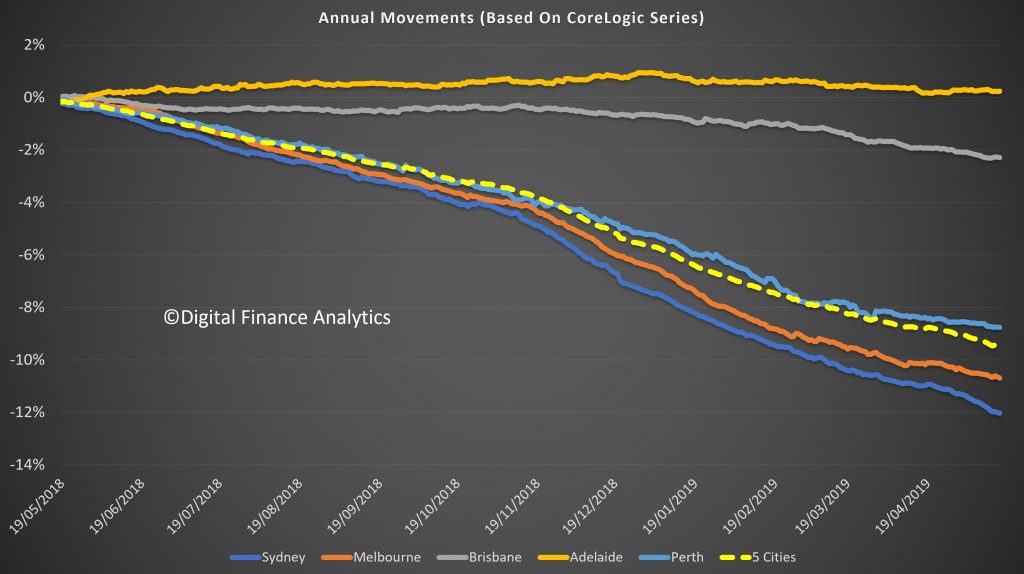

The HIA reported today that there was been a 10% improvement in affordability in a year. They attribute this to – wait for it, more building and wage rises – but do not mention the elephant in the room, the home price falls, which are continuing – at more than 10% in Sydney and Melbourne! No surprise, as home prices fall, affordability improves…

Five of the eight capital cities saw improved affordability over the year to March 2019. Sydney continues to be home to the greatest improvements, its index is up by 12.4 per cent. This was followed by Melbourne (+9.6 per cent), Perth (+7.7 per cent), Darwin (+5.9 per cent) and Brisbane (+2.5 per cent). Affordability deteriorated in Hobart (-5.1 per cent), Canberra (-5.1 per cent) and Adelaide (-1.1 per cent).

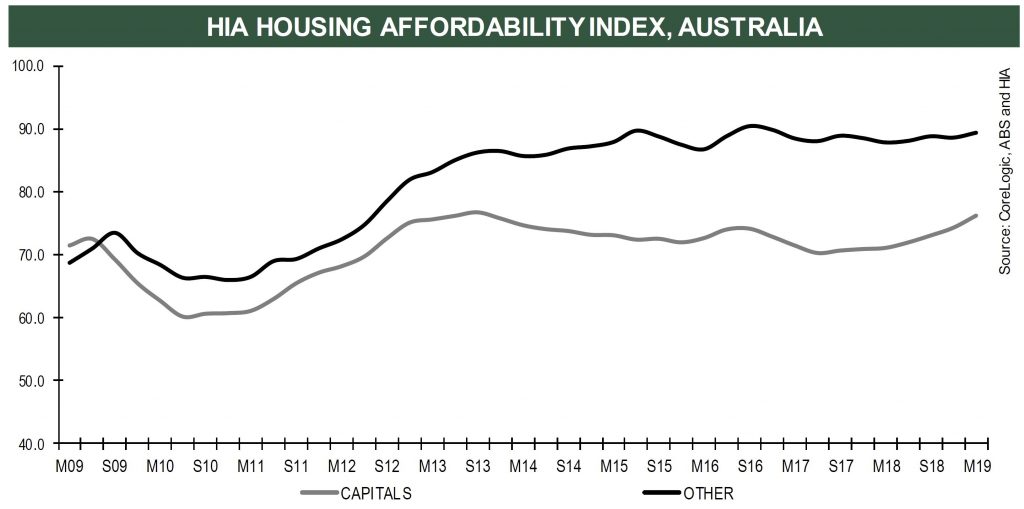

HIA’s Affordability Index is calculated for each of the eight capital cities and regional areas on a quarterly basis and takes into account the latest dwelling prices, mortgage interest rates and wage developments.

“The HIA Affordability Index rose by 2.2 per cent in the March 2019 quarter to post the most significant improvement in affordability since September 2013,” said Tim Reardon, HIA Chief Economist.

“The improvement in housing affordability has been experienced across the country, with the exception only of Tasmania and the ACT, where ongoing house price growth has seen affordability remain static,” added Mr Reardon.

“The boom in home building of the past five years is a key factor behind the improvement in housing affordability. With completions of new homes remaining at elevated levels, affordability is poised to continue to improve.

“Wage growth also contributed to the improvement in affordability.

“The improvement in affordability is most significant in east coast capital cities. Affordability in Sydney deteriorated to an extent that in June 2017 it required two average Sydney incomes to be able to afford repayments on an average Sydney home. In just over a year this has improved to only requiring 1.8 standard incomes to purchase the same home.

“Similarly, in Melbourne the Affordability Index has improved by almost 10 per cent in a year,” concluded Mr Reardon.

– And a rate cut from the RBA also will help to lower income, making affordability only worse. Ouch.

– But income(s) is/are also falling. Which makes housing LESS affordable.

– A(n) (old school) real estate agent told that he consdered a debt-to-gross-household-income ratio of about 4 to 4.5 already to be “(too) high” for the average household.

– Well, property prices may have come down by some 10% but when one’s income falls with the same % then the (un-)affordability remains the same.

– In some neighbourhoods of Sydney australian banks were willing to lend 12 times gross Household income. When the ratio has to come down from 12 times to say 4 times gross Household income then some property prices have to down by some 65%. Ouch.

– And this assumes that those incomes remain the same, an assumption that is very un-realistic in a “recession” when un-employment is bound to go (much) higher.