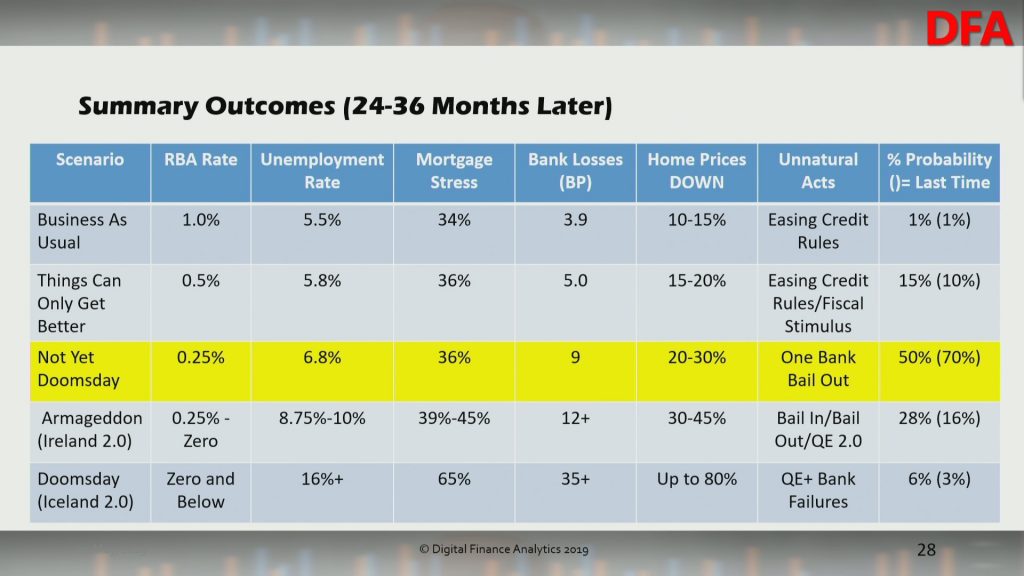

We ran the latest live Q&A session last night. One highlight was our updated scenarios. With the trade wars in play, the election results, RBA comments and APRA’s latest, the relative weighting for the scenarios have changed. Cash rates have been reduced, and bank losses adjusted.

Of course we have yet to get soundings from our household surveys as to whether buying intentions are changing; that will take a few weeks. And more unnatural acts might shift the results too.

You can watch the edited version of the event here:

Or the full show, including the live chat here:

Wonderful content Martin.

Pertinent, positively realistic, and purposeful.

Thanks from all of us, especially those of us who cant afford to contribute dollars as yet.

Keep up the good work Martin.

Cheers,

Merlin

HI Martin – there is a good podcast which you may have heard of jolly swagman with John hempton on recently. HIs feeling was that the A$ would be the defence mechanism if things go pair shaped. ALso on another excellent podcast – macrovoices had Juliet Declerc talking about QE and MMT. I’m not sure if either of these would have been factored into your scenarios?

HI Martin – there is a good podcast which you may have heard of, jolly swagman, which had John hempton on recently. HIs feeling was that the A$ would be the defence mechanism if things go pair shaped. ALso on another excellent podcast – macrovoices, they had Juliet Declerc talking about QE and MMT. I’m not sure if either of these have been factored into your scenarios?