Introduction

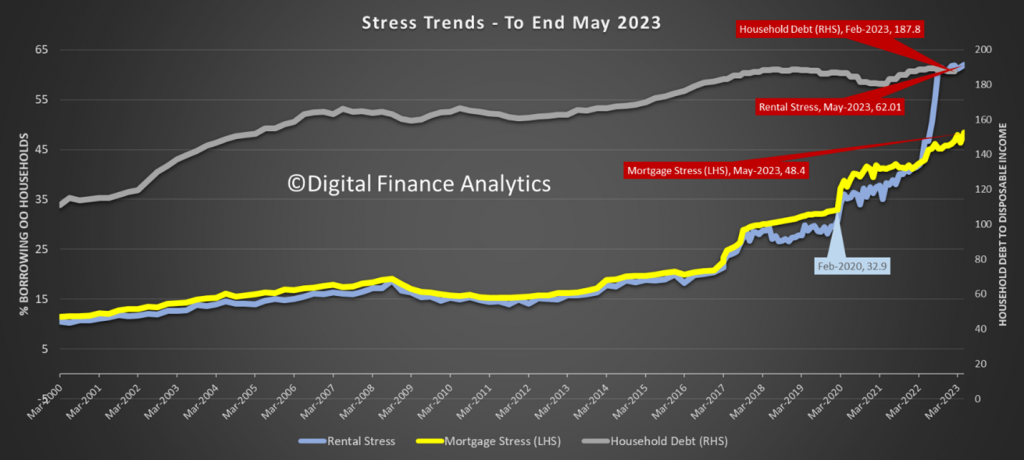

The latest edition of the DFA Household surveys (a 0.5% sample across Australia), reveals the creeping mortgage and rental stress which is continuing to reach new highs. We measure stress in cash flow terms – money in and money out, and where there is a deficit, households are identified as “stressed”. Often households will be able to hang on for months by tapping into savings, drawing down more from refinanced loans, or from other forms or credit, or by tightening their spending. Some have been able to gain temporary relief by refinancing to a cheaper loan (even if on extended terms), but as income growth remain below the current inflation rates, incomes continue to lose ground. Data this past week showed more than ever households were now working multiple jobs to get buy.

The rises in stress since before COVID are stark.

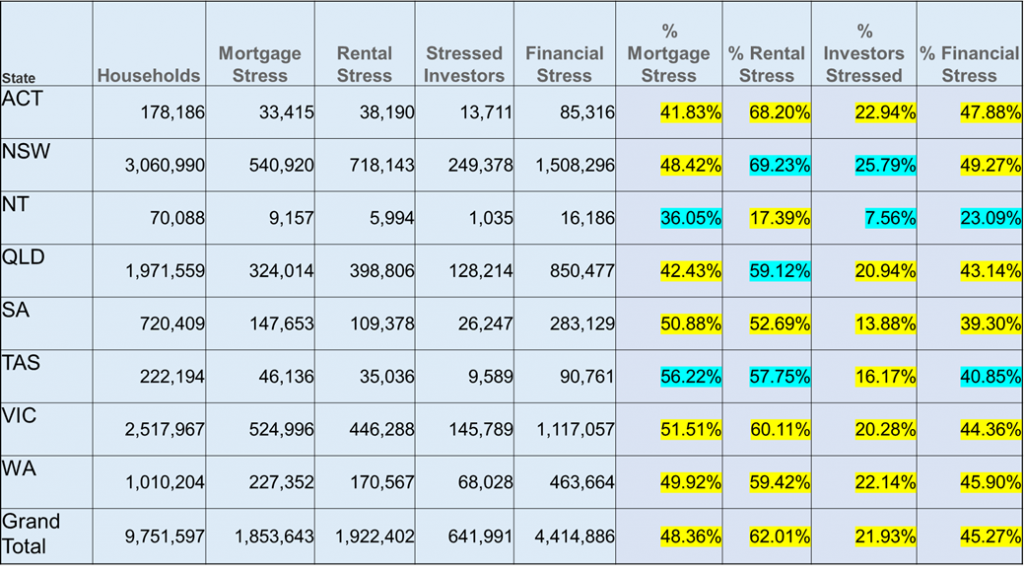

Analysis By State

We display the latest results by state and highlight in yellow where the proportion have rises since last month in yellow. Tasmania continues to experience the highest proportion of mortgage stressed households. But the more populous states of NSW and VIC reported strong increases. Rental stress remained highest in the ACT. Financial Stress, an aggregate measure across all households remained highest in NSW, where the average house price remain most extreme, compared to income.

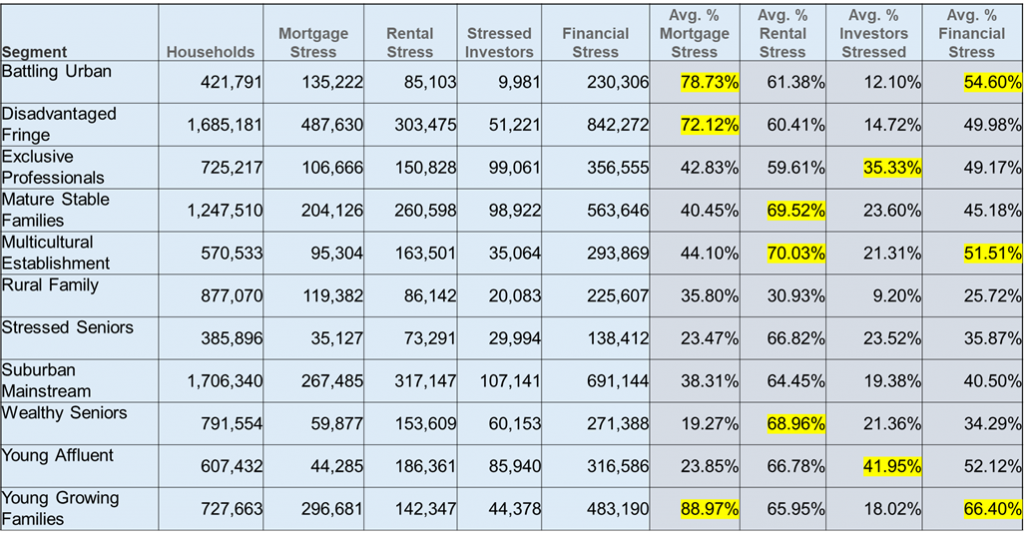

Analysis By Cohort

We can also analyse the data by our segments, or cohorts. This is a critical dimension to understand, given that generally younger households, including first time buyers are the most exposed. But other cohorts, including first generation migrants, and older households continue to drop into stress. Underlying inflation, as well as increasing mortgage rates, and rents explain this.

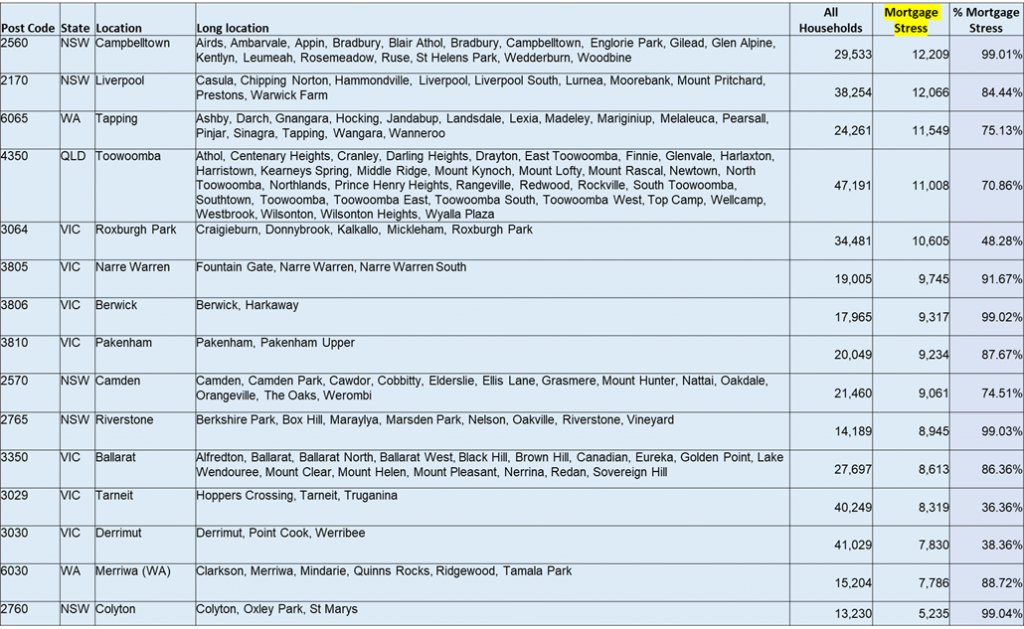

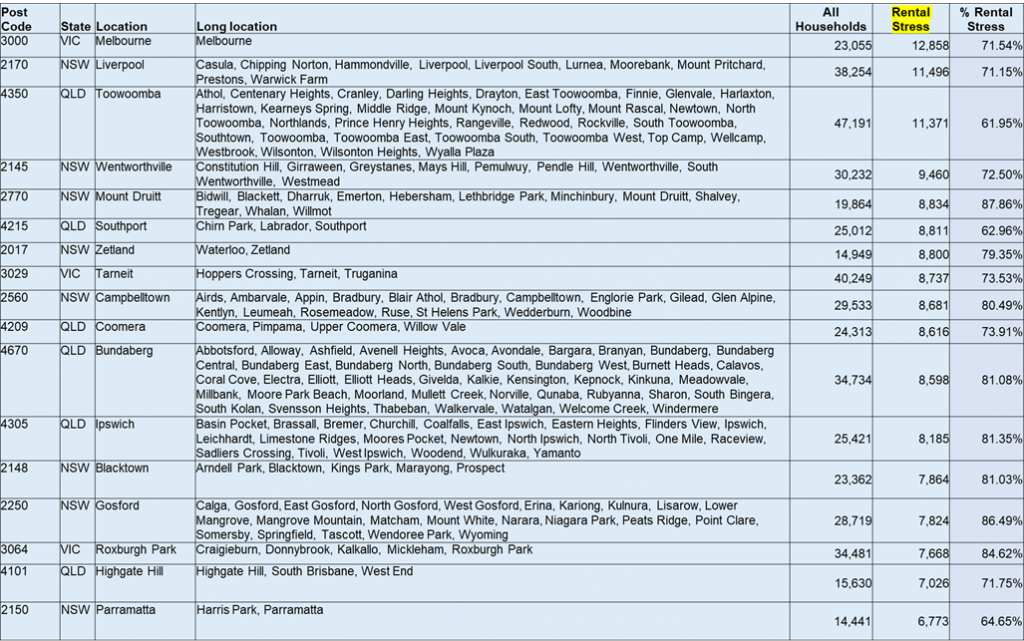

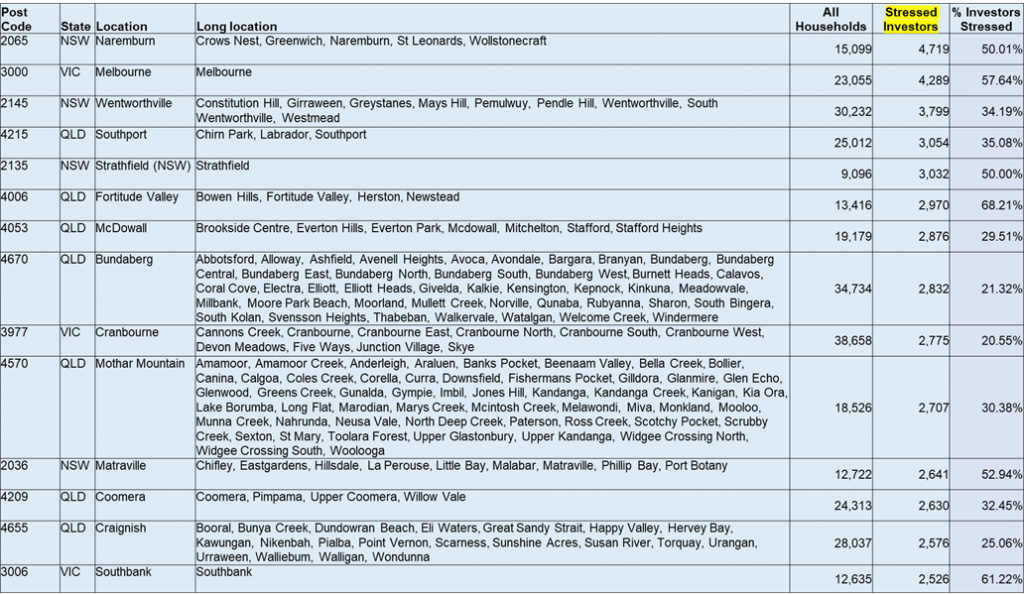

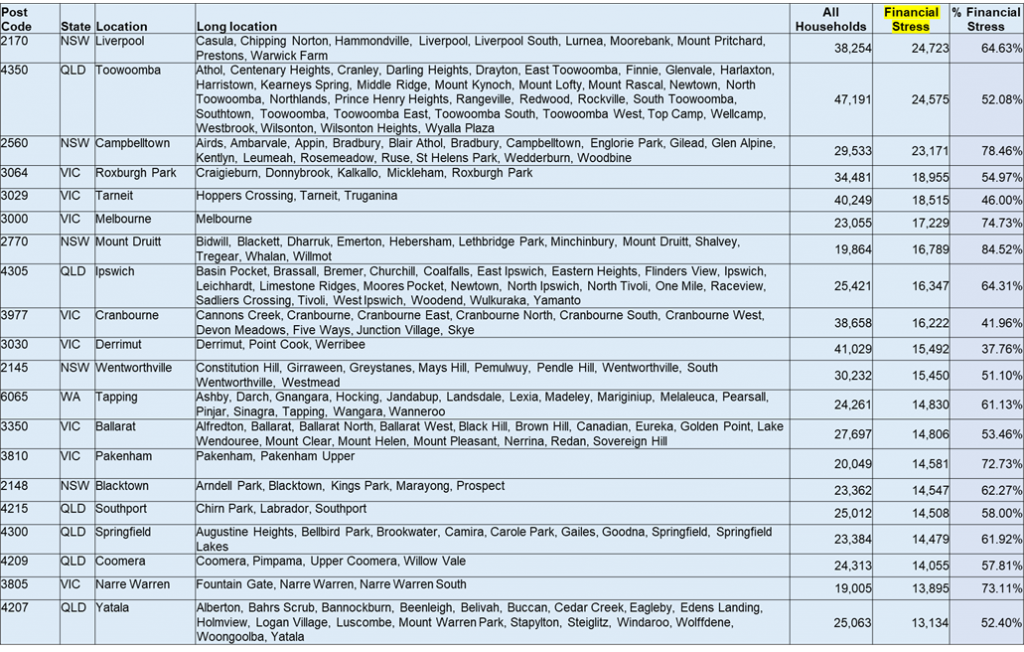

Post Code Analysis

We list the top households – by count – for each post code. We use counts to avoid over-weighting small household post codes.

We find that the focus of high stress remains in the high growth new-development suburbs, where many households purchased ant peak low rates and high home prices. But regional areas, and more developed suburbs are also registering. This is a national issue, not just confirmed to the main cities.

Future Outlook and Conclusions

We expect the RBA to lift rates again, as inflation is still far from being controlled and it is both sticky and embedded. Prices for electricity will rise from 1 July by up to 25% in some east coast states, whilst the mortgage cliff is reaching its heights in the same period.

The recent FWC award will have a small inflationary impact, and we expect more wages rises in the services, as well as more prices rises as businesses seek to support their margins.

Households in cash flow difficulty should discuss their mortgage situation with their bank, build robust cash flows, and prioritise effectively, because this is a crisis years in the making, and it will not abate any time soon. Moreover, hopes of cash rate cuts this year are fading, despite the rising risk of recession and higher unemployment, both of which may amplify stress further.

We will update our analysis in a months’ time.