The vast majority of households with home insurance may well be exposed to unexpected loss according to ASIC. Following a survey of 23 home insurance brands covering 12 insurers, ASIC is calling for further improvements across the sector to help consumers make good decisions about their home insurance cover.

In response to ASIC’s recommendations from October 2014, insurers have made a range of improvements. In particular, most insurers have implemented, or are implementing, the following changes:

- Incorporating a sum insured calculator into point of sale processes, including through updated sales scripts, and providing better access to online calculators. This helps consumers select an appropriate sum insured amount during the quote and sales process, an important way to help reduce the risk of underinsurance; since October 2014, four additional insurers have made available sum insured calculators in both their telephone and online sales channels.

- Training staff so that information provided to consumers about the sum insured, and the maximum amount paid by the insurer, is clear and in plain English; since October 2014, an additional eight insurers have adopted this practice for their telephone sales and an additional 11 for their online sales.

- Providing information or assistance to consumers about the effect of changes to building codes which may increase the cost of rebuilding homes after a total loss; since October 2014, four additional insurers have made changes to provide this information.

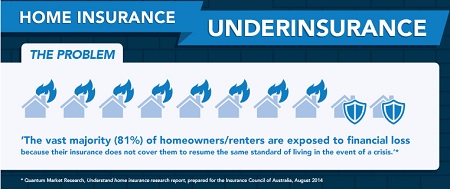

View ASICS’s infographic which sets out the survey results

Although welcoming these changes, ASIC’s survey identified that there is scope for insurers to take additional steps. In particular, we would like insurers to help consumers select the right insurance cover by:

- explaining that the sum insured amount needs to enable complete replacement of contents or complete rebuilding of their home;

- providing guidance about coverage or sum insured amounts, rather than simply referring consumers to the product disclosure statement;

- referring to the Key Facts Sheet to assist decision making; and

- providing information and guidance about natural perils risks and additional rebuilding costs due to natural perils, to better estimate rebuilding costs after a total loss.

An example of an initiative that is aimed at providing more information and guidance to consumers is one insurer’s website that allows consumers to enter their suburb or postcode and receive targeted information about that area including relevant risks, types of claims, types of weather events, and a dollar figure for how much other consumers in the area insure their building and contents.

ASIC has been working with the insurance industry to better understand barriers to the provision of financial product advice to consumers purchasing home insurance. ASIC has already taken steps to encourage and facilitate insurers operating under general advice models to provide useful information to consumers.

‘ASIC is keen to see industry make improvements in all of the areas identified in ASIC’s 2014 report,’ ASIC Deputy Chair Peter Kell said.

‘Our goal is to make sure that consumers buy insurance that better meets their needs – including by helping to reduce levels of underinsurance, especially when there are natural disasters.’

ASIC will continue this work with the insurance industry to further enhance the sector’s ability to assist consumers in purchasing home insurance that better meets their needs.

Background

ASIC released two reports in October 2014 exploring consumer experiences with the sale of home insurance.

In Report 415, ASIC reviewed the sales practices of 13 insurers who sell home insurance across Australia. Report 415 found that for sum insured policies, it is important to help consumers to set an appropriate sum insured amount, so that they are adequately insured in the event of a total loss.

Most home insurance policies in Australia are ‘sum insured’ policies, where the insurer agrees to pay only up to an agreed amount (the sum insured), nominated by the consumer, to repair or rebuild a damaged or destroyed home.

ASIC encourages insurers to inform consumers that the building sum insured amount should reflect the amount that it would cost to completely rebuild their home. Similarly, the contents sum insured amount should reflect the amount it would cost to completely replace all contents with new items at today’s prices. The sum insured amount should also reflect the cost to rebuild the consumer’s home to meet new building codes and standards, and any other supplementary costs. For information on supplementary costs see MoneySmart’s page on home insurance supplementary costs

Findings from Report 415 were considered in the Financial System Inquiry which called for improved guidance (including tools and calculators) and disclosure for general insurance, especially in relation to home insurance. The Government has agreed to support work by industry to increase guidance and disclosure in general insurance.

ASIC also notes and welcomes subsequent industry recommendations targeted at effective disclosure. Some of the Effective Disclosure Taskforce’s recommendations align with ASIC’s findings, particularly in relation to improving the provision of information to consumers about natural hazard risk, and integrating sum insured calculators into the sales process.