This is the edited version of our live event, in which we discuss the latest data, updated scenarios and answer questions in real time from the live chat.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

This is the edited version of our live event, in which we discuss the latest data, updated scenarios and answer questions in real time from the live chat.

We ran our regular live Q&A event last night, and had the biggest audience ever (thanks to all those who took part).

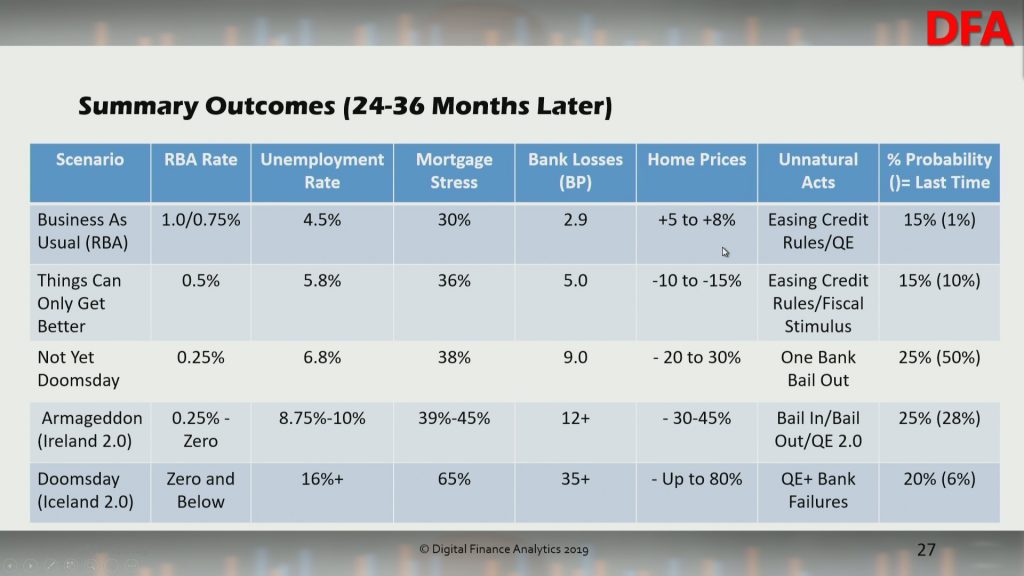

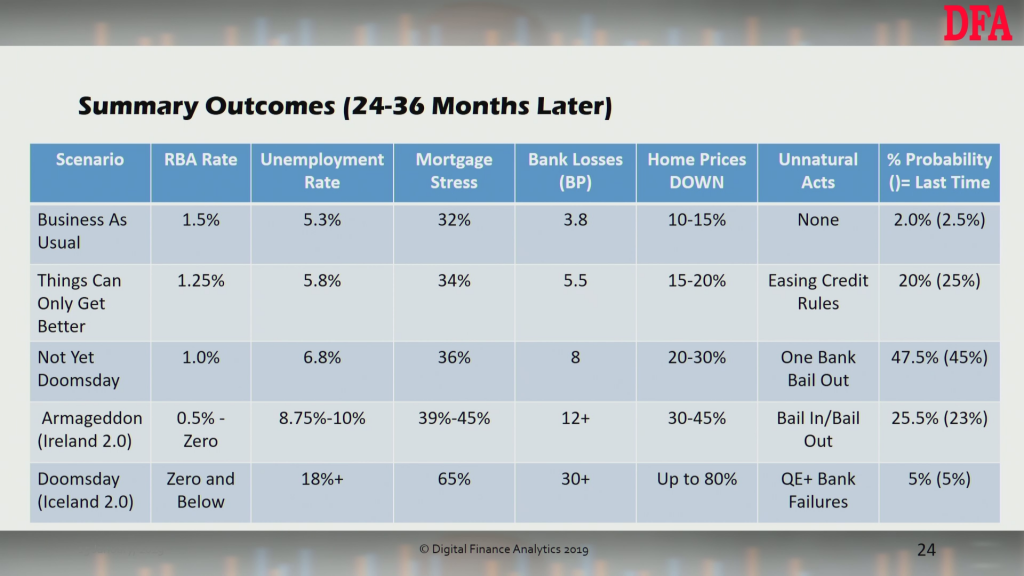

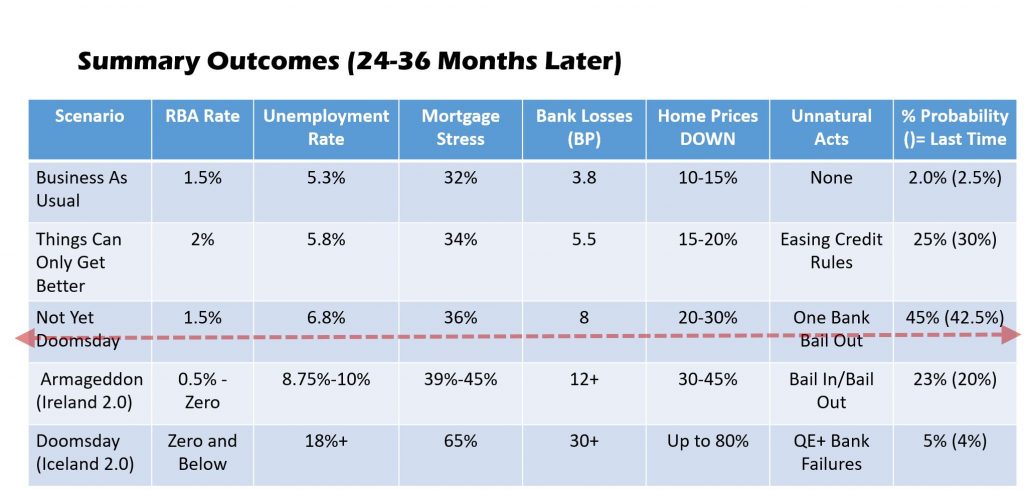

During the show we discussed the latest data from the RBA, ABS and Moody’s, and our updated scenarios. In the current “risk-on” environment, and with the RBA’s pivot to lower rates, QE and lifting the money supply incorporated into our modelling, plus the heightened international risk profiles; there are some big changes to our scenarios.

Given the RBA (and the FED) have flipped to more QE, the future could play out a number of ways over the next 2-3 years. Indeed, if the RBA does get unemployment down to 4.5%, it is possible home prices will be higher by then.

We are expecting a small bounce, but then further falls in home prices as the broader economy weakens, and the risks from an international crisis rise further. But remember average rises or falls mask significant variations. We discuss specific examples on the show where prices have already dropped more than 30%.

You can watch the edited version of the show and our rationale for the scenario revision.

Alternatively, the original stream, including the live chat replay is available.

And we also included a view behind the scenes during the session.

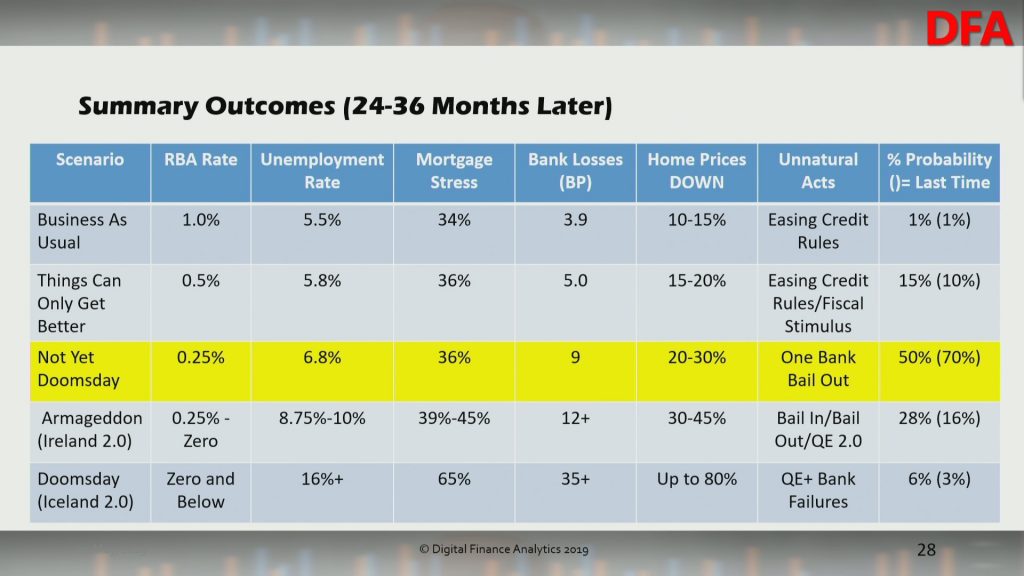

We ran the latest live Q&A session last night. One highlight was our updated scenarios. With the trade wars in play, the election results, RBA comments and APRA’s latest, the relative weighting for the scenarios have changed. Cash rates have been reduced, and bank losses adjusted.

Of course we have yet to get soundings from our household surveys as to whether buying intentions are changing; that will take a few weeks. And more unnatural acts might shift the results too.

You can watch the edited version of the event here:

Or the full show, including the live chat here:

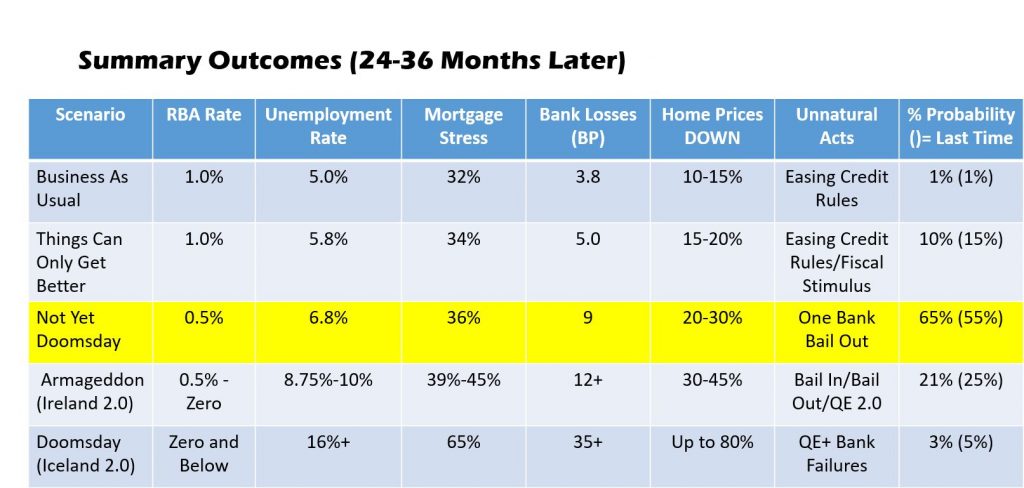

We have updated our home price and mortgage risk scenarios, based on our household surveys, and other data sources. While the risk from a global financial crisis is being pushed out temporally, as central banks do QE again, the risks of a local property crash continue to play out as expected.

As price falls pass 20%, the second order impacts on the economy also play in. We think a 20-30% fall in property values in the major markets is all but baked in now, with the risk still on the downside. The next leading indicator will be an uptick in the unemployment rate (in about 6 months time?)

We discussed the rationale for this analysis, which is driven from our Core Market Model in our live stream last night. We also answer a range of questions from viewers.

You can watch the edited edition.

Or the original live event, including the pre-show, and chat replay.

Main Show Starts here 2

This is the edited version of our live stream event where we discuss our latest scenarios and a range of finance and property questions.

Live recording and chat can be found at: https://youtu.be/BNrTHJ2MWjo

We have updated our scenarios to take account of a range of new data, and the latest input from our household surveys. A peak to trough fall of 20-30% over 2-3 years remains our base case, but with risks to the downside. On the other hand the RBA’s base case gets only a 1% probability now.

The factors we have taken into account include:

We also have used updated households intention to transaction data, mortgage stress and affordability metrics.

ANZ yesterday revealed their mortgage underwriting standards are now ~20% tighter. Others are even tighter. “Mortgage Power” has been significantly curtailed.

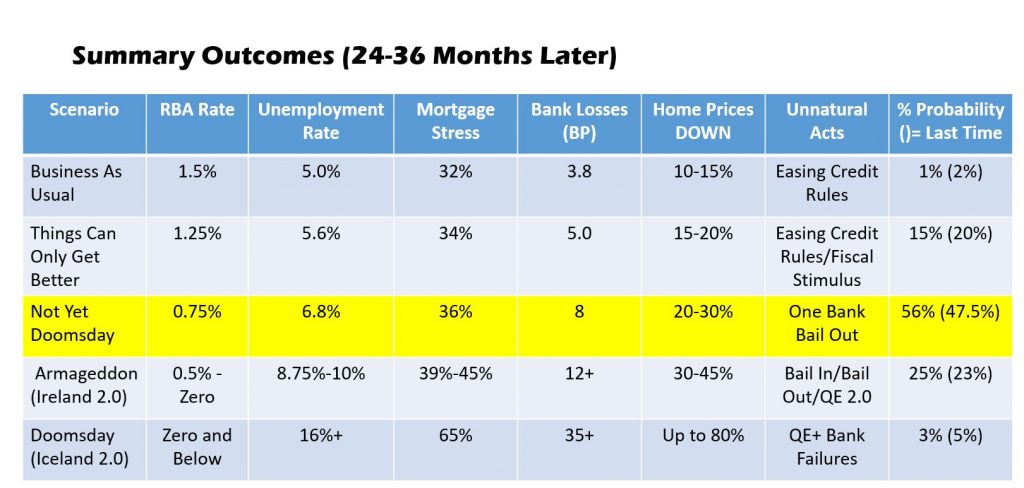

Here are the results from our Core Market Model, with a probability rating.

Business As Usual: RBA driven scenario

Things Can Only Get Better: Economy is weaker, as wages continue to grow only slowly, costs rise, and RBA cuts later in the year. Some Government tax stimulation either before or after the election, or both. Some easing of credit rules so lending growth accelerates.

Not Yet Doomsday: A locally driven downturn, as wages are flat, despite some mortgage rate repricing. RBA cuts significantly. Employment rises, and one Bank requires assistance. Fiscal stimulus does not have significant impact as household consumption falls.

Ireland 2.0: International crisis overlaid on scenario 2, with QE and lower rates, in response. May be from Europe (Brexit), China, or US, or some combination as global growth falls. In response cash rate is cut hard to zero bounds, QE in Australia commences, and banks are rescued/restructured via bail in and bail out.

Iceland 2.0: As above, but no bank rescues, so banks fail. RBA moves to negative interest rates (see Japan).

We discussed these scenarios during our live stream Q&A event last night. Here is the edited version of the event:

The podcast edition:

You can also watch the full live version of our stream, complete with live chat, and a couple of system errors, due to a camera overheating!

We have updated our scenarios to take account of potential RBA rate cuts later in the year, revised mortgage stress and household confidence data and other factors. We also updated our probability allocation. Here is a summary.

Our central scenario is one of home price fall, peak to trough, of up to 30%. A deeper fall, in the event of international financial stability is also possible. We do not think the RBA has any hope of lifting rates from current emergency levels, having dropped them too low previously.

We discussed these updates during yesterdays live stream Q&A event. Here is a high quality edited version.

You can also watch the recorded “live” version, including the chat replay here:

We have updated our home price scenarios using the latest available data, and discussed them during our live event which was streamed on Tuesday evening.

Most probable case is a peak to trough fall of between 20 and 30%, but risks continue to accumulate on the downside. We do not think recent “unnatural acts” from RBA and APRA will have much effect, given the legal obligations which currently exist relating to responsible lending (which were clearly not respected in recent years as the Royal Commission highlighted).

This version has been trimmed and does not include the pre-show or live show chat.

The alternative version, as streamed on the night is still available, complete with the chat room comments (some of which people may find concerning).

We have revised our scenarios based on the latest data from our household surveys, and other available information.

Scenarios are a way of exploring different futures, and to consider the consequences, not as a forecast, but to facilitate understanding and debate.

None of these scenarios may turn out to be right…. Things change.

We use a framework driven from our core market model and we are going to look at the five potential outcomes, updated with the latest data and results.

Here is the summary results.

Since last time, conditions appear to have deteriorated further. We discussed this in our recent live stream event.