ANZ have announced a new flavour of interest only loans. They said that from 25th March 2019 they will increase the maximum Loan to Value Ratio of Interest Only Loans from 80% to 90%, and increase the maximum term from 5 years to 10 years.

These loans will be marketed only for high-income professionals with stable jobs. And timing means people could transact before the election in May (probably) and so lock in tax benefits relating to negative gearing, which Labor are going to remove for existing property purchased after a certain data, TBA.

ANZ says their response to APRA’s responsible Lending guidelines from 2017 was to manage down the growth of IO loans. But they have decided to increase their focus on the investor market, wiliest ensuring they remain in line with the APRA requirements.

Just to remind ANZ, the key APRA points are :

- Take 80% of rental streams as income to allow for vacancy rates

- Assess the risk on a principal and interest rate loan basis

- Ensure the borrower has firm plans to repay the capital

- Ensure adequate validation of income and expenditure

- Ignore any tax breaks or benefits, so asses on a pre-tax basis.

ANZ says these changes will apply to new loans, either fixed or variable interest rate.

The LVR limit is inclusive of the Lenders Mortgage Insurance Premium

For Owner Occupier Home Loan products: Interest Only term cannot exceed a maximum 5 years per application OR 5 years in total since the last full credit critical application.

For Residential Investment Home Loan products: Interest Only term cannot exceed a maximum 10 years per application OR 10 years in total since the last full credit critical application.

For servicing, the customer is assessed based on their ability to repay the loan over 20 years P&I. And we understand these new loans are assessed at a minimum floor rate of 8.25%, which is a very high hurdle to cross.

These are not available to Owner Occupied Borrowers.

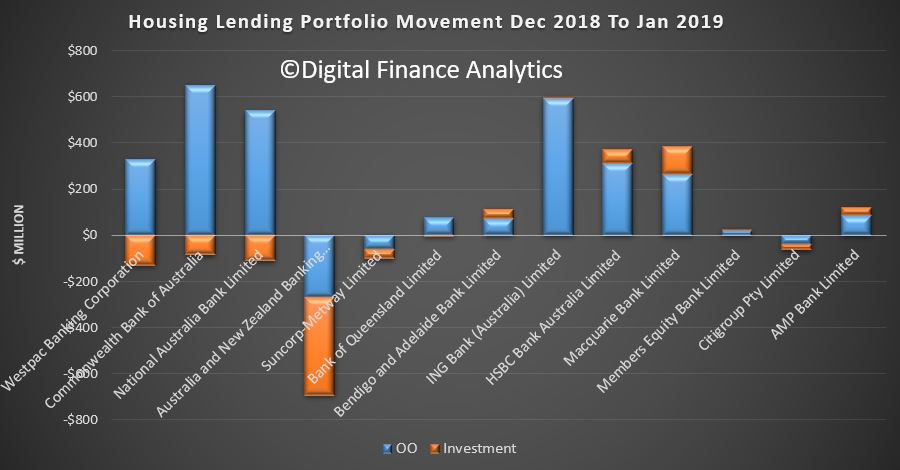

Two comments, first this is to be expected, as ANZ has seen their mortgage portfolio growth drop away, and they are desperate to write business. They are trying to target a specific customer segment, and some who are currently facing a loan reset may be rescued.

But then, our modelling suggests only a very small cohort who might be eligible, and we expect other lenders to react, so they will lift competition for that small segment.

Talking of reaction, we think APRA should step in to ban loans of this duration, but they probably won’t, and the RBA might even welcome the move behind the scenes as generating a rise in credit.

But frankly, this is just one more of those unnatural acts I keep talking about from actors who are trying to keep the property bubble alive. But potential investors should realise that prices are likely to keep falling, rental streams are diminishing, especially in Sydney, and a repayment plan over 20 years, will require higher monthly repayments down the track. This has high risk written all over it!