APRA has released their monthly banking statistics for February (last working day of the month!).

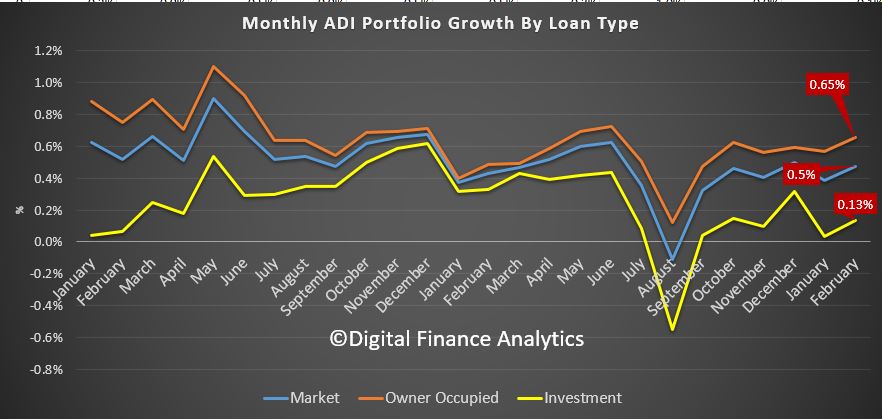

Total mortgage loans on book grew by 0.5%, or if annualised at a rate of 5.7% (still way above inflation and wages growth, so overall household debt is still growing!), to $1.61 trillion. Momentum is drifting up. Within that owner occupied loans rose 0.65% to $1.06 trillion and investment loans rose 0.13% to $553 billion.

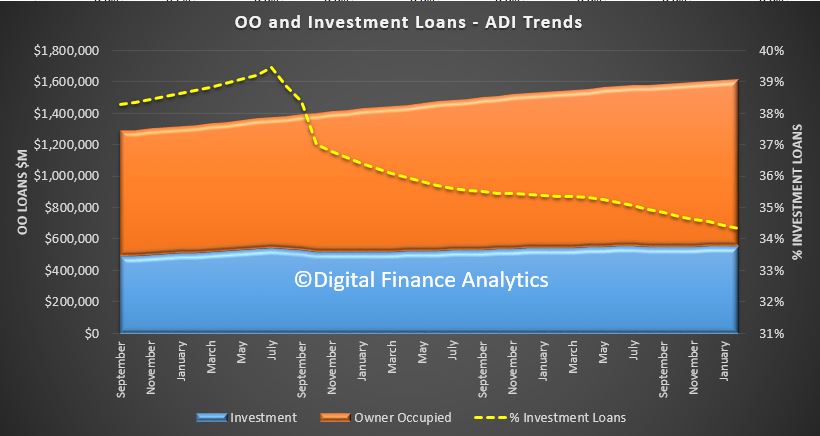

The share of investment loans now comprises 34.3% of all loans on book, so the drift down continues as investors flee the market, whilst owner occupied buyers are stronger, but leading to a small net rise. This is not sustainable. The regulators are still keen to see growing consumer debt to support economic growth, never mind the long term consequences.

Here is the monthly tracker, which shows the small rise.

Here is the monthly tracker, which shows the small rise.

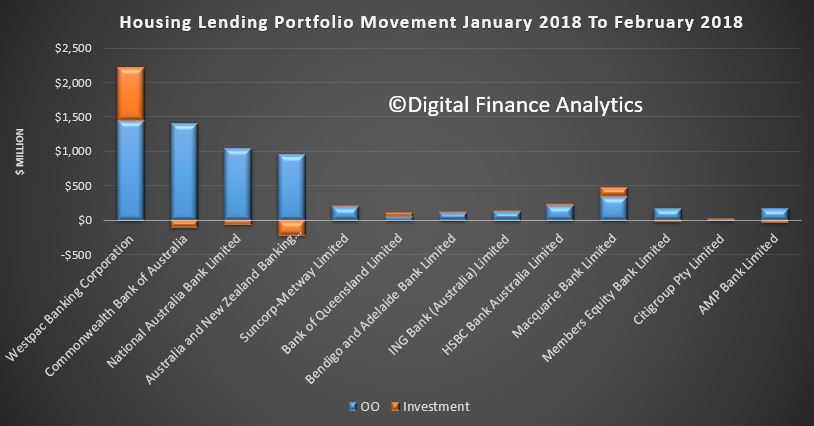

The portfolio movements of the individual banks highlights Westpac’s strong growth in investment loans, compared with the other three majors. Macquarrie is also growing investment loans.

The portfolio movements of the individual banks highlights Westpac’s strong growth in investment loans, compared with the other three majors. Macquarrie is also growing investment loans.

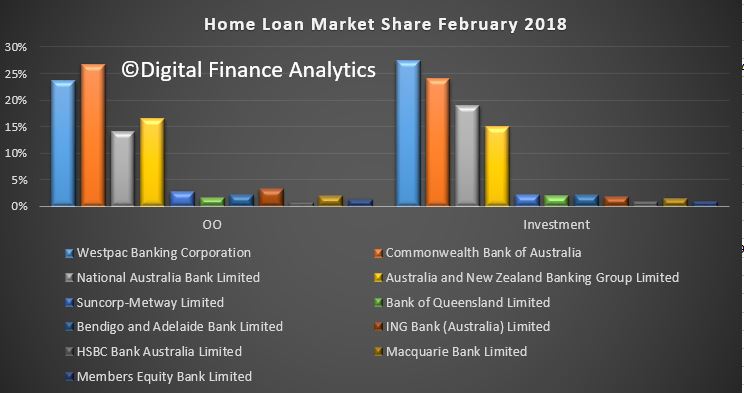

The overall market shares have hardly changed with CBA the largest owner occupied lender and Westpac the largest investment loan lender. We found out quite recently they have around 50% of their investment loans in the interest only category.

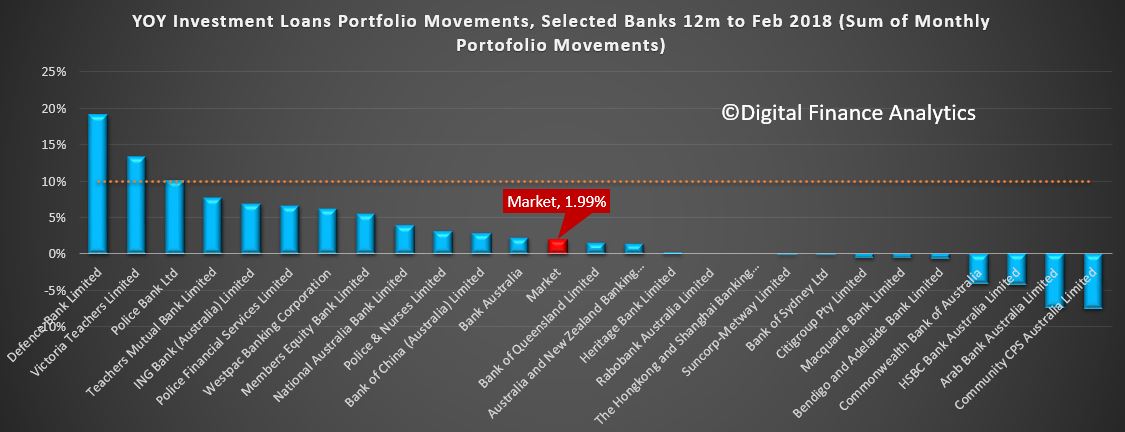

The portfolio growth of investment lending is mostly well below the 10% APRA speed limit, which of course, based on their recent statements, is in any case now being superseded by serviceability metrics.

The portfolio growth of investment lending is mostly well below the 10% APRA speed limit, which of course, based on their recent statements, is in any case now being superseded by serviceability metrics.

We will look at the RBA data which is also out today, to see movements at a market level, and specifically the trends in the non-bank sector, which we expect to be stronger.

We will look at the RBA data which is also out today, to see movements at a market level, and specifically the trends in the non-bank sector, which we expect to be stronger.