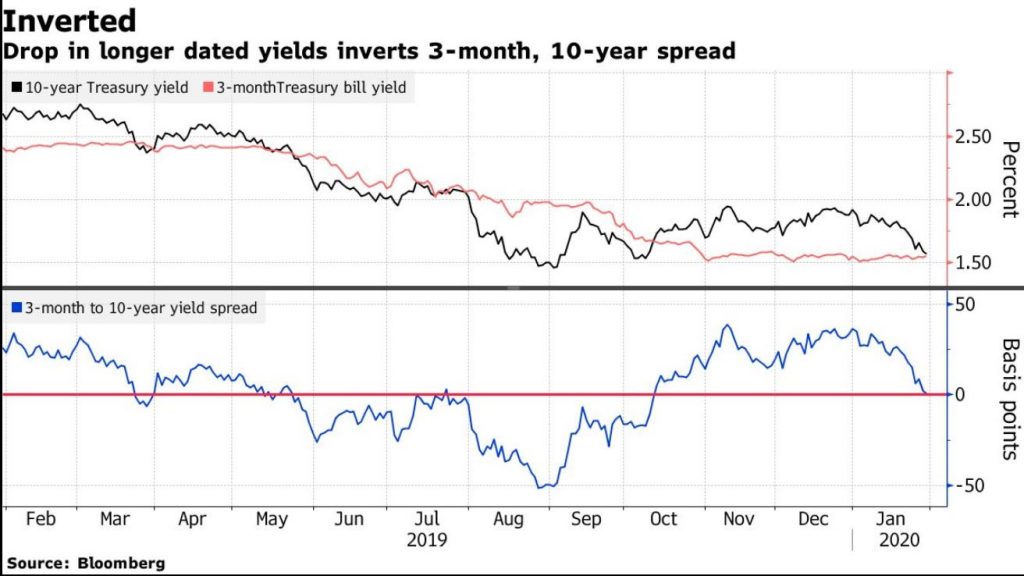

The fears relating to the coronavirus and weakish consumer sentiment from the US, plus the Feds hold decision turned the tables on the US yield curve overnight, with the 3-month rate 2 basis points higher than the 10-year at one point. Its slightly positive now… but this is a sign of uncertainty.

Plus a measure of core U.S. inflation released on Thursday showed price pressures slowed to an annualized 1.3% in the fourth quarter from 2.1%, a weaker figure than analysts had expected. And below the Fed’s target.

The dip will be seen as some as a warning signal because it has inverted before each of the past seven U.S. recessions. The last inversion was at the height of the trade war.

But it also is driven by the thought that the Fed may need to pump more liquidity into the market, despite the assurance they were planning to ease back their open market operations in the next few months. This means buying more treasuries out along the curve. – Price up means yields fall.

Clearly, investors are looking for some form of safety and buying Treasuries out the curve is really the only way to do it.

And Bloomberg says that falling yields also triggered other market dynamics which are exacerbating the move. Convexity hedging — when mortgage portfolio managers buy or sell bonds to manage their duration exposure — is back in play. As yields fall, they make purchases.

The sequence of a swift drop in yields and curve flattening unleashing convexity-linked forces that re-starts the cycle is a recurring feature of the Treasury market .

A massive wave of convexity-related hedging in the swaps market in March helped send 10-year yields to levels then not seen since 2017. That came after the Fed took an abrupt shift away from policy tightening they had been doing in 2018. The Fed went on to cut rates three times over all of 2019.

Other factors may be at work now as well. Structural demand for long-dated Treasuries — linked to liability-driven investment and hedging from foreign investors including Taiwanese insurers — has helped to drive the curve flatter, according to Citigroup Inc.

We think its too soon to know whether this is an over-reaction, but once again it underscores markets are on a hair trigger. So expect more volatility ahead.

– This is NOT a sign of “insecurity”, it’s a sign that the markets are still (very) complacent. Once the yield curve starts to steepen again then that’s a sign that markets are starting to worry again.

– Another sign of complacency is that the 3 month T-bill rate remained flat in the recent sell-off.

– No, the FED (and RBA, RBNZ, BoE, …… ) do(es) NOT control ANY of the yields. They FOLLOW those yields. That’s why the 3 month T-bill rate is so usefull as a risk / market indicator.