The RBA released their credit aggregates to May 2019 today, we already covered the APRA ADI series in an earlier post.

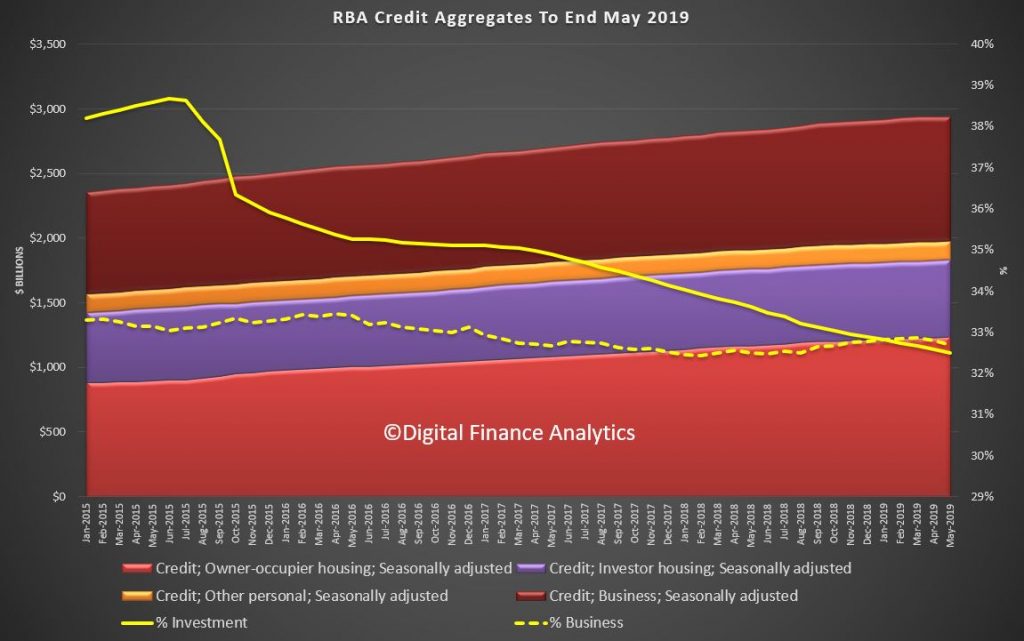

Seasonally adjusted owner occupied housing rose by 0.34% to $1.24 trillion dollars while investment lending slid 0.04% to $595 billion dollars, and comprises 32.5% of all household finance, in seasonally adjusted terms. Business lending was down 0.35% to $959.6 billion dollars and was 32.7% of credit, the lowest for the past six months. Personal credit fell again, down 0.59% to $145.8 billion dollars.

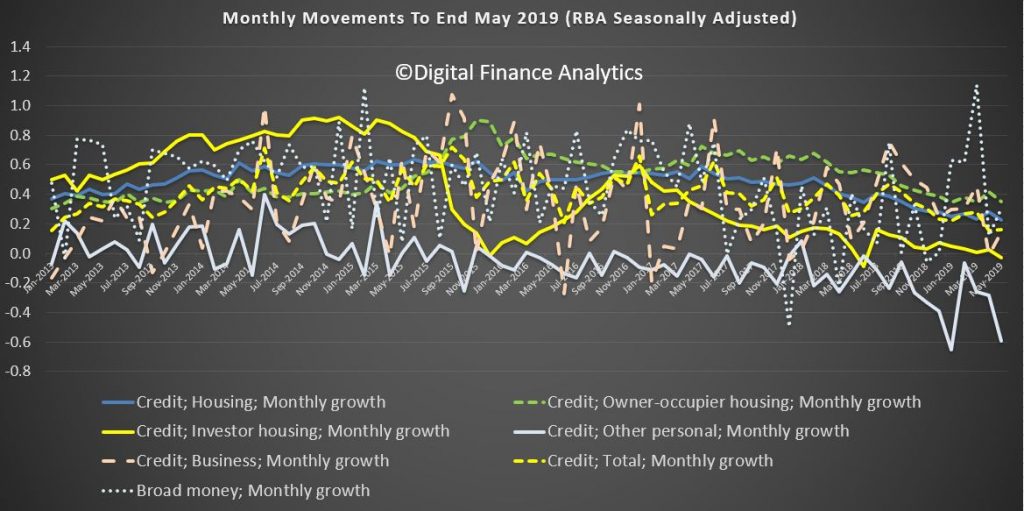

The monthly movements were quite volatile once again.

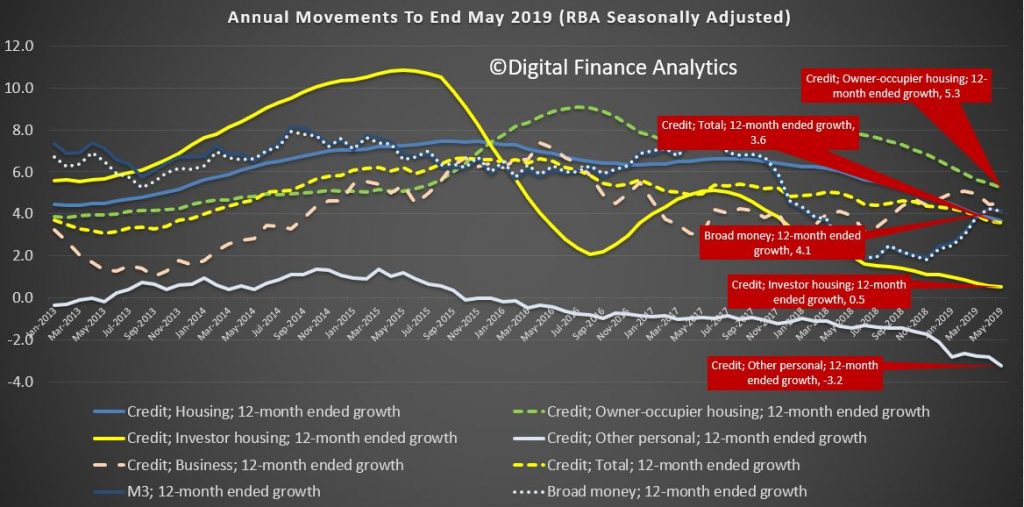

However the annual movements paint a clearer picture. Over the past year owner occupied lending rose 5.3%, investor lending rose just 0.5% while personal credit fell 3.2%. Business lending grew 4.5%. Broad money grew 4.1%, the earlier acceleration in the first past of the year has not been explained.

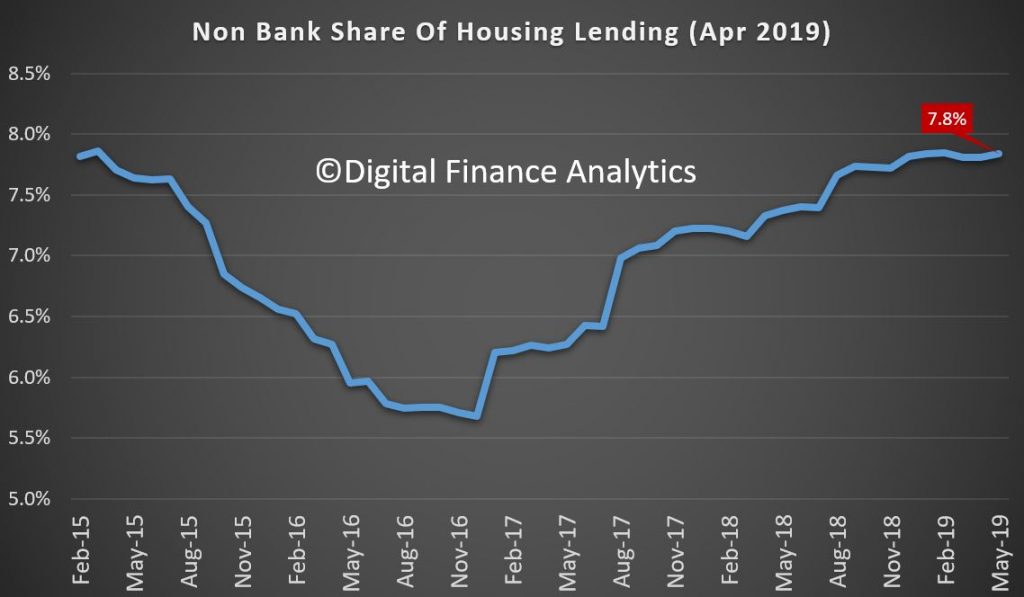

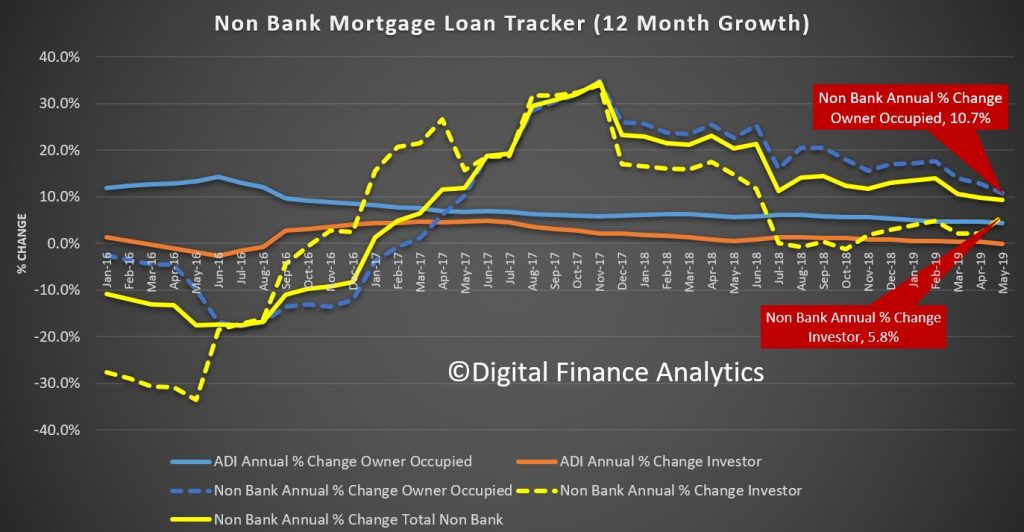

We can proxy the growth in the non bank sector by comparing the APRA and RBA dataset. Whilst only approximate, it does give a fair indication. Non-bank lending recorded an estimated 7.8% rise over the year, significantly higher than the ADI’s.

Overall growth in the non-bank, non-ADI sector for mortgages was an impressive 7.8% annualised.

Further analysis by category shows that owner occupied lending by non-banks rose 10.7% over the past year, while investment loans rose 5.8%. Both are higher than the ADI’s, suggesting the non-bank sector is able and willing to lend.

Total household credit growth remain above both inflation and wages, so households are getting mired further into debt, the sustainability of which we question. And again, we think regulators are not looking at the non-bank sector sufficiently hard.

Next month we will see the post-election post-rate cut situation. Many are expecting credit to rebound, and home prices to follow – we will see.

Changing The Game

It is also worth noting the RBA will be changing the reporting on the credit aggregates ahead. You can read about their plans. But essentially it will provide more granularity, and make some “significant” revisions to past results. The RBA plans to start publishing the financial aggregates from August 2019 using an improved conceptual framework and a new data collection.

The New Economic and Financial Statistics Collection

Over the past few years, APRA, the ABS and the RBA have worked to modernise the existing set of forms, and banks and other reporting institutions have adapted their infrastructure to be able to report on the new versions of these forms. This has been a large scale and complex project, involving considerable collaboration between the three agencies and the industry. The new set of forms are called the Economic and Financial Statistics (EFS) collection and will better meet the data needs of policymakers.

The EFS collection will be implemented in three phases.

The first phase will focus on data used for the financial aggregates and national accounts finance and wealth estimates.

The second phase will update current forms on housing and business loan approvals. It will also provide much more granular information on banks’ and other reporting institutions’ lending, their liabilities and interest rates.

The third phase will provide information on other aspects of reporting institutions’ activity and performance, including profits, fees charged and activity in specific financial products and markets. The first phase national accounts aggregates will be used in addition to this performance data in the compilation of Australia’s Gross Domestic Product (GDP).

The EFS collection will increase the reliability and accuracy of the inputs used to calculate the aggregates. One of the most important changes in the EFS is more detailed and precise definitions of the data to be reported. These definitions are accompanied by comprehensive guidance to assist institutions in reporting consistent data.