Last Wednesday, Australia and New Zealand Banking Group Limited announced that it had agreed to sell its New Zealand life insurance business OnePath Life NZ Limited to Cigna Corporation, a global healthcare services organization with an established New Zealand specialist insurance business. The planned sale is credit positive for ANZ because it will lift the group’s Level 2 Common Equity Tier 1 (CET1) ratio by approximately 15 basis points, says Moody’s.

Total consideration for the sale is NZD700 million and the company expects to generate a gain of approximately NZD50 million. As part of the agreement, ANZ will enter a 20-year strategic alliance with Cigna to offer life insurance products through ANZ’s distribution channels. ANZ expects to complete the sale during its 2019 fiscal year, which ends September 2019.

The sale follows ANZ’s announcement in December 2017 that it had agreed to sell its Australian insurance business to Zurich Insurance Company Ltd. (financial strength Aa3 stable) for a total consideration of AUD2.85 billion.

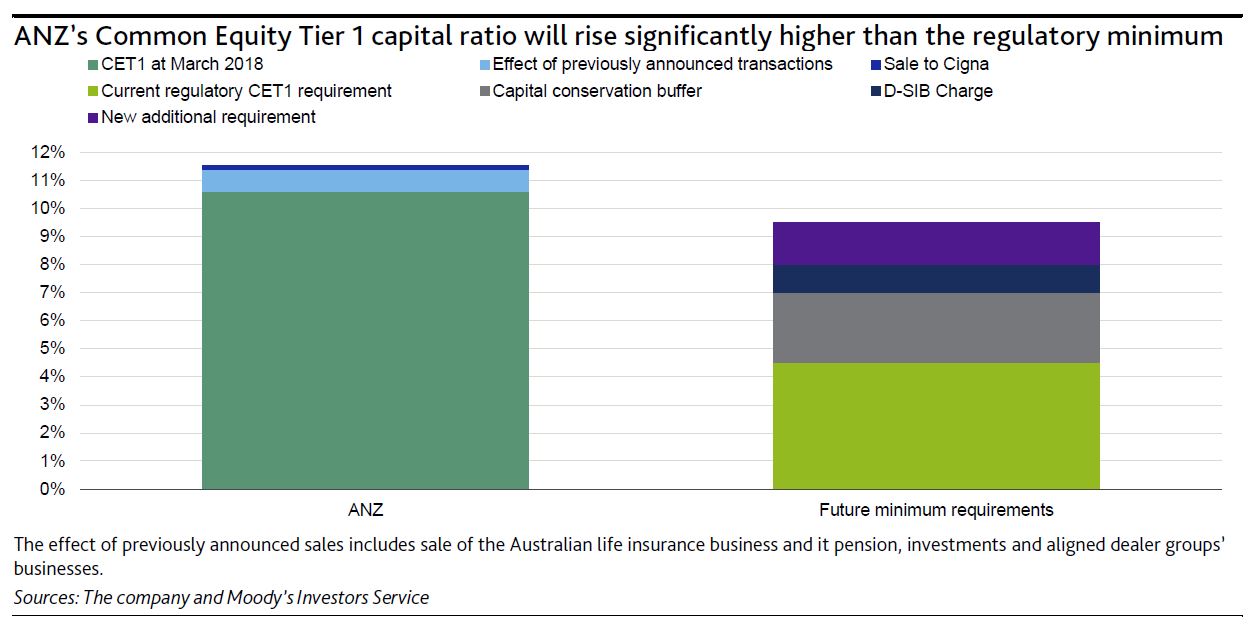

The sale comes as capital requirements for Australian banks are increasing. The Australian Prudential Regulation Authority announced in July that it is increasing the minimum capital requirements for ANZ and domestic peers Commonwealth Bank of Australia, National Australia Bank Limited and Westpac Banking Corporation to 9.5% by 2021 from 8% currently, including a capital conservation buffer and a domestic systemically important bank charge. Although the higher capital requirements will take effect in early 2021, the regulator said it expects banks to exceed the new requirement by 1 January 2020 at the latest.

ANZ’s sale of OnePath Life NZ, combined with the previously announced sale of its Australian life insurance business and it pension, investments and aligned dealer groups’ business, will boost ANZ’s CET1 ratio by approximately 95 basis points. That includes 65 basis points from the sale and reinsurance of its Australian life insurance business, 15 basis points from the sale of pensions, investments and aligned dealer groups’ business and 15 basis points from the sale of OnePath Life NZ). The transactions will significantly raise ANZ’s CET1 ratio well above the future minimum requirement of 9.5%.

Consequently, we expect that ANZ will continue to return surplus capital to shareholders in line with its announced AUD1.5 billion on-market share buyback. ANZ had completed AUD1.1 billion of share buybacks as of 31 March 2018. The additional capital generated by these business sales may provide capacity for future share buybacks. Despite these capital distributions, ANZ remains highly capitalized, with excess capital above the higher future minimum requirements of AUD 5.7 billion, assuming it completes the full AUD1.5 billion on-market share buyback.