Australian Finance Group (AFG) has today released half yearly results for 2018 with underlying NPAT in H1 FY2018 of $14.4m, up 11% on H1 FY2017, and a reported NPAT in H1 FY2018 of $16.7m.

Residential settlements were up 6% to $18.6b (interesting compared with Mortgage Choice’s 6% fall!) and their combined residential and commercial loan book is $140.8 billion with growth of 11% over H1 FY2017.

Settlements were strongest in NSW, then VIC. But growth in VIC was significantly stronger and it may overtake NSW ahead.

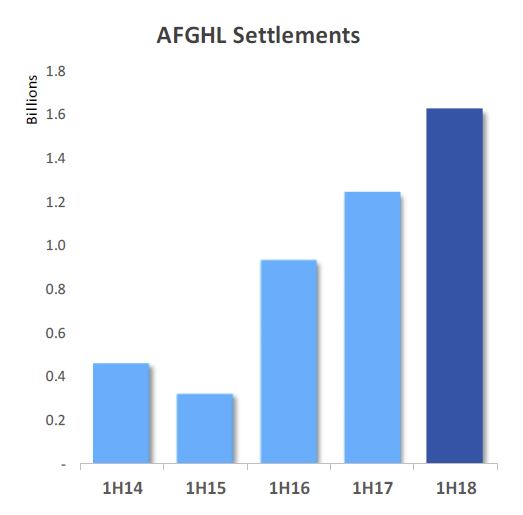

Settlements were strongest in NSW, then VIC. But growth in VIC was significantly stronger and it may overtake NSW ahead.  AFG Home Loans (AFGHL) continued to deliver positive financial growth and settlements grew 31% to $1.62 billion. Lodgements were up 7%, servicing more than 17,000 customers.

AFG Home Loans (AFGHL) continued to deliver positive financial growth and settlements grew 31% to $1.62 billion. Lodgements were up 7%, servicing more than 17,000 customers.

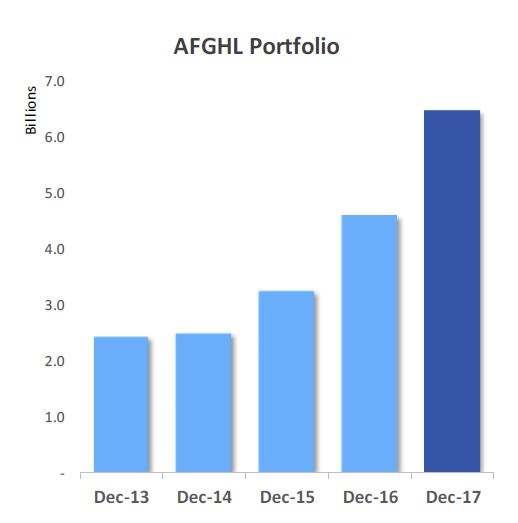

The AFGHL loan book has reached $6.5 billion, an increase of 40% on the same period last year. AFGHL now represents 8.7% of overall AFG Residential settlements – up from 7.8% in FY17

The AFGHL loan book has reached $6.5 billion, an increase of 40% on the same period last year. AFGHL now represents 8.7% of overall AFG Residential settlements – up from 7.8% in FY17

Strong organic growth and cash flow generation of the business has allowed AFG to pay a Special Dividend of 12 cents per share.

Strong organic growth and cash flow generation of the business has allowed AFG to pay a Special Dividend of 12 cents per share.

AFG Securities completed a successful $350m Residential Mortgage Backed Securities (RMBS) issue in October 2017, which underlined the performance of the AFG Securities business.

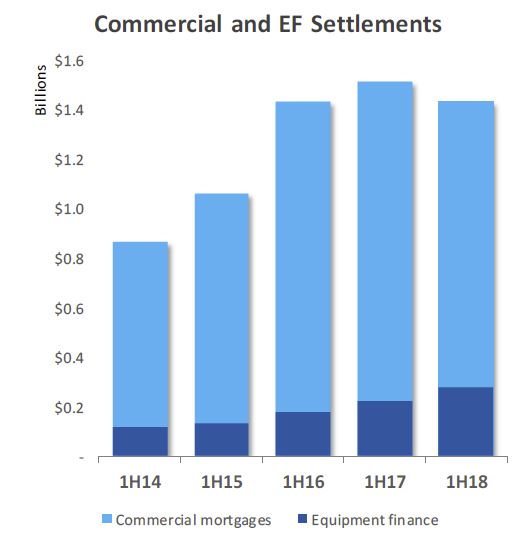

AFG’s commercial business experienced loan book growth in all states despite softer settlements.

The overall commercial loan book grew by 14% to $7.2 billion. This growth has been driven by a 6% increase in sub-$5m commercial mortgage settlements and a 26% increase in asset finance.

The overall commercial loan book grew by 14% to $7.2 billion. This growth has been driven by a 6% increase in sub-$5m commercial mortgage settlements and a 26% increase in asset finance.

Settlements slipped in NSW, but grew in VIC.

AFG Business has a current panel of five core lenders aimed at the small to medium enterprise (SME) market. Further business lending lines will be added as the platform is rolled out to more brokers looking to diversify their offering.

AFG Business has a current panel of five core lenders aimed at the small to medium enterprise (SME) market. Further business lending lines will be added as the platform is rolled out to more brokers looking to diversify their offering.

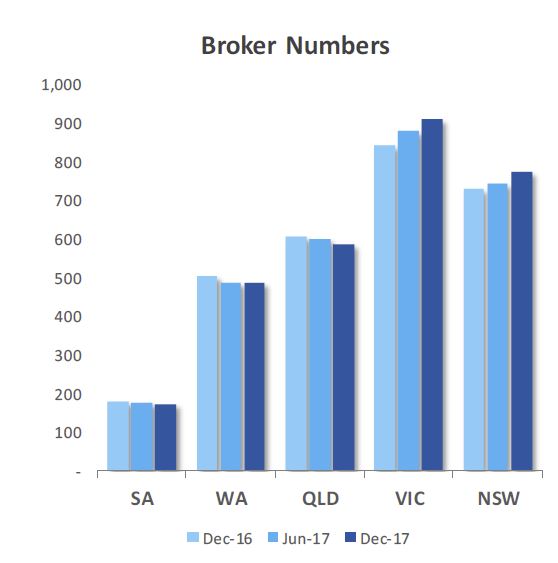

AFG had over 2,900 active brokers at 31 December 2017, further extending AFG’s national distribution network providing quality lending solutions and service to consumers. Growth continues to be strong in NSW and Victoria, offset by weaker conditions in other states.

The return on equity was 33% and they announced an interim dividend of 4.7c per share fully franked plus a special dividend of 12c per share fully franked

The return on equity was 33% and they announced an interim dividend of 4.7c per share fully franked plus a special dividend of 12c per share fully franked