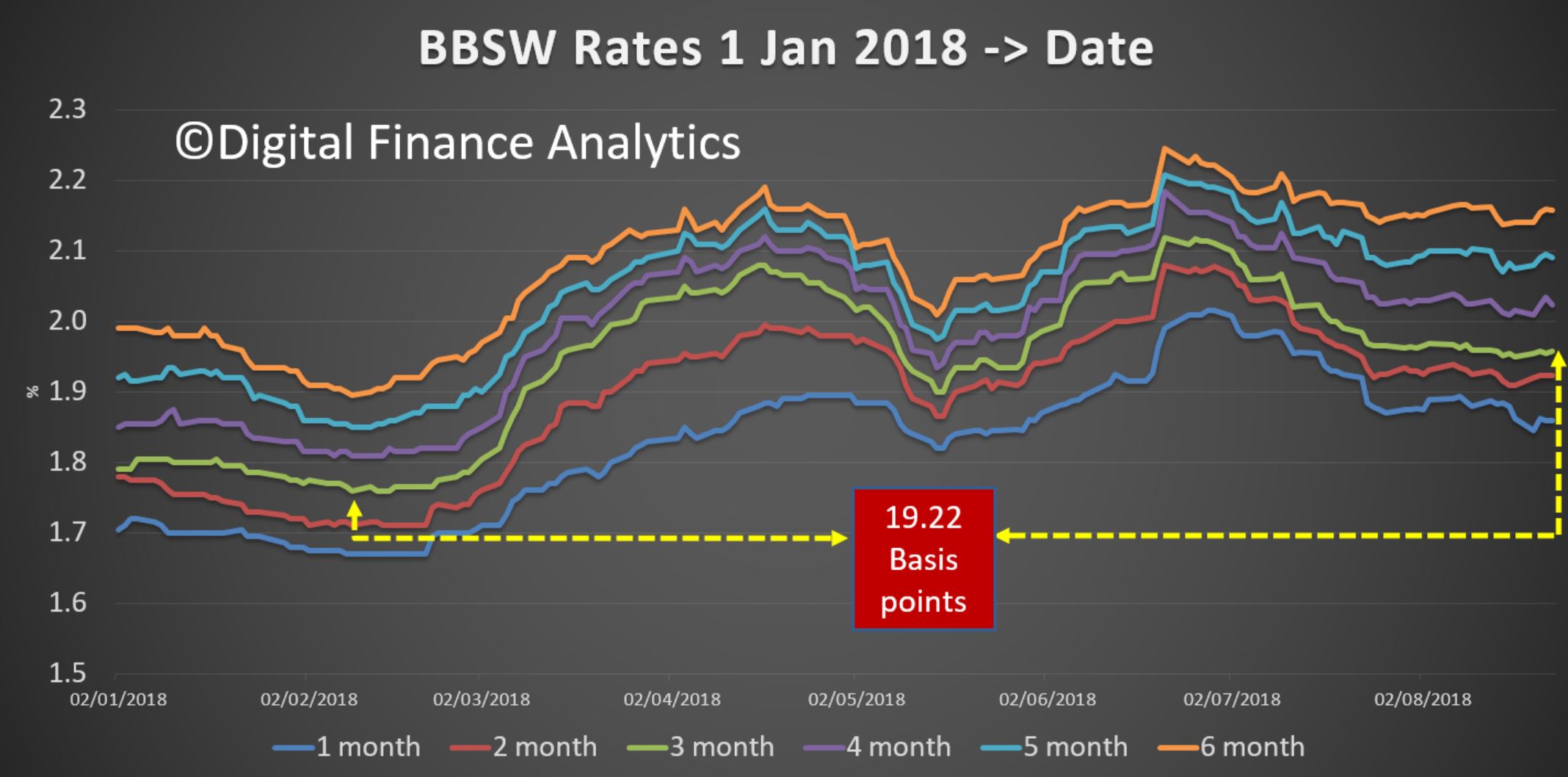

The BBSW stands 19 basis points above where it was in February.

Westpac last week had highlighted a margin problem, and showed the rise in funding, which has squeezed their margins. Expect more “great offers” to attract low risk new customers, at the expense of the back book.

Westpac last week had highlighted a margin problem, and showed the rise in funding, which has squeezed their margins. Expect more “great offers” to attract low risk new customers, at the expense of the back book.

Westpac chief executive Brian Hartzer says he didn’t “relish” having to make the decision to lift variable mortgage rates as higher wholesale funding costs fail to subside.

Following similar moves by several smaller lenders in recent months, Westpac today said variable interest rates for its owner occupied and residential investment property loans would rise 14 basis points due to the “sustained increase in wholesale funding costs” since February.

CEO Brian Hartzer told Westpac Wire it was a “difficult” decision but the bank had “come to the conclusion that what we’re looking at is a sustained increase in that key benchmark wholesale funding cost rate”.

“It’s now been elevated for over six months…reluctantly we came to the conclusion that needed to be reflected in our mortgage costs,” he said. He added that while conscious of the impact the interest rate change would have on consumers’ cost of living, some mortgage rates would remain below where they were three years ago and “from a credit point of view, no, I’m not concerned” about any impact on the bank’s mortgage book.

In an update to the Australian Securities Exchange last week, Westpac said funding costs had risen primarily due to the sharp increase in the bank bill swap rate (BBSW) since February. Compared to the first half, the BBSW was on average 24 basis points higher in the third quarter, the bank added.

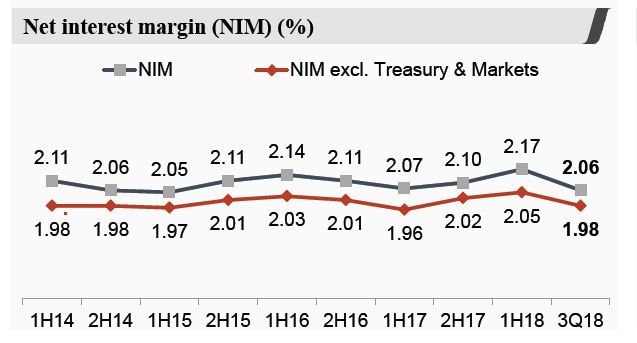

Along with a lower contribution from the Group’s Treasury and other factors including changes in the mix of its mortgage portfolio, the higher funding costs dragged on the bank’s net interest margin, which fell to 2.06 per cent in the June quarter from 2.17 per cent in the first half to March 31.

Mr Hartzer said several factors had driven the increase in wholesale funding costs since February, including greater competition for funds from foreign banks that raise money in the domestic wholesale market. The Reserve Bank of Australia has also noted this rise in competition domestically, plus that the cost of raising funding in the United States and then converting it back into Australian dollars has also increased this year and “at times been well above the cost of raising funds domestically”.