NAB today lifted its back book mortgage rates by up to 16 basis points, which marks the end of its initiative to hold rates lower.

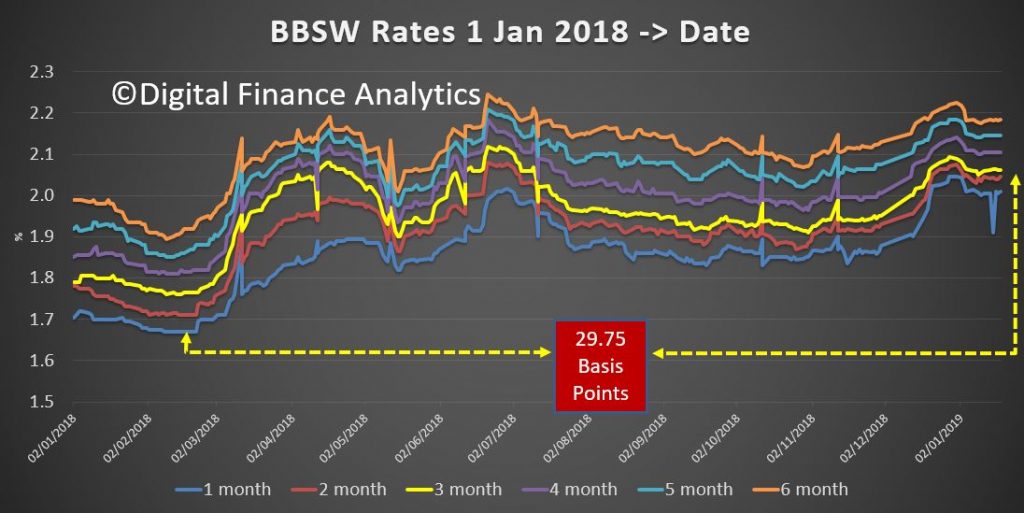

As we have been saying for some time margin pressure is building, as illustrated by the BBSW

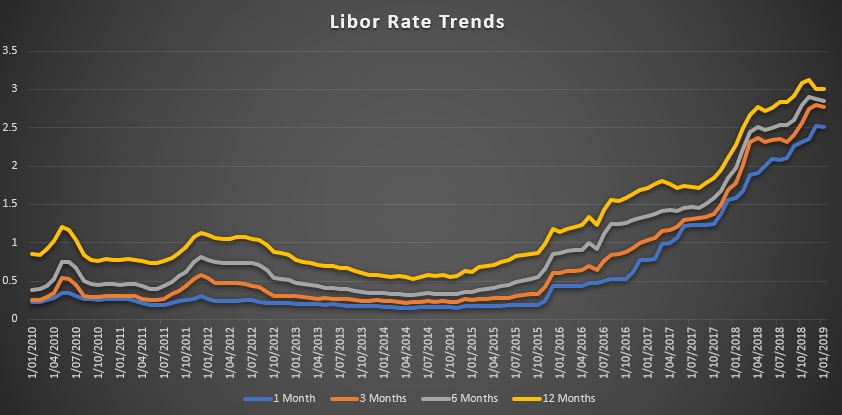

… and LIBOR rates

We expect more rises across the lending community, which will put more pressure on mortgage stress, which today stands at above one million households according to our surveys.

NABs chief customer officer Mike Baird said that the bank could no longer afford to absorb higher funding costs.

NAB lifted rates on existing principal and interest loans for owner occupiers by 12 bps to 5.36 per cent and interest-only loans for owner occupiers by 16 bps to 5.93 per cent.

The bank raised rates for principal and interest loans for investors by 16 bps to 5.96 per cent and for interest-only investors by 16 bps to 6.41 per cent.

NAB said its decision to keep variable rates on hold had saved 930,000 households around $70 million. The bank said it had raised rates for principal and interest loans by a smaller amount in order to encourage home owners to pay down their home loans sooner. Nice, but meaningless touch!