Interesting to read Moody’s assessment of APRA’s changed stance relative to the 10% speed limit for investor loans in “Australia’s tighter bank regulation will contain risk from removal of investor lending restriction, a credit positive.” Overall they see the underwriting standards rising, reducing risk, though they recognize some potential to lift investment loan volumes, which are inherently more risky.

Last Thursday, the Australia Prudential Regulation Authority (APRA) announced its intention to remove the current 10% limit on investor loan growth, replacing it with additional requirements for bank boards to comply with APRA’s guidelines for lending policies and practices. Although removal of the cap on investor loan growth will likely spur growth in investor lending, which we view as more risky than lending to owner occupiers, APRA’s increased oversight to ensure that bank underwriting continues to strengthen contains the risk, a credit positive.

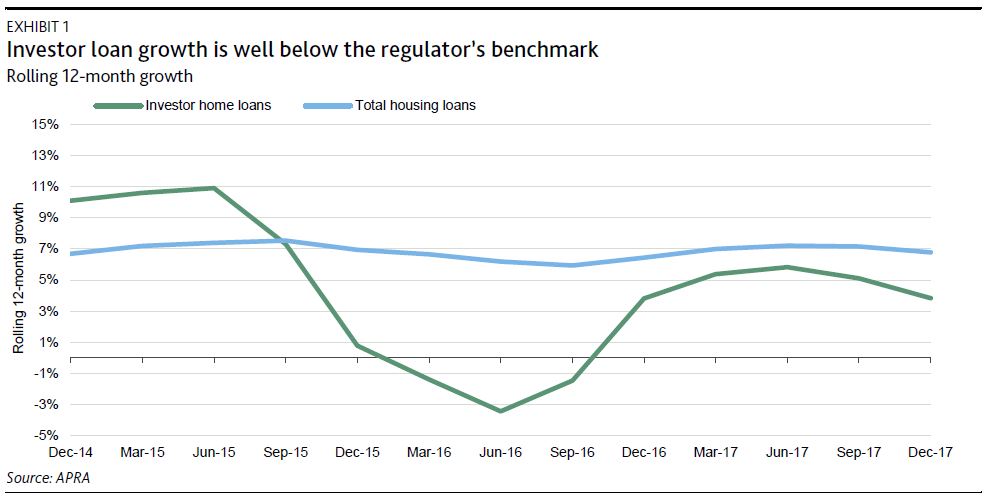

For a bank to gain an exemption from the limit on investor loan growth, the bank’s board must confirm that it has operated below the 10% limit for at least the past six months. As shown in Exhibit 1, investor loan growth for the banking system has been running at well below 10%.

The board also will have to provide written confirmation that lending policies meet APRA’s guidance on serviceability assessments as set out in Prudential Practice Guide APG 223 – Residential Mortgage Lending (APG 223). In particular, bank’s underwriting will need to include interest rate buffers comfortably above two percentage points and interest rate floors comfortably above 7%, which must apply to a borrower’s new and existing debt; haircuts on uncertain and variable income, such as, for example, at least a 20% haircut on nonsalary and rental income; and for interest-only loans, an assessment of serviceability for the remaining principal and interest repayments after the interest-only term.

Furthermore, the board also must confirm that lending practices meet APRA’s guidance on the assessment of borrower financial information and management of overrides, as set out in APG 223. In particular, banks will need to commit to the following:

- Improved collection of a borrower’s expenses to reduce reliance on benchmark estimates such as the Household Expenditure Measure

- Strengthen controls to verify a borrower’s existing debt and prepare to participate in the new comprehensive credit reporting regime that takes effect 1 July 2018. Under the new regime, information shared by banks on a customer’s credit history will be expanded beyond just reporting negative behaviour to provide a more balanced assessment

- Setting risk tolerances on the extent of overrides to lending policies

- Develop limits on the proportion of new lending at high debt-to-income levels (where debt is greater than 6x a borrower’s income), and policy limits on maximum debt-to-income levels for individual borrowers

We consider APRA’s increased focus on lending policies and practices a strong mitigant against the risk of a significant rise in investor lending. Indeed, APRA has cautioned that a return to more rapid rates of investor loan growth could warrant the application of a countercyclical capital buffer or some other industrywide measure.

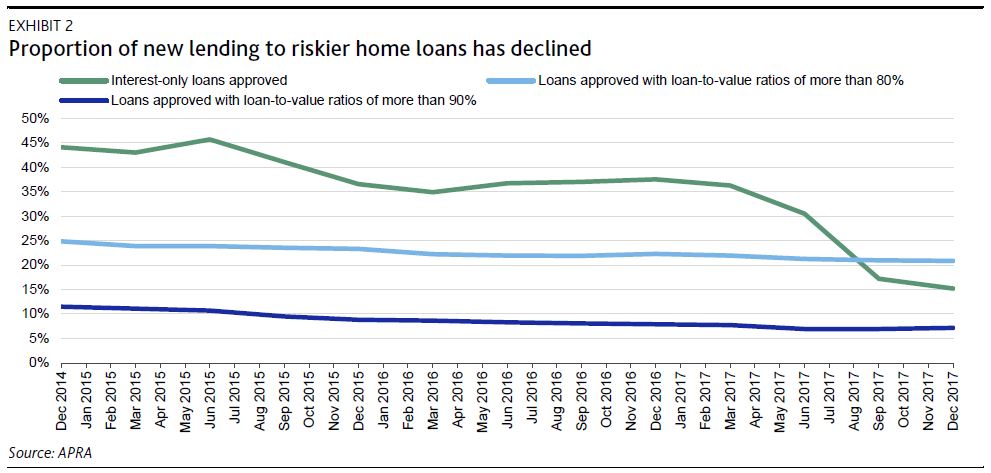

Furthermore, APRA’s announcement reflects its recognition that since the introduction of the limit in December 2014, banks’ loan underwriting and lending practices have improved, as reflected by the decline in investor interest-only and high loan-to-value lending (see Exhibit 2). APRA also cited strengthening bank capitalisation, which has been supported by higher regulatory capital requirements.

Banks will have until 31 May 2018 to provide all necessary confirmations for the removal of the investor loan growth benchmark on 1 July 2018.