APRA has released their monthly banking statistics to end May 2019. It updates the stock of mortgages by lender.

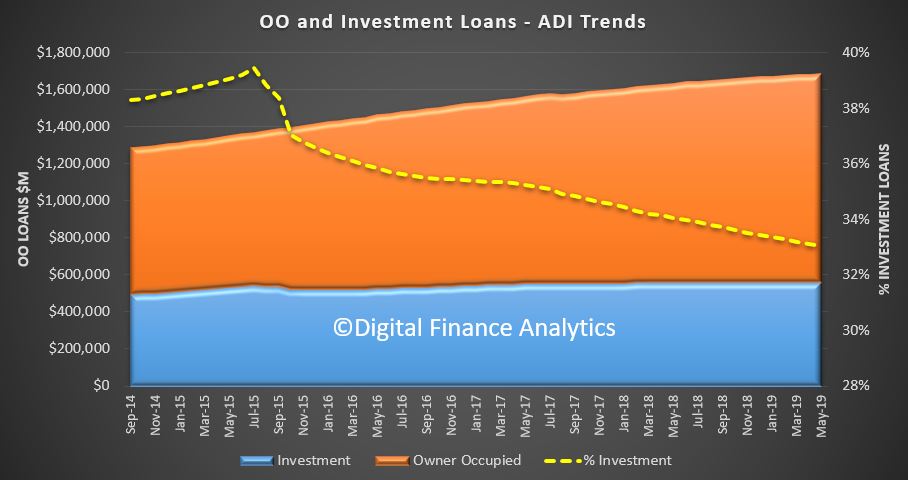

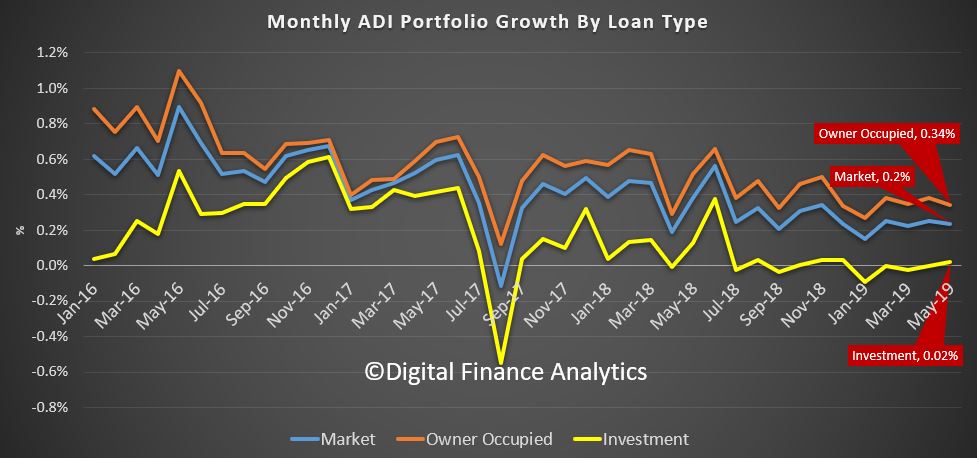

Overall mortgage lending rose o.24% (or 2.8% annualised) to a new record of $1.69 trillion dollars. Within that owner occupied lending rose 0.34% to $1.13 trillion dollars while lending for investment purposes rose 0.023% to $557 billion dollars. Investment loans as a proportion of all loans outstanding fell again to 33.85%.

This of course is the last month before the election, and APRA easing mark 2 and the RBA cash rate cut.

So little here to show the credit impulse is accelerating. Investment lending remains in the doldrums, and owner occupied lending eased back in growth terms.

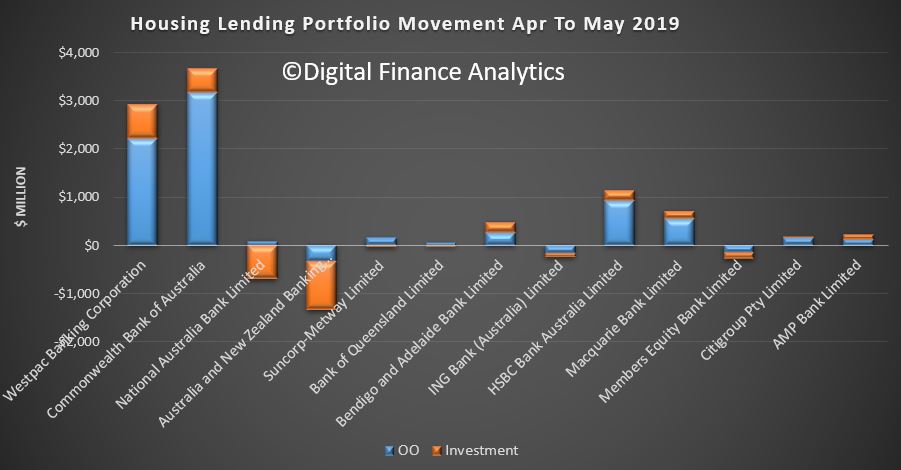

The monthly movements between the banks shows Westpac and CBA in positive territory, on both investment and owner occupied lending, while NAB and ANZ dropped investment loans further. HSBC and Macquarie also advanced, along with Bendigo and Adelaide Banks. Members Equity (ME Bank) dropped also.

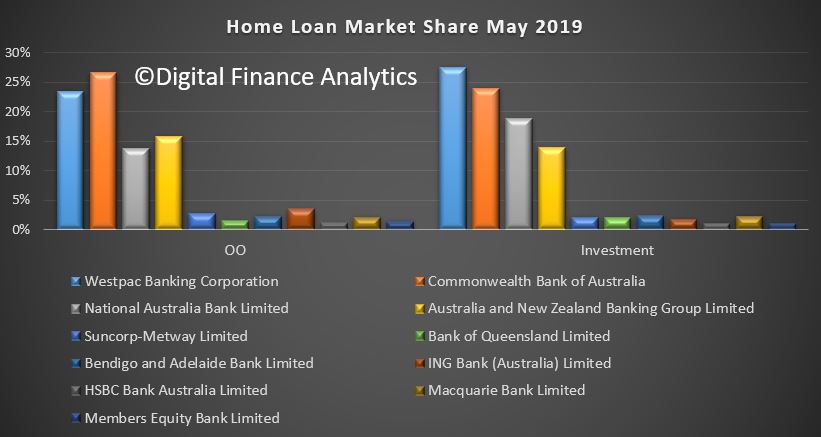

That said the portfolio movements were quite limited. CBA holds the largest share of owner occupied loans and Westpac investment loans.

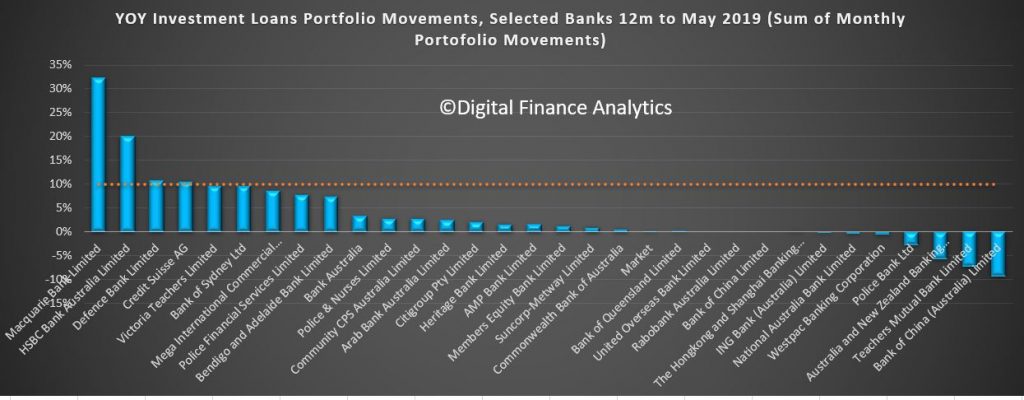

The annualised investment lending trends (sum of monthly movements) puts the majors well behind the likes of Macquarie and HSBC. The abolished investment loan speed limit just accentuates the point that some are driving loan growth very hard.

We would expect lending momentum to pick up in the light of APRA’s changes, lower interest rates and the chatter about home price recovery.

However, to emphasize the obvious point one more time – lending is still growing faster than incomes – so household debt is still growing – adding more weight in the saddlebag of consumer spending. Not that the RBA seems at all worried – though we think they should be!

The RBA data also comes out today and this will give a whole of market view.