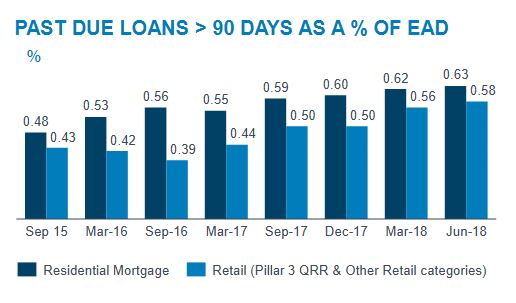

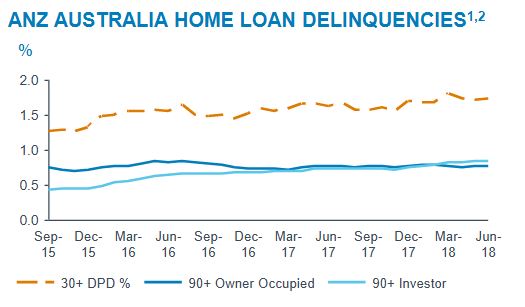

ANZ released their latest update today, and it shows the benefit of returning to its core retail business in Australia, and the release of capital resulting from this. Provisions were significantly lower, thanks to a shirking institutional book, but the home lending sector past 90 days continues to rise to 0.63%, up 10 basis points from March 2016. This is pretty consistent across the industry, despite ultra-low interest rates.

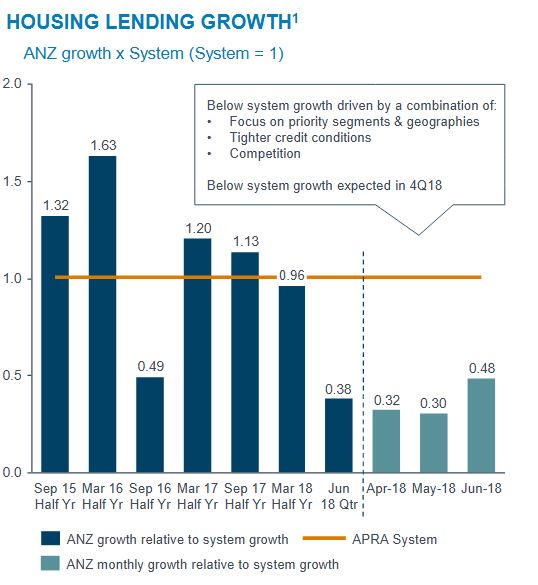

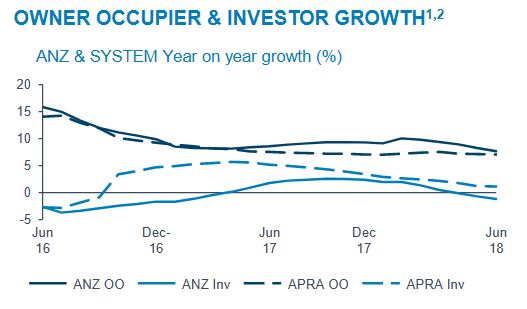

In fact their disclosure on home loans was quite revealing, with lower system growth, a focus on owner occupied loans, and a reduction in mortgage power. This underscore the credit tightening is not temporary.

In fact their disclosure on home loans was quite revealing, with lower system growth, a focus on owner occupied loans, and a reduction in mortgage power. This underscore the credit tightening is not temporary.

The Bills/OIS spread has remained elevated suggesting margin pressure is in the wind.

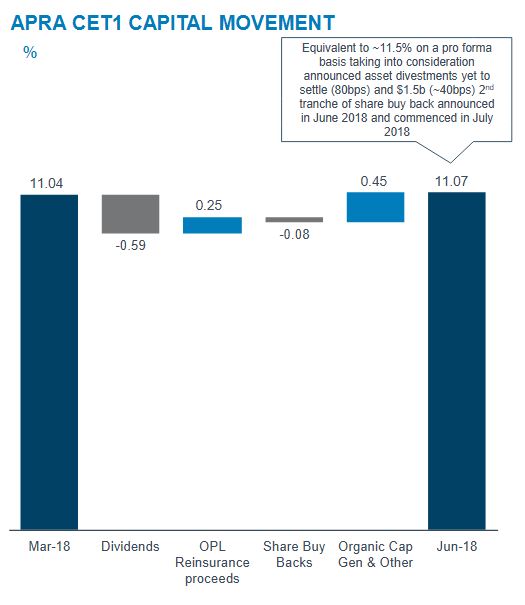

They said level 2 Common Equity Tier 1 (CET1) ratio was 11.07% at Jun-18, up 3bps from Mar-18 largely driven by: organic capital generation (+50bps) and receipt of reinsurance proceeds from the One Path Life (OPL) sale (+25bps); offset by the FY18 Interim Dividend (-59bps) and the share buyback (-8bps). 2018 interim DRP was neutralised.

The ¬$1.5bn of the announced $3bn on-market share buyback had been completed as at 30-Jun 2018.

The ¬$1.5bn of the announced $3bn on-market share buyback had been completed as at 30-Jun 2018.

Total Risk Weighted Assets decreased $2bn to $394bn driven by a $2bn reduction in CRWA. There was a $2bn reduction in CRWAs from net risk improvement across both Institutional and Retail businesses in Australia & New Zealand.

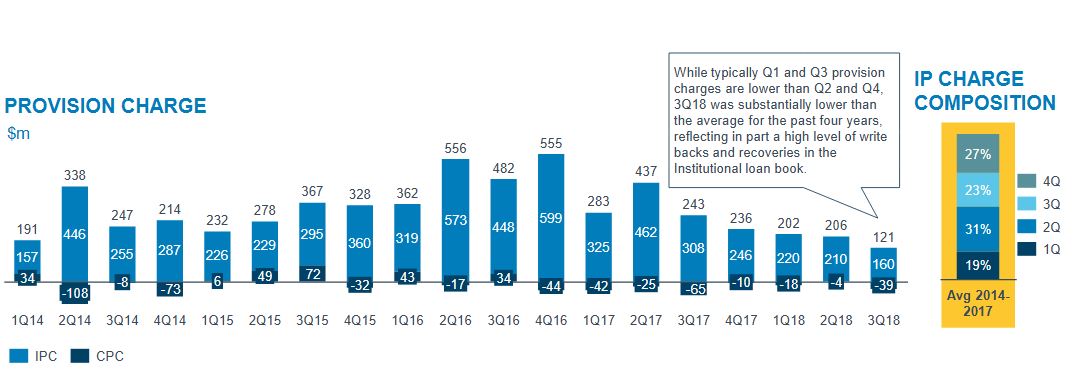

Total provision charge was $121m in 3Q18 with individual provision (IP) charge of $160m. The IP charge in 3Q18 was the lowest quarter since 2014, reflecting both the ongoing benign environment and improved quality of the portfolio

While typically Q1 and Q3 provision charges are lower than Q2 and Q4, 3Q18 was substantially lower than the average for the past four years, reflecting in part a high level of write backs and recoveries in the Institutional loan book.

While typically Q1 and Q3 provision charges are lower than Q2 and Q4, 3Q18 was substantially lower than the average for the past four years, reflecting in part a high level of write backs and recoveries in the Institutional loan book.

ANZ has retained an overlay initially taken at 30 Sep 2017 in relation to the Retail Trade book which remains on watch.

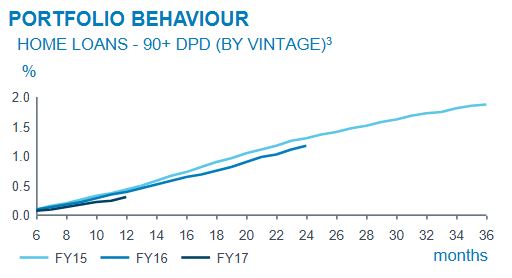

Australian Residential Mortgage 90+ day past due loans (as a % of Residential Mortgage EAD) was flat vs prior quarter. There are some pockets of stress in the mortgage book, primarily in Western Australia, more particularly in Perth itself.

Throughout FY18 the Australian housing system has been characterised by slowing credit system growth, increased price competition, increased capital intensity and tighter credit conditions. As at end June 2018, YTD APRA System has grown 4.1%, down 18% vs. prior comparable period 5.3%.

Throughout FY18 the Australian housing system has been characterised by slowing credit system growth, increased price competition, increased capital intensity and tighter credit conditions. As at end June 2018, YTD APRA System has grown 4.1%, down 18% vs. prior comparable period 5.3%.

ANZ’s ongoing focus is on the Owner Occupier Principal & Interest segment, with Owner Occupier loan growth of 4.4% annualised in the June quarter. Investor segment growth in the June quarter was -2.5% annualised.

ANZ’s ongoing focus is on the Owner Occupier Principal & Interest segment, with Owner Occupier loan growth of 4.4% annualised in the June quarter. Investor segment growth in the June quarter was -2.5% annualised.

ANZ’s total Australian home lending portfolio grew at 0.4 times system in the June quarter (2% annualised growth).

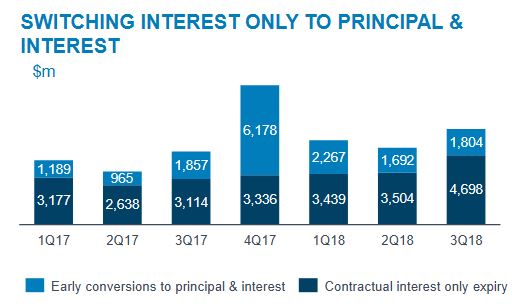

ANZ Interest Only home loan flows in the June quarter represented 13% of total home loan flows.

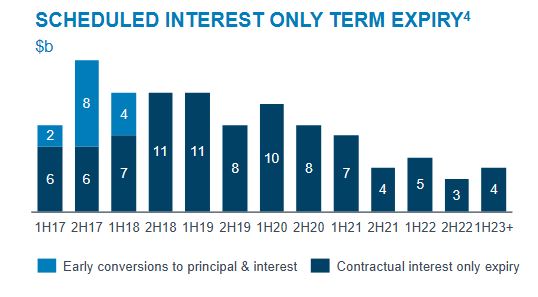

$6.5bn of Interest Only loans switched to Principal & Interest in the June quarter (3Q18), compared with $5.2bn in 2Q18,$5.7bn in 1Q18 and $5.6bn per quarter on average across FY17.

They show the expected rate of interest only loans peaking in the next year or so.

They show the expected rate of interest only loans peaking in the next year or so.

The combined impact of prudential responses over the past 3 financial years including various regulatory changes, together with subsequent policy changes by the banks, has been a meaningful reduction in the average maximum borrowing capacity for home loan borrowers. This suggests to us that there are higher risks in the back book, compared with new business being written now and confirms the reduction in “mortgage power” available to borrowers.

The combined impact of prudential responses over the past 3 financial years including various regulatory changes, together with subsequent policy changes by the banks, has been a meaningful reduction in the average maximum borrowing capacity for home loan borrowers. This suggests to us that there are higher risks in the back book, compared with new business being written now and confirms the reduction in “mortgage power” available to borrowers.