The UK household sector’s worsening financial health reduces consumer resilience to income or interest rate shocks and presents risks for UK consumer loan portfolios, Fitch Ratings says in a new report. Consumer credit has been a key driver of rising household debt.

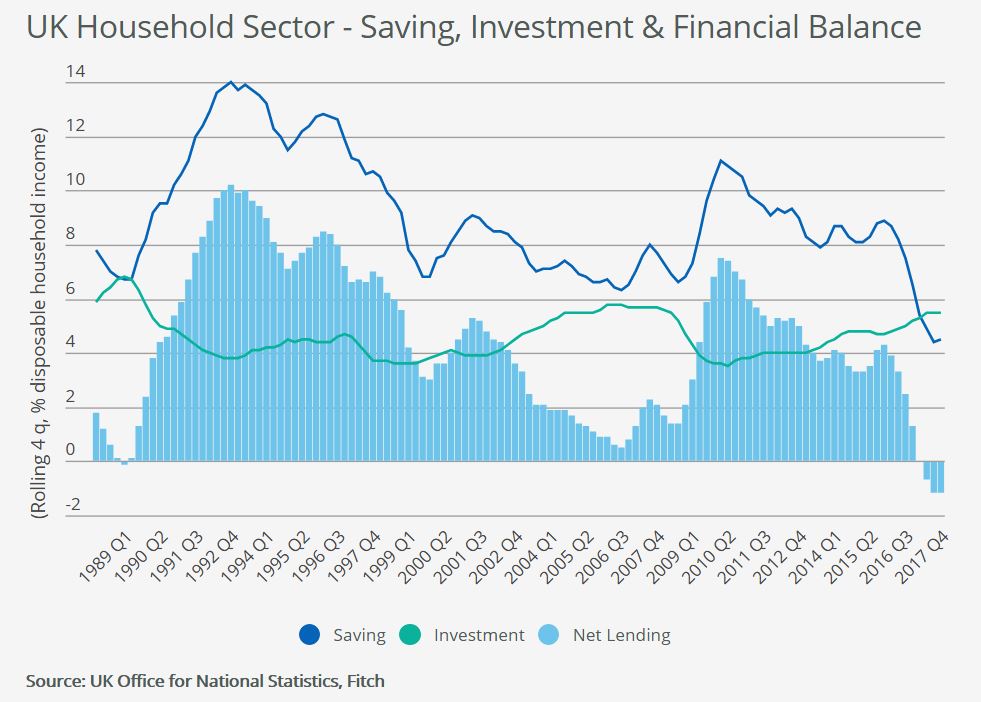

UK households’ swing into an aggregate net financial deficit position over the last year is almost unprecedented, having only previously occurred briefly during the late 1980s. Greater residential investment is a factor, but the household saving ratio has declined steadily since the mid-1990s to an historical low of 4.9% last year. This has been partly due to lower private pensions saving relative to income.

More recently, the UK household debt to income ratio has risen, retracing more than a third of its post-global financial crisis decline (in contrast with the US), and is likely to keep rising given the sector’s financial deficit. This has been largely driven by growing consumer credit, notably car loans.

Low interest rates mean the rise has yet to increase the debt service burden. We calculate that the effective interest rate on all UK household debt fell to 3.3% last year. The fall in the effective interest rate has saved household borrowers GBP20 billion-25 billion in interest payments since 2009.

But weaker household finances reduce the resilience of consumer spending – by far the largest demand component of UK GDP – to shocks. A major interest rate shock appears unlikely (we forecast the UK base rate to rise gradually, to 1.25% by end-2019), but a more immediate shock could come from tightening credit supply. The impact of the Brexit referendum on real wages may be fading, but Brexit uncertainty creates risks of a bigger shock to growth and employment.

Any performance deterioration in UK consumer loans would be from a very strong level. The charge-off rate on bank-financed consumer credit hit a record low of 1.7% in 4Q17. We forecast a modest rise in UK unemployment this year, to 4.7%, implying that charge-offs, which are closely correlated with changes in unemployment, will head back up to 2%-3%.

Fitch-rated consumer ABS deals have substantial headroom to absorb any performance deterioration. For example, the lowest long-term charge-off assumption we currently apply to any prime UK credit card trust is 5%, following the sharp increase in competition in credit card lending since 2013.

UK auto ABS deals have also performed strongly and benefit from structural credit protection, although if unemployment rose and consumer demand fell, both credit risk and residual value risk, which has become more prominent with the rise of the personal contract purchase (PCP) product, could increase.

UK banks are highly exposed to UK households, but mostly through mortgages, with consumer credit accounting for just 10% of banks’ lending to the sector. Recent stress testing by the Bank of England highlighted strong capital buffers against severe consumer credit losses. Nevertheless, high household debt is a constraint in our assessment of UK banks’ operating environment, and currently caps UK domestic banks’ Viability Ratings in the ‘a’ range, all else being equal.

Non-bank financial institutions are more exposed, although their specialist nature means any impact from deteriorating performance would vary across the industry.