A new trend has emerged in the SME lending space, with Australian small businesses more likely to use a non-bank to fund growth rather than their main bank, according to a national survey, via Australian Broker.

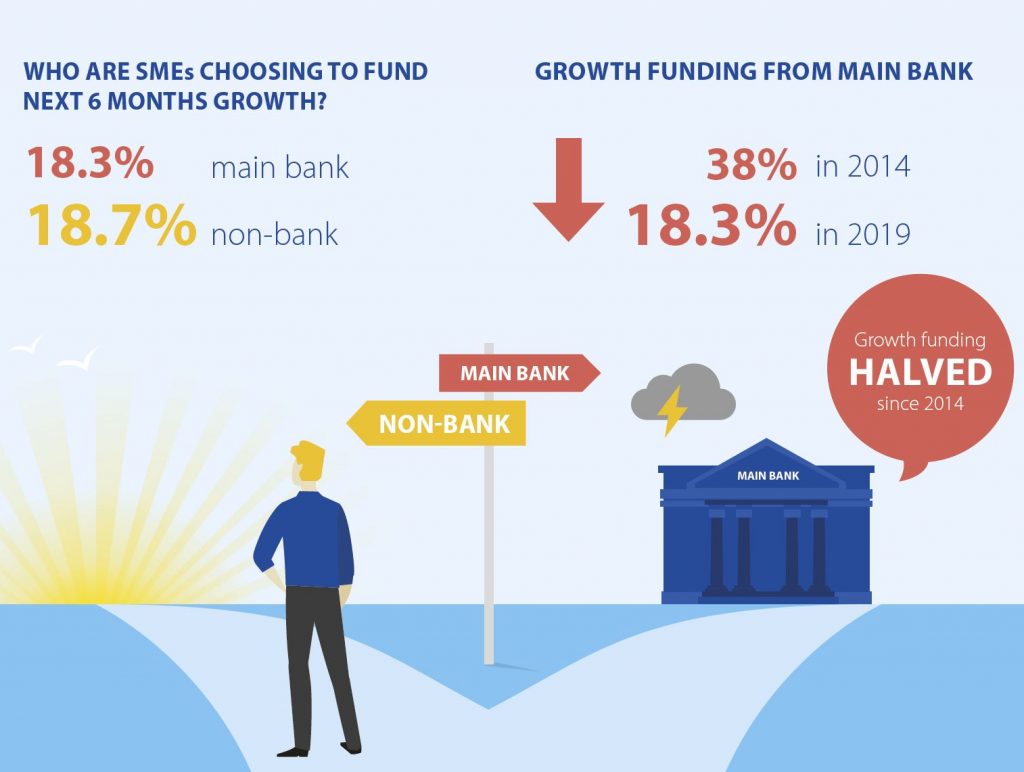

Small business owners’ reliance on non-banks is the highest it’s ever been, with 18.7% of SMEs planning to fund revenue growth with such a lender, as charted in the September 2019 SME Growth Index commissioned by Scottish Pacific and drawing data from over 1,000 businesses.

Conversely, business owners planning to fund their growth via their main bank has halved, dropping from 38% in the first year of reporting in 2014 to 18.3% in the most recent data.

The main reason given for turning away from banks, cited by 21.3% of the SMEs, was avoiding having to use property as security against new or refinanced loans, up from 18.7% in September 2018.

Other considerations contributing to the gravitation towards non-banks included reduced compliance paperwork (19.8%), short application times (17.1%), royal commission disclosures (8.8%) and banks’ credit appetite (6.9%).

Of the SME owners relying on non-bank funding, 77% utilise invoice finance, 23% merchant cash advances, 10% peer to peer lending, 9% crowdfunding and 5% other online lending.

Just 2.6% of those surveyed indicated they would not consider using a non-bank lender – down from 4.0% last year.

“[However], the SME sector still has a long way to go in taking advantage of the alternatives available to them,” said Peter Langham, Scottish Pacific CEO.

“Some business owners remain unaware of funding alternatives. [They] are aware of non-bank funding, but don’t fully understand how it works.

“They are too busy to research it, so put this in the ‘too hard’ basket. When they can’t secure bank funding, they just tip their own money in to fund growth.”

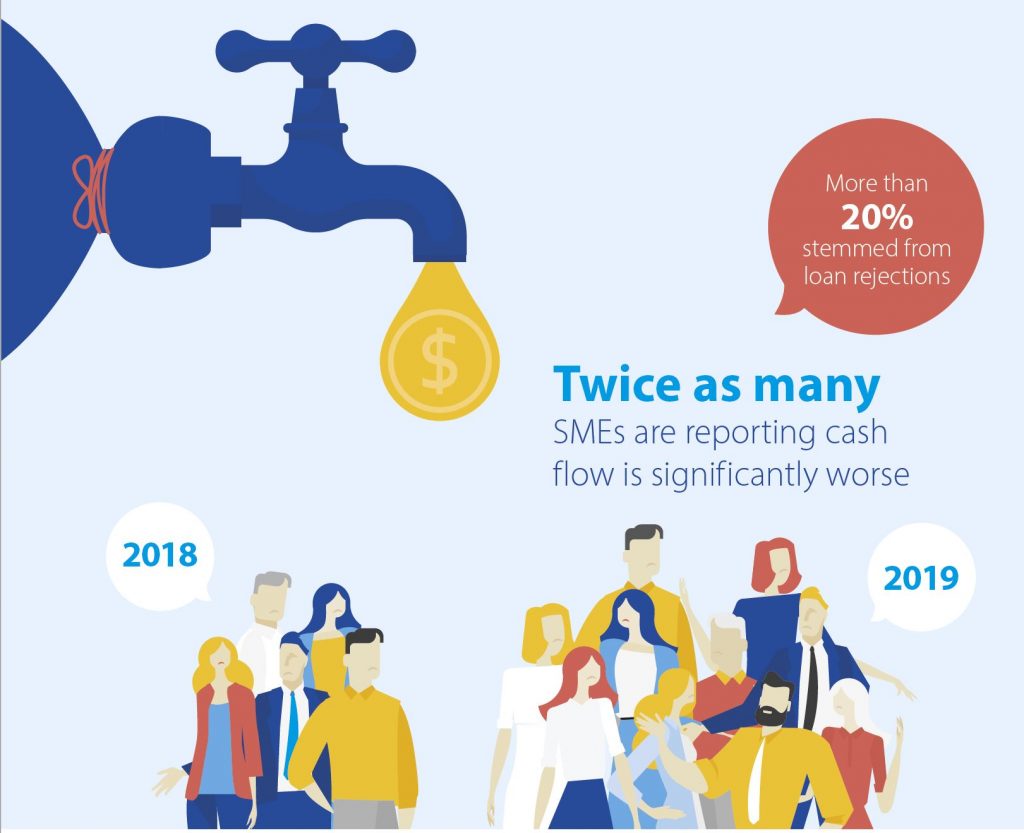

For growth SMEs, almost twice as many as in H1 2018 say their cash flow is

worse or significantly worse (21.2%, up from 12.3%). At the same time,

non-growth SMEs reporting worsening cash flow has increased to 17.6%, up from 10% in H1 2018.

According to the survey, 83% of business owners plan to stimulate revenue growth with their own funds.