APRA has released their monthly banking stats to the end of November 2019. They are of course in the process of a major revision of these statistics, but we are now beginning to get some trend data down to the individual ADI level. The data is based on gross balances outstanding by owner occupied and investment loans, but it does not show where new loans were added, or loans repaid. So little flow data can be imputed.

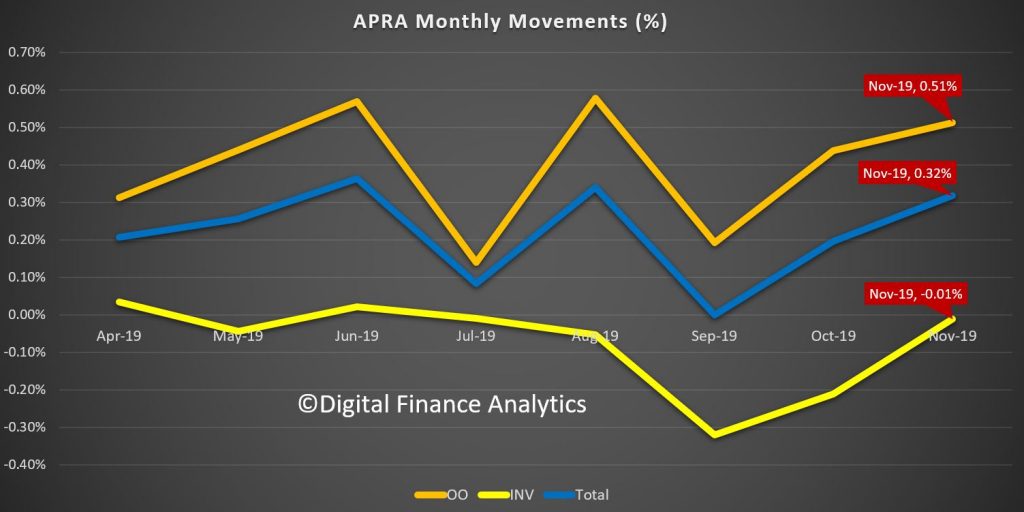

Total owner occupied loans rose 0.51% or $5.58 billion dollars in November to $1.09 trillion dollars, while investment loans fell 0.01% or $75 million dollars to $643 billion dollars. The share of loans for investment purposes fell again to 37%.

The trend movements show some improvement relative to earlier months. Total loans rose 0.32% in the month, which would given an annualised 3.8%.

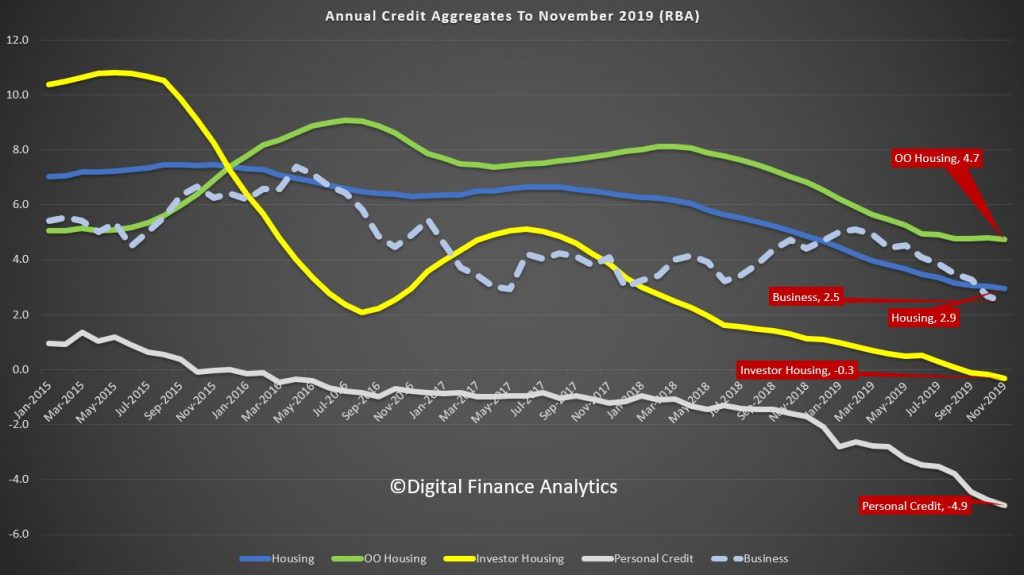

The RBA data released before Christmas showed that total loan growth over the past year for mortgages fell to the lowest ever (2.9%), which suggests that non-banks may be lending less now. But we cannot be sure of this.

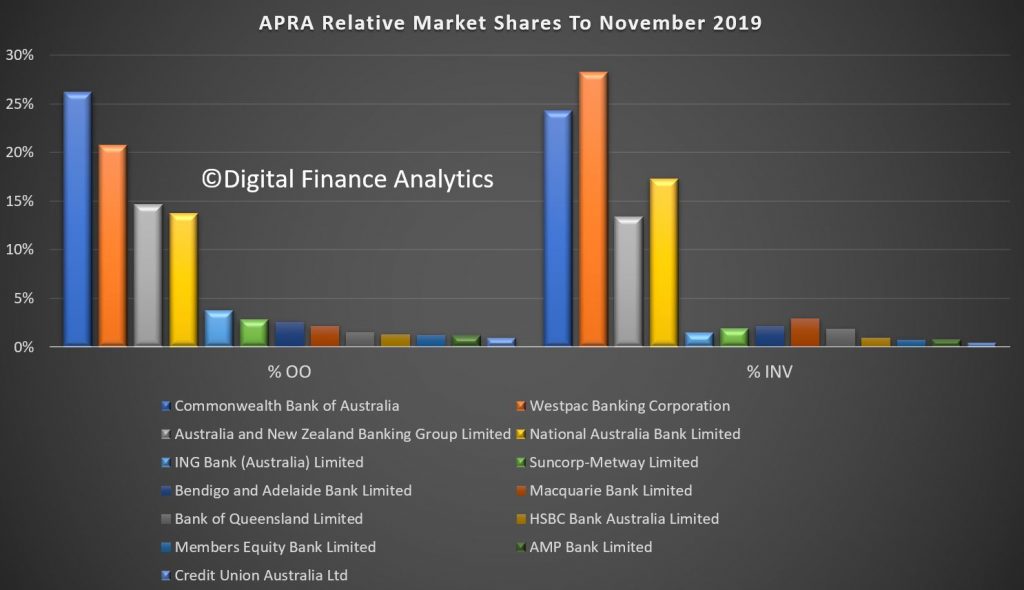

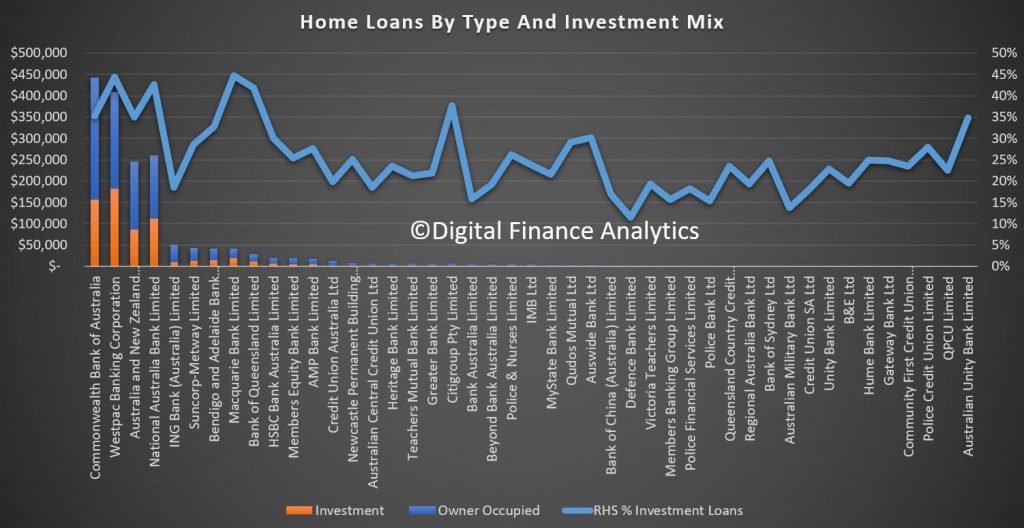

We can also look at individual lenders. The relative shares of the largest players hardly changed, with CBA the largest owner occupied lender, while Westpac has the largest share of investment loans.

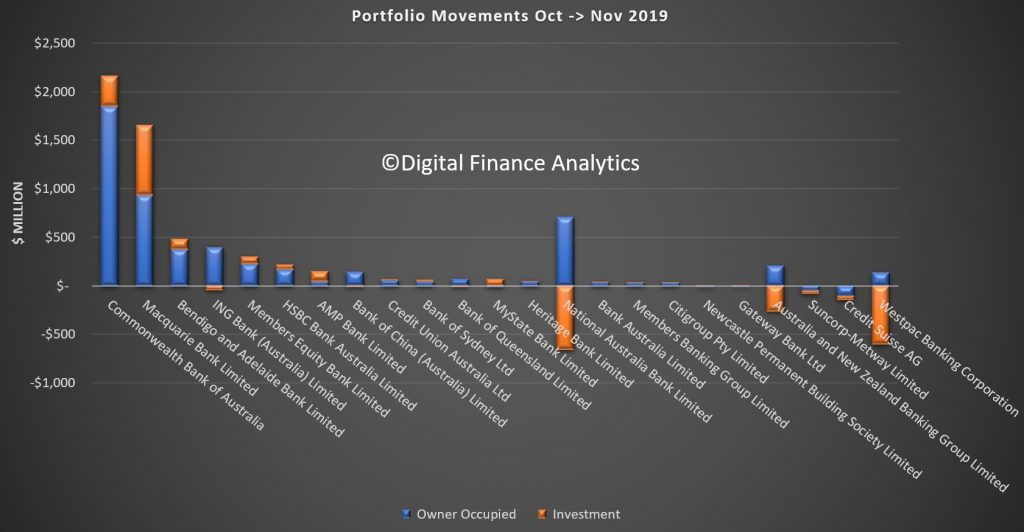

However, the relative movements this month underscored divergent results from lenders. CBA and Macquarie both saw significant growth in loans in the month, with Macquarie writing net more investment loans than any other lender at $718 million dollars. Bendigo Bank and AMP Bank are also chasing investment lending. On the other hand, ING dropped their investment loan balances, alongside the other big lenders, with NAB down $661 million, ANZ down $263 million and Westpac down $602 million. Suncorp and Credit Suisse both dropped their owner occupied and investment loan portfolios.

Finally, the relative proportion of loans for investment purposes reveals that Macquarie has 44.8% of its loans for this purpose, Westpac at 44.5%, NAB at 42.6% and Citi at 37.7%. Bearing in mind investment loans are intrinsically more risky, this is worth watching.

So, some small uplift in net volume of loans, but not equally spread across the sector, which suggests different players have different underwriting settings.

And the growth in lending suggests the household debt ratio is set to continue to rise, despite its already stratospheric level.