The latest from the ABS suggests that thanks to a lift in export prices, against imports, the GDP next time will be significantly assisted. Indeed the quantum of the changes are surprising strong. This may be sufficient to stop the RBA cutting the cash rate next month.

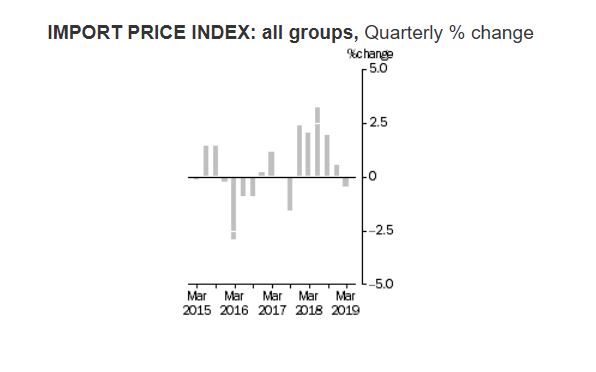

IMPORT PRICE INDEX

The Import Price Index fell 0.5% in the March quarter 2019. This follows a rise in the December quarter 2018 of 0.5%.

The main contributor to the fall this quarter is Petroleum, petroleum products and related materials (-6.8%), due to an increase in global supply.

Other major price falls were recorded in Inorganic chemicals and Medicinal and pharmaceutical products.

Inorganic chemicals fell 15.3%, driven by falls in the price of caustic soda, due to a global oversupply.

Medicinal and pharmaceutical products fell 3.1%, due to annual price reviews and increased competition from generic medicines.

These falls were partially offset by rises in prices for Gold, non-monetary (excluding gold ores and concentrates) (+6.8%), and General industrial machinery and equipment, n.e.s., and machine parts, n.e.s. (+2.5%).

Through the year to the March quarter 2019, the Import Price Index rose 5.2%. The main contributors to the rise are Petroleum, petroleum products and related materials (+5.6%), and General industrial machinery and equipment, n.e.s., and machine parts, n.e.s. (+8.6%).

MAJOR IMPORT PRODUCTS

The price movements of Australia’s major import products are summarised below:

- Petroleum, petroleum products and related materials (SITC 33) (-6.8%);

- Road vehicles (incl. air-cushion vehicles) (SITC 78) (-0.4%);

- Telecommunications and sound-recording equipment and reproducing apparatus and equipment (SITC 76) (-0.1%);

- Electrical machinery, apparatus and appliances, n.e.s. (SITC 77) (+1.0%);

- General industrial machinery and equipment, n.e.s., and machine parts, n.e.s. (SITC 74) (+2.5%).

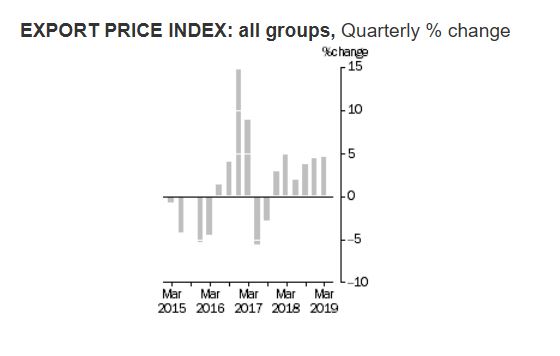

EXPORT PRICE INDEX

The Export Price Index rose 4.5% in the March quarter 2019. This follows a rise in the December quarter 2018 of 4.4%.

The main contributor to the rise this quarter is Metalliferous ores and metal scrap (+12.9%), reflecting local and global supply disruptions for iron ore and on-going demand from China.

Other major price rises were recorded in Gold, non-monetary (excluding gold ores and concentrates), Cereals and cereal preparations, Gas, natural and manufactured, and Non-ferrous metals.

Gold, non-monetary (excluding gold ores and concentrates), rose 6.6%, due to increased investor demand amid concerns over global economic growth.

Cereals and cereal preparations rose 4.3%, due to the impact of dry weather conditions globally in many wheat growing regions.

Gas, natural and manufactured rose 0.9%, due to the continuation of demand across Asia for liquefied natural gas. Export contract prices for liquefied natural gas are influenced by the international crude oil price with a four to six month lag.

Non-ferrous metals rose 3.3%, driven by increased demand for copper.

Offsetting these rises were falls in prices for Petroleum, petroleum products and related materials (-11.7%), and Meat and meat preparations (-2.3%).

Through the year to the March quarter 2019, the Export Price Index rose 15.3%. The main contributors to the rise are Metalliferous ores and metal scrap (+25.4%), Gas, natural and manufactured (+37.1%), and Coal, coke and briquettes (+9.0%).

MAJOR EXPORT PRODUCTS

The price movements of Australia’s major export products are summarised below:

- Metalliferous ores and metal scrap (SITC 28) (+12.9%);

- Coal, coke and briquettes (SITC 32) (+0.1%);

- Gas, natural and manufactured (SITC 34) (+0.9%);

- Gold, non-monetary (excluding gold ores and concentrates) (SITC 97) (+6.6%);

- Meat and meat preparations (SITC 01) (-2.3%).