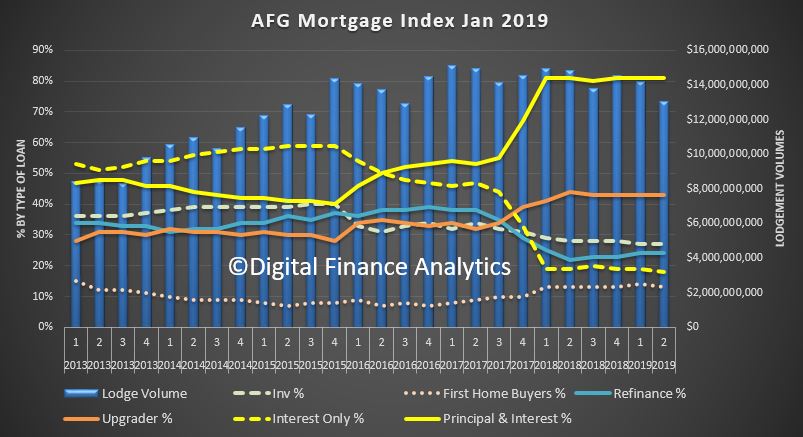

AFG reported an 8% fall in loan applications compared with the prior quarter, according to their quarterly index, released today. Whilst it only represents the activity though AFG, it is a useful bellwether.

The trajectory of the market is clear, as the volume of investor loans and interest only loans remain significantly lower than before the regulatory intervention. More households are choosing to fix their loan interest rate. NAB lifted their rates today!

AFG used the release as an opportunity to reinforce the role of mortgage brokers (remembering the Royal Commission, out soon, will likely opine on broker commissions).

They said:

Australia’s home loan market is enjoying record levels of competition driven by mortgage brokers, with new lending data released today revealing the market share of non-bank lenders is higher than ever.

And latest industry figures reveal consumers are increasingly relying on mortgage brokers for help, with three out of every five mortgages in Australia now generated through mortgage brokers.

As the financial services sector prepares for next month’s release of the Financial Services Royal Commission’s final report, the AFG quarterly Mortgage Index confirmed the crucial role played by mortgage brokers in creating a competitive home loan market.

It also provides a timely warning to policymakers of the importance of ensuring the availability of credit and consumer choice do not become sacrificial lambs in the regulatory response to the Royal Commission

recommendations.

AFG lodged $13 billion in home lending applications for the final quarter of 2018, down 8% on the prior quarter.

Credit tightening is having an impact on volumes in every state – however, the Sydney and Melbourne property markets have been the most significantly impacted.

“Customers must be kept first and foremost in any discussion of changes to the financial sector,” said AFG Chief

Executive Officer David Bailey. “Although overall volumes are down our brokers still lodged over 25,000 applications for borrowers during the quarter. This is a fraction of the number of consumers they help with post-settlement and ongoing reviews and support.

“AFG now has more than 50 lenders on our panel and in clear evidence of the vital role mortgage brokers play in delivering a competitive home loan market, non-major lenders’ market share is at a record high of 42.1%.

“The non-majors are becoming an increasingly important part of the assistance brokers provide to customers. Penetration has increased across all categories of borrowers, with non-major market share gains recorded for Refinancers (now 46.8%), Upgraders (42%), First home buyers (32.1%) and Investors (43.4%).”

New Mortgage & Finance Association of Australia (MFAA) data shows mortgage broker market share has grown to 59.1%, reinforcing that consumers are increasingly turning to brokers for their expertise as the market becomes increasingly complex.

The record market share for mortgage brokers was the strongest evidence that consumers were more than satisfied with the customer service provided by brokers, Mr Bailey said.

“A spike in those choosing to fix their interest rates indicates borrowers are bracing for more bank-led rate rises, with quarterly volumes increasing from 19% to 23.1%.

“Notably, the major lenders’ market share of Interest Only and Investment lending has stabilised after APRA’s easing of caps.”

January 24th 2019