China’s two recent reserve requirement ratio (RRR) cuts amid slowing economic growth and rising trade risks have prompted market speculation that a new cycle of monetary easing is underway, but Fitch Ratings believes it is too early to conclude recent policy actions mark a clear reversion in stance.

A return to policy settings that add to the economy’s imbalances and vulnerabilities, such as credit stimulus, nevertheless remains a risk and could put downward pressure on China’s sovereign rating, as Fitch has previously stated.

The decision by the People’s Bank of China over the weekend to implement another 50bp RRR cut across much of the banking sector follows a targeted 100bp cut in April. The latest cut will release around CNY700 billion in reserves, effective on 5 July, bringing the combined net reserve injection to CNY1.1 trillion this year. The government has stressed that funds released by the latest cut should be used to support implementation of the debt-to-equity swap programme and small and micro-sized enterprise lending.

Fitch believes that the recent RRR cuts should be viewed in the context of liquidity management measures to ensure interbank funding conditions remain stable amid the ongoing crackdown on shadow banking. The authorities have previously relied on liquidity tools such as the medium-term lending facility, the pledged supplementary lending facility and the standing lending facility to provide liquidity in the face of weak base money growth, but an RRR cut should provide more permanent (and lower-cost) support. This should reduce liquidity risks for smaller banks, in particular, which are net liquidity takers and generally more reliant on shadow financing.

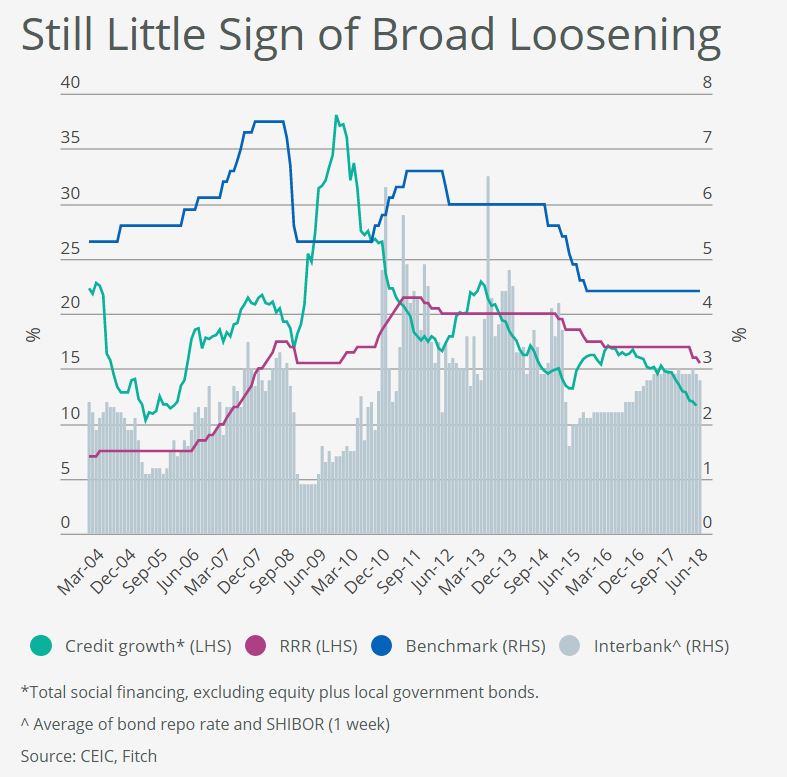

RRR cuts have previously coincided with policy loosening, but periods of clear easing (2008-2009, 2011-2012 and 2015) have also been marked by cuts to benchmark interest rates and a sustained decline in interbank rates, which have so far been absent (see chart). Meanwhile, the authorities continue to maintain a tighter bias towards macro-prudential policies and other financial regulations that aim to close regulatory loopholes, many of which are unlikely to be unwound at this stage, given the prominence the deleveraging campaign has taken at major policy meetings.

For now, Fitch’s expectation is that regulatory tightening will have a more powerful impact on credit growth than the additional liquidity generated by recent RRR cuts. Additionally, while further cuts are still possible, Fitch does not believe banks have sufficient capital to support aggressive asset expansion. That said, these adjustments do suggest that the authorities’ deleveraging drive has likely moved past its apex, and the swift deceleration in credit growth over the past year or so should soon begin to moderate.

Our baseline forecast is that GDP growth will slow during the second half of this year, due to deceleration in credit growth and a softening in the property market. Trade tensions with the US have not so far had a noticeable impact on exports, but could soon become a key policy consideration, given that a buoyant external environment has been an important contributor to China’s strong growth over the past year. If this dissipates, the authorities could be tempted to fall back on domestic stimulus to meet growth targets.

The authorities do have other policy tools beyond credit stimulus to shore up growth. Other forms of stimulus, including an on-balance-sheet fiscal stimulus, would not necessarily be ratings negative. Fitch estimates gross general government debt at less than 50% of GDP, in line with ‘A’ rated peers, which provides some room for fiscal easing. A recent State Council decision to lower taxes, which included a cut to value-added-tax rates, and plans to increase personal income tax deductions perhaps signal an initial step in that direction.