In April 2016, the Reserve Bank conducted a survey of activity in foreign exchange and over-the-counter (OTC) interest rate derivatives markets in Australia. Using data from the BIS and the RBA summary, here is a snapshot. This was part of a global survey of 52 countries, coordinated by the Bank for International Settlements (BIS). Similar surveys have been conducted every three years since 1986.

Globally, the Australian dollar remains the fifth most traded currency, although its share of turnover decreased by 1½ percentage points to around 7 per cent.

The AUD/USD remains the fourth most traded currency pair, having also accounted for a slightly decreased share of global turnover.

The AUD/USD remains the fourth most traded currency pair, having also accounted for a slightly decreased share of global turnover.

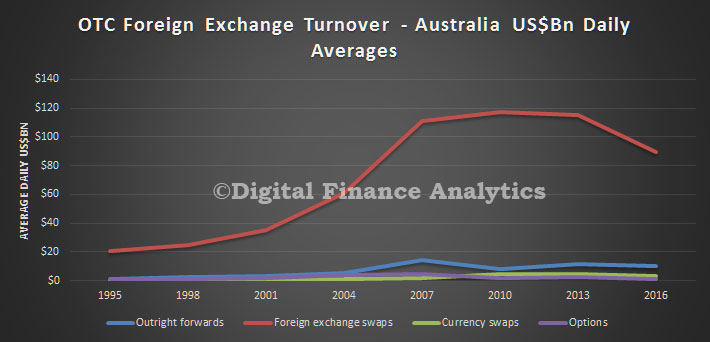

Activity in Australia’s foreign exchange market has moderated since the previous survey in April 2013. Total turnover fell by around 25 per cent, compared with a 5 per cent decrease in global turnover over the same period.

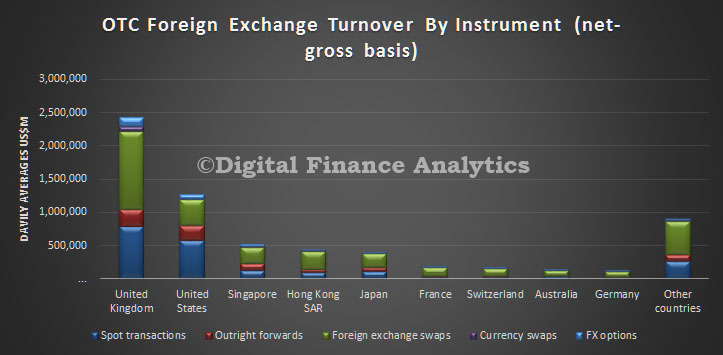

Nonetheless, the Australian foreign exchange market remains the eighth largest in the world.

Nonetheless, the Australian foreign exchange market remains the eighth largest in the world.

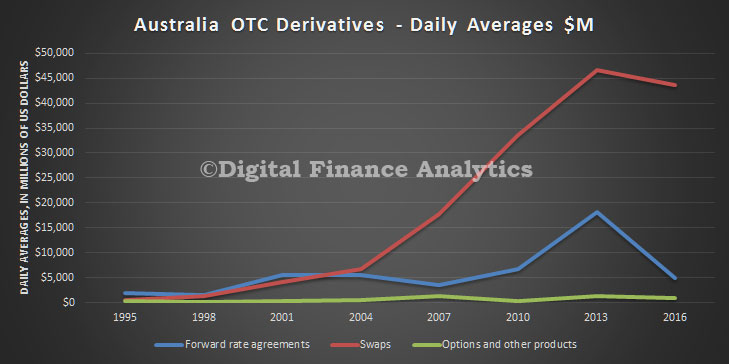

Activity in Australian OTC interest rate derivatives markets declined markedly over the three-year period, primarily reflecting a decline in turnover of forward rate agreements.

Activity in Australian OTC interest rate derivatives markets declined markedly over the three-year period, primarily reflecting a decline in turnover of forward rate agreements.

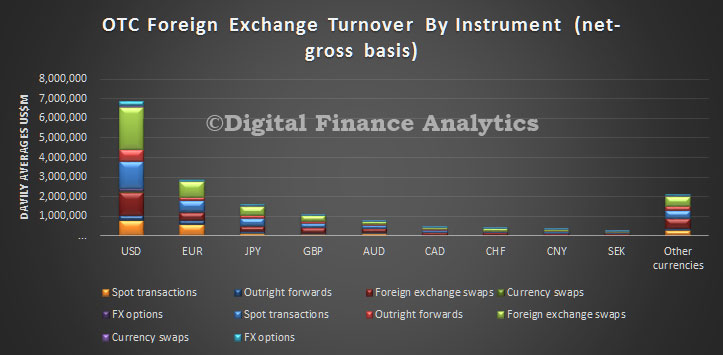

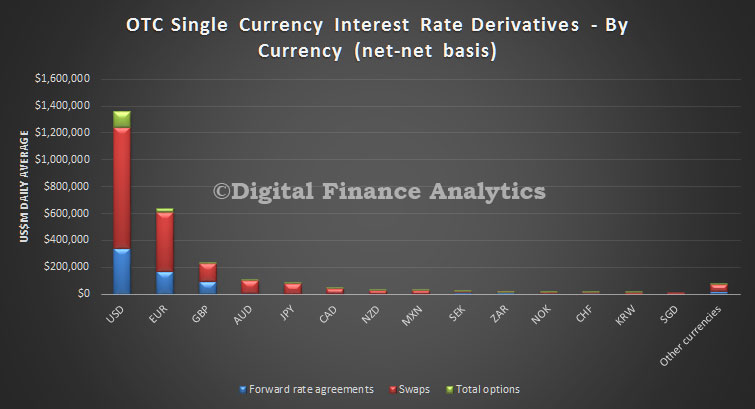

The BIS data highlights the high volume of US$ Swaps, relative to other currencies. AUD is in fourth position.

The BIS data highlights the high volume of US$ Swaps, relative to other currencies. AUD is in fourth position.

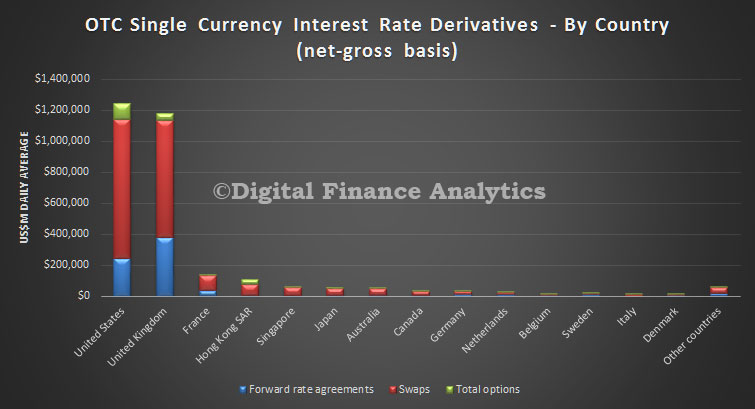

The USA and UK dominate the derivative markets, with Australia in seventh position.

The USA and UK dominate the derivative markets, with Australia in seventh position.

The preliminary results of the global turnover survey and links to other participating jurisdictions’ results are available from the BIS website. More detailed results for the Australian market are available on the 2016 BIS Triennial Survey Results – Australia page.

The preliminary results of the global turnover survey and links to other participating jurisdictions’ results are available from the BIS website. More detailed results for the Australian market are available on the 2016 BIS Triennial Survey Results – Australia page.

The BIS will also publish global data on outstanding OTC derivatives as at June 2016 in November.

The Reserve Bank will publish Australian data on outstanding OTC derivatives at that time.