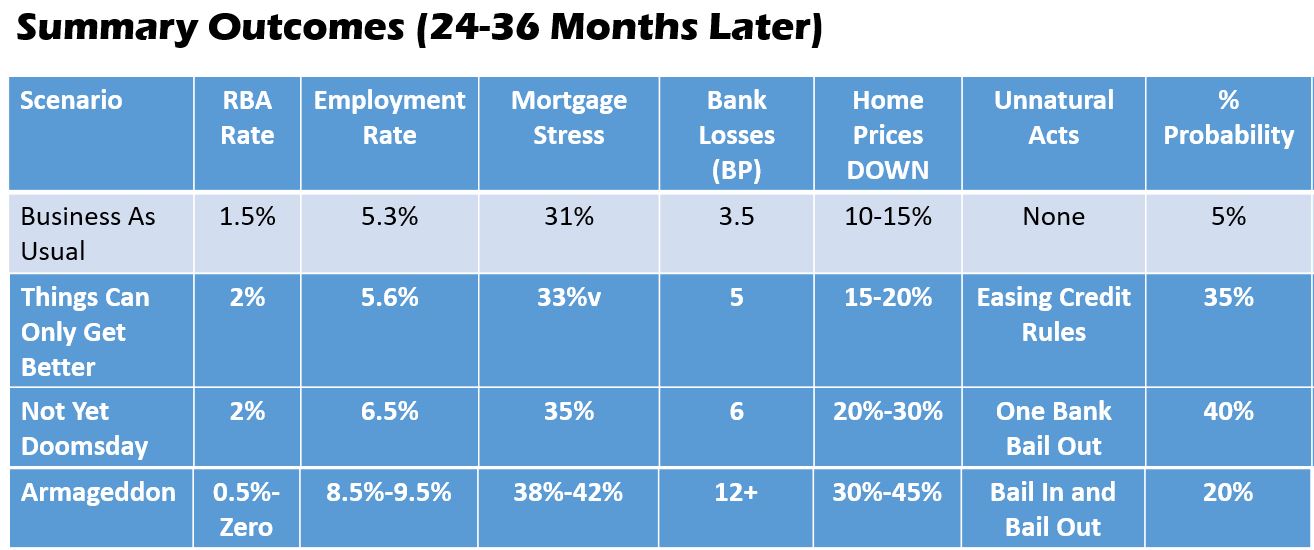

Yesterday we ran a live discussion on our revised property and finance scenarios. For those who need to “answers” this is a brief overview. We explain more about our thoughts in the full show (below).

- Scenarios are a way of exploring different futures, and to consider the consequences, not as a forecast, but to facilitate understanding and debate.

- None of these scenarios may turn out to be right…. Things change.

- We use a framework driven from our core market model and we are going to look at the four potential outcomes, updated with the latest data and outcomes.

Business As Usual

- Credit growth eases

- Fall in prices continues, employment around current level

- RBA still banking on household consumption to support growth.

Things Can Only Get Better

- International rates rise out of cycle

- Exchange rate down

- RBA lifts rates – pressure on rates 50 basis points.

- Credit growth slides.

- Loss rates rise.

- Home prices slide further.

Not Yet Doomsday

- US rate rises trigger pressure in the USA

- Flight to quality, to US$ or gold.

- Capital exits Australia, need rates higher to retain investment, yet needs to cut to help the economy.

- One bank in Australia would have issues, due to investor loans.

Armageddon

- International crisis, pressure on economies.

- Caught in the tide.

- Unemployment lifts

- Defaults rise.

- Unusual measures.

- Australia parallels Ireland (or worst)

For each scenario we look at a range of outcomes, and also apply a probability rating. The results are shown here: