Today the ABS published their housing lending statistics for May 2018, and APRA Chair Wayne Byers spoke on the resilience in the financial sector. Interesting timing.

APRA pretty much says they called it just right, and their tightening has not really impacted overall growth, and any further tightening will be marginal.

APRA pretty much says they called it just right, and their tightening has not really impacted overall growth, and any further tightening will be marginal.

First, the changes in lending practices to date do not seem to have had an obvious impact on housing credit flows in aggregate. Total housing lending grew at around 6 per cent in the year to May 2018, which is only marginally below long-run averages and roughly in line with the average run rate since 2011 (covering the period since house prices last went through a period of softening in Australia). Indeed, cumulative credit growth in the roughly three and a half years since APRA stepped up the intensity of its actions was greater than cumulative credit growth in the preceding three and a half years. Credit growth appears to be slowing somewhat at the moment, but that is not surprising in an environment of softening house prices and rising interest rates.

Second, it is evident that the composition of housing credit has shifted notably. Lending to investors is certainly now growing more slowly compared to three or four years ago. But despite the tightening in lending standards – which, it’s important to remember, also apply to owner-occupiers – lending to owner-occupiers grew at a very healthy 8 per cent over the past year. This relatively high rate of rate of growth for owner-occupiers (running broadly at almost 3x household income growth) has been sustained during a period in which lending policies and practices have been gradually strengthened.

Despite the prominence it has been given, our goal in seeking to reinforce standards and practices has been relatively modest: ensuring that internal policies are followed in practice, and applying what is, in most cases, a healthy dose of common sense. This has been an orderly adjustment, and we expect it to continue over time. While there is more “good housekeeping” to do, the heavy lifting on lending standards has largely been done. Any tightening from here on is expected to be at the margin as banks seek to get a better handle on borrower expenses, and better visibility of borrower debt commitments.

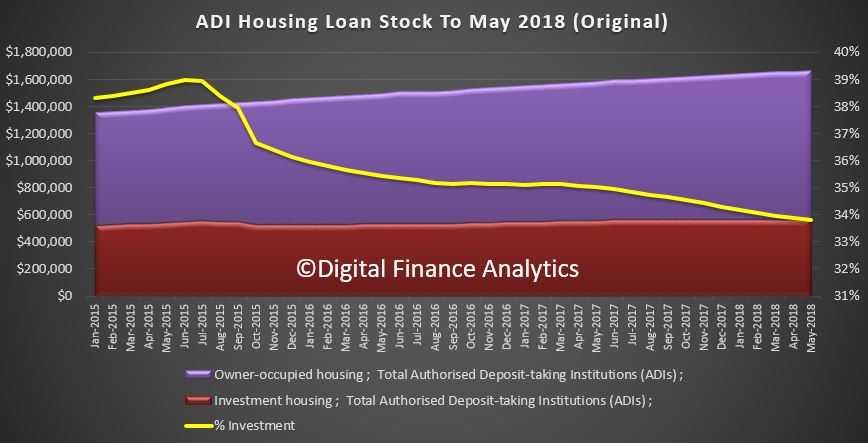

The ABS data shows that total lending stock grew again in May. This is original data split between owner occupied and investment loans.

Total housing loan stock rose 0.5% in the month to $1.66 trillion. Within that owner occupied lending rose 0.5% to $1.1 trillion and and investment lending rose just 0.1% to $563 billion. Investment loans fell to be 33.8% of all loans. Overall growth is circa 6% annualised. As for whether growth at 3 times income is “healthy” to quote Wayne Byers; well that’s another story. Remember debt has to be repaid, eventually.

Total housing loan stock rose 0.5% in the month to $1.66 trillion. Within that owner occupied lending rose 0.5% to $1.1 trillion and and investment lending rose just 0.1% to $563 billion. Investment loans fell to be 33.8% of all loans. Overall growth is circa 6% annualised. As for whether growth at 3 times income is “healthy” to quote Wayne Byers; well that’s another story. Remember debt has to be repaid, eventually.

Growth has been strongest in owner occupied lending, but investment lending was also higher.

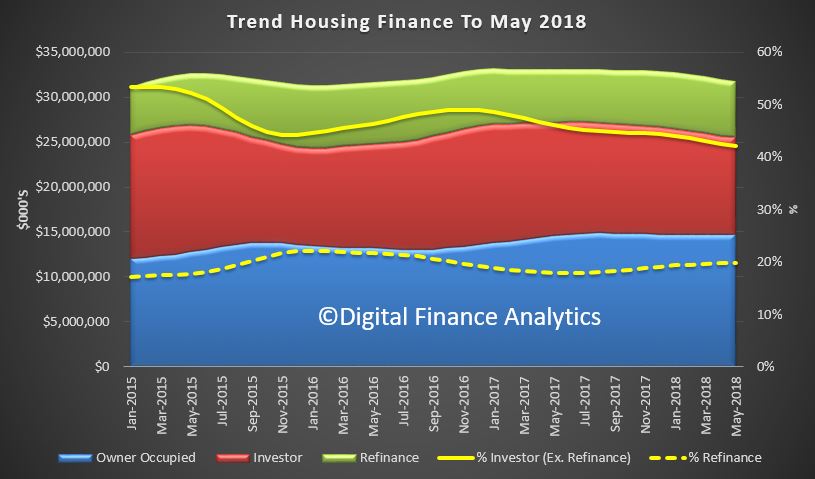

The trend housing flows were down month on month with a fall of 0.1% in owner occupied lending to $14.7 billion and investment lending down 1.9% to $10.7 billion. There was$6.3 billion of refinancing, a drop of 0.4%. 42% of lending was for investment purposes (excluding refinancing) and 19.9% of lending was refinancing, this proportion rose a little.

The trend housing flows were down month on month with a fall of 0.1% in owner occupied lending to $14.7 billion and investment lending down 1.9% to $10.7 billion. There was$6.3 billion of refinancing, a drop of 0.4%. 42% of lending was for investment purposes (excluding refinancing) and 19.9% of lending was refinancing, this proportion rose a little.

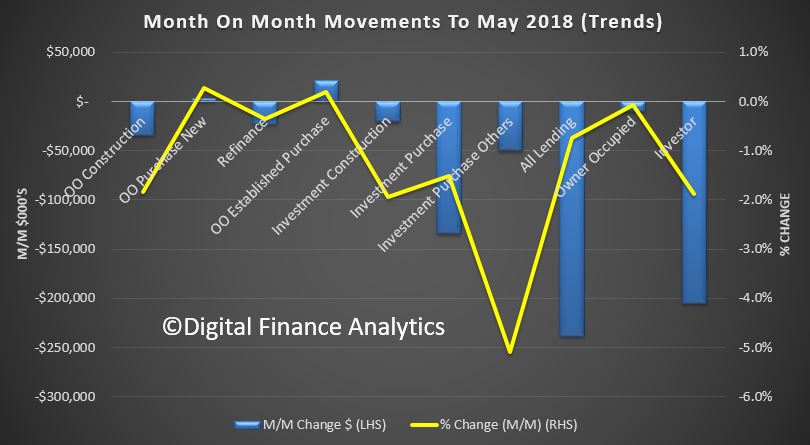

Looking in more detail at the trend movements by category, only owner occupied purchase of established dwellings rose, all other categories fell back. Investor lending continued to slide on a relative basis.

Looking in more detail at the trend movements by category, only owner occupied purchase of established dwellings rose, all other categories fell back. Investor lending continued to slide on a relative basis.

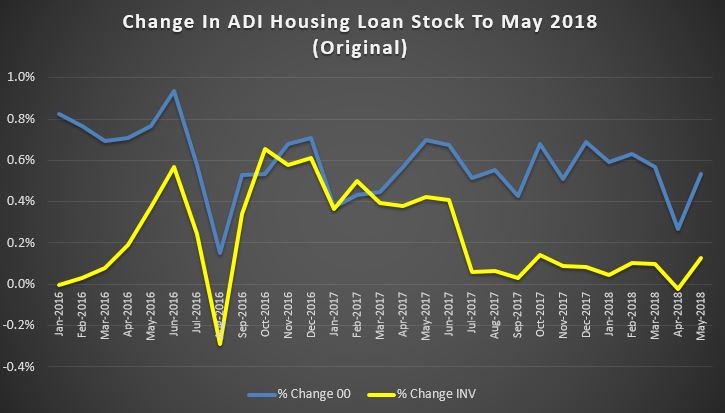

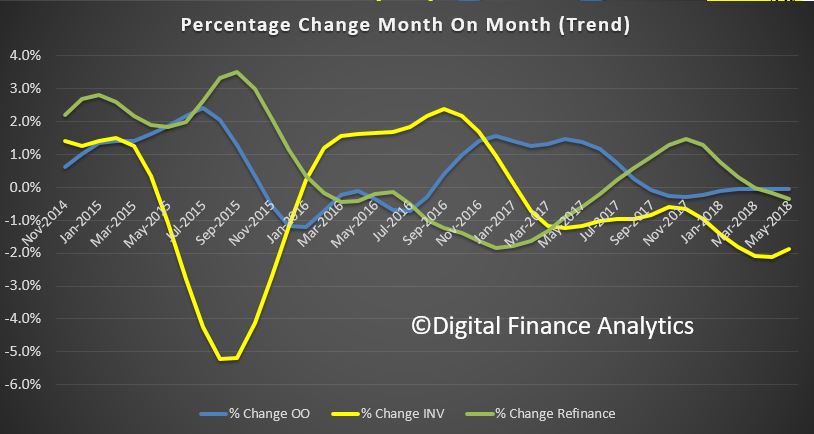

The month on month changes show the movements, and we note a slower rate of decline in investor lending.

The month on month changes show the movements, and we note a slower rate of decline in investor lending.

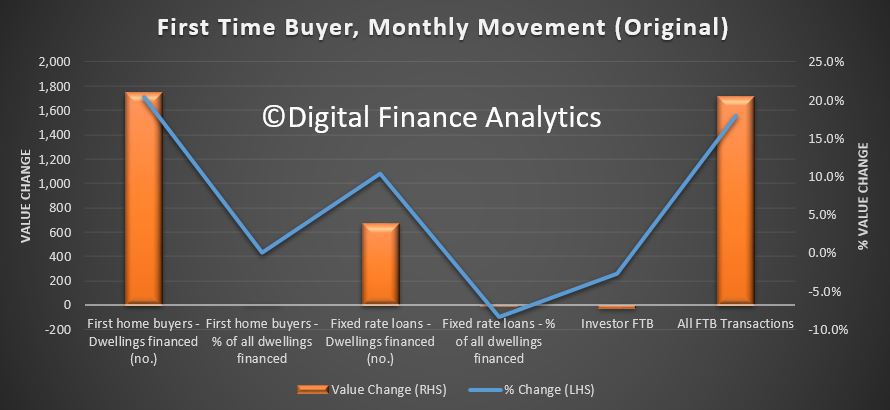

First time buyers continue to support the market, with a 17.6% share of all loans written but a significant rise in the absolute number of first time loans written (up 20.5% on last months) as well as a rise in non first time buyer borrowers. These are original numbers, so they do move around from month to month, and does reflect the incentives for first time buyers in some states.

First time buyers continue to support the market, with a 17.6% share of all loans written but a significant rise in the absolute number of first time loans written (up 20.5% on last months) as well as a rise in non first time buyer borrowers. These are original numbers, so they do move around from month to month, and does reflect the incentives for first time buyers in some states.

![]() The number of investor first time buyers continues to fall.

The number of investor first time buyers continues to fall.

![]() The month on month movements show the additional 1,750 buyers in the month. Worth noting also that the average loan size continues to grow, at $412,000 for non-first time buyers, up 0.4% on the previous month and $344,000 for a first time buyer, up 0.5%. There are some variations across the states, but I won’t include those here. There was also a further fall in the number of fixed rate loans being written, down to 12.1% from 13.2% last month.

The month on month movements show the additional 1,750 buyers in the month. Worth noting also that the average loan size continues to grow, at $412,000 for non-first time buyers, up 0.4% on the previous month and $344,000 for a first time buyer, up 0.5%. There are some variations across the states, but I won’t include those here. There was also a further fall in the number of fixed rate loans being written, down to 12.1% from 13.2% last month.

To me this begs the question, if credit is still running at these levels, and APRA says the tightening is all but done, will we see home prices starting to trend higher? Clearly the plan is to keep the debt bomb ticking for yet longer.

To me this begs the question, if credit is still running at these levels, and APRA says the tightening is all but done, will we see home prices starting to trend higher? Clearly the plan is to keep the debt bomb ticking for yet longer.

But this may well mean the RBA will lift rates sooner than I expected.

Thanks Martin – great post as always.

Re RBA – true, but rate rises are already occurring in the real economy without them doing anything with the Policy Rate. We also haven’t yet seen the Hayne recommendations (or all the unexploded bombs yet to be uncovered) and we haven’t cycled anywhere near all the Interest Only to P&I roll-overs, while residential building is about to become a drag on growth in the quarters ahead…. not to mention that it would be an extremely brave central bank of a small, trade dependent, open economy to raise rates at the beginning of a trade war between #1 and #2 economies in the world.