AMP Capital chief economist Shane Oliver believes house price falls could be greater than he anticipated following weak auction clearance figures, via InvestorDaily.

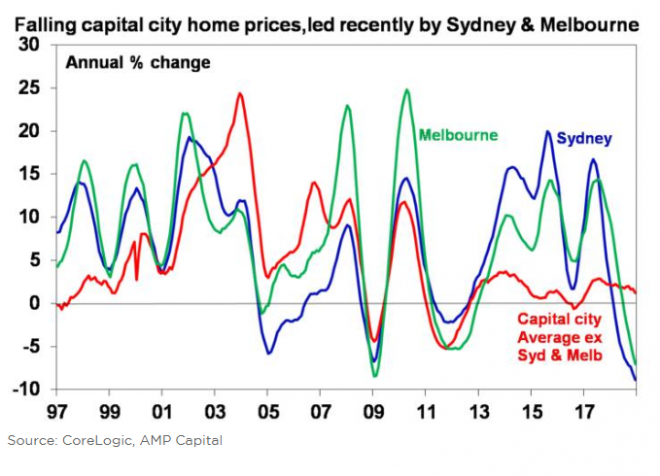

CoreLogic data shows that capital city dwelling prices are down 7 per cent from their September 2017 high.

Sydney prices are down 11 per cent from their July 2017 high, while Melbourne is down 7 per cent from its November peak.

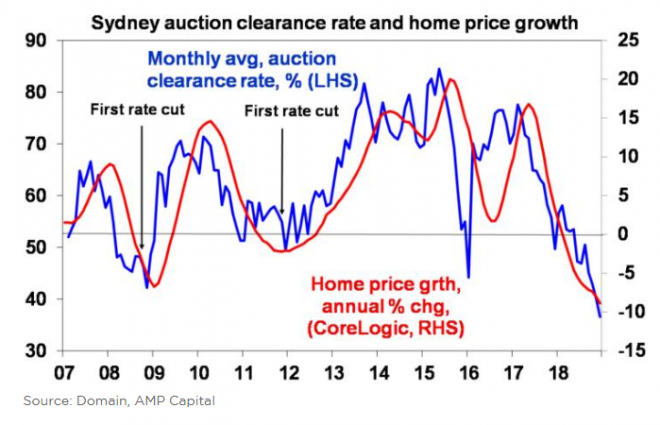

For Sydney and Melbourne, AMP’s base case has been that prices would have a top to bottom fall of around 20 per cent out to 2020. However, looking at the data, AMP Capital’s top forecaster has reconsidered his outlook.

“The further plunge in auction clearance rates and acceleration in price falls late last year suggest a deeper fall – possibly of around 25 per cent (although it’s impossible to be precise),” Mr Oliver said.

This suggests around another 15 per cent fall in Sydney and more in Melbourne, he said, adding that a 25 per cent top to bottom drop would take prices back to where they were in late 2014/early 2015.

While a 25 per cent drop in property prices may seem like a ‘crash’ to some, it comes after a significant period of growth; over the five years to 2017, Sydney prices rise soared 72 per cent and Melbourne prices increased 56 per cent.

“A 25 per cent plunge in Sydney and Melbourne may seem like a crash but given the extent of the prior gains, it’s arguably not. But a 25 per cent national average fall would probably be interpreted as a crash,” he said.

“Our assessment is that this is unlikely unless we see much higher interest rates or unemployment (neither of which are expected) driving a sharp rise in defaults and forced property sales or a collapse in immigration (which would collapse demand).

“Strong population growth is still driving strong underlying demand for housing. While mortgage stress is a risk, it tends to be overstated, and is unlikely to be a generalised issue unless interest rates or unemployment shoot higher. And, while Sydney and Melbourne are at risk, other cities have not seen the same boom and so are unlikely to crash.”

The latest Domain Q4 House Price Report, released on Wednesday (23 January), revealed that Sydney house prices fell 3.2 per cent over the quarter and 9.9 per cent over the year to $1,062,619. Unit prices fell 3.3 per cent over the quarter and 5.8 per cent over the year to $702,012.

“The depth of Sydney’s current house price downturn is the sharpest in more than two decades, although the duration is yet to surpass the 2004-06 slump,” Domain Senior Research Analyst Dr Nicola Powell said.

“House prices have fallen 11.4 per cent from the mid-2017 peak, pushing them back to mid-2016 levels. For the second time since Domain records began in 1993 house prices have fallen for four consecutive quarters, the only other period this occurred was in 2008.

“Despite the consistent quarterly moderations, the depth of the falls have not gained significant momentum. The pullback in price was anticipated given the stellar run of growth that lasted almost six years. Home owners reaped an unprecedented gain of 89 per cent over this period.”

New research released this week from NAB revealed how consumers are weighing up the new opportunities or threats that the current housing downturn presents. It found that half of Aussies think it is not a good time to sell their home or investment property.

This view was broadly consistent across states, although a much higher number in Western Australia said it wasn’t a good time to sell their home.

“We suspect this is influenced by the fact that some home owners in WA may also be sitting on capital losses,” NAB chief economist Alan Oster said.

Over the next 12 months Australians are still most positive about renovating their home and buying a property to live in. But it’s also clear consumers are far more uncertain about the future – around 4 in 10 said they simply didn’t know if it would be a good time to buy, sell, renovate or take out a mortgage.

On average, consumers expect price falls of -2.1 per cent over the next 12 months (against -2.4 per cent forecast by property professionals in NAB’s latest Residential Property Survey).

NSW (-3.1 per cent) and Victoria (-2.9 per cent) are expected to lead the way down, but consumers again are a little less pessimistic than property professionals.