APRA released their monthly stats showing total reported balances for each bank to the end of January 2020.

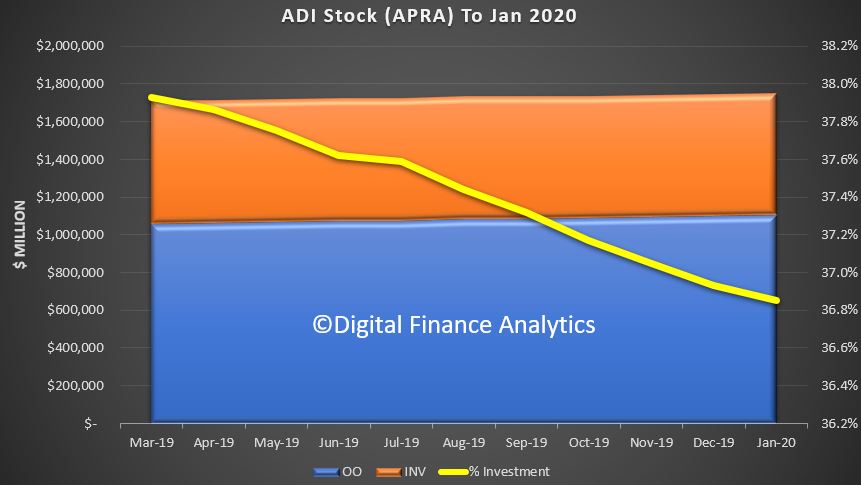

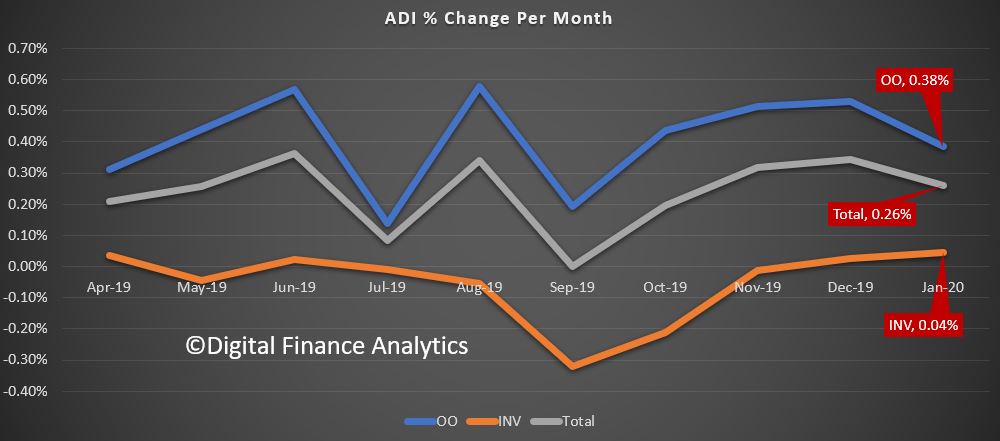

Total balances grew by 0.26%, to $1.75 trillion dollars, with loans for owner occupation up 0.38%, to $1.1 trillion dollars and investment loans up 0.04% to $0.64 trillion dollars. Investment loans made up 36.9% of the portfolio.

These are net balances, after repayments and new loans, and refinancing between banks.

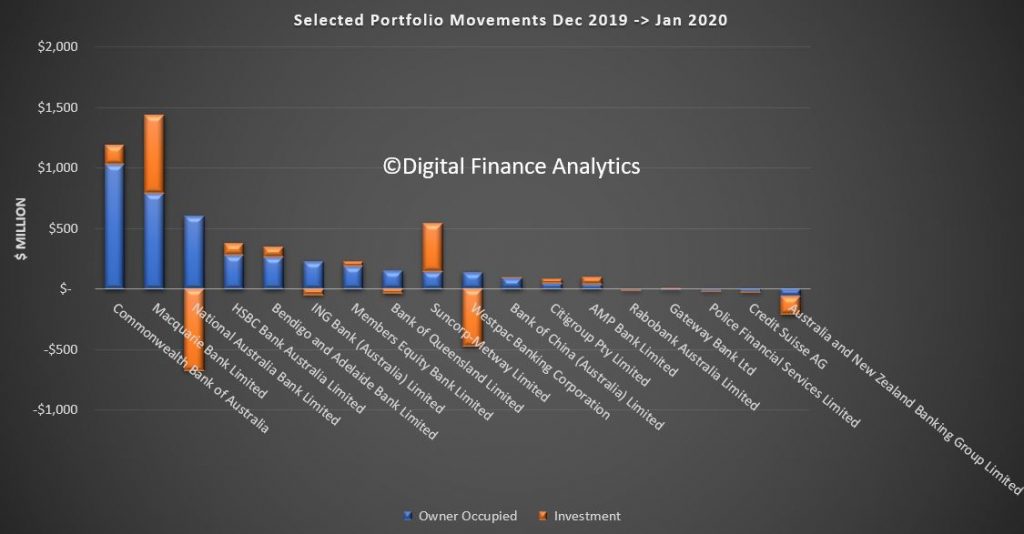

The individual movements between banks shows that CBA and Macquarie Bank are leading the growth, while NAB, and Westpac dropped investment loan balances, ANZ dropped both types, while Suncorp accelerated their investment lending. Macquarie still leads in investment lending however.

This suggests ongoing weakness in credit growth – and we will examine the RBA data shortly, also out today. But clearly individual lenders are executing different strategies, and the portfolio changes highlight the net impact.