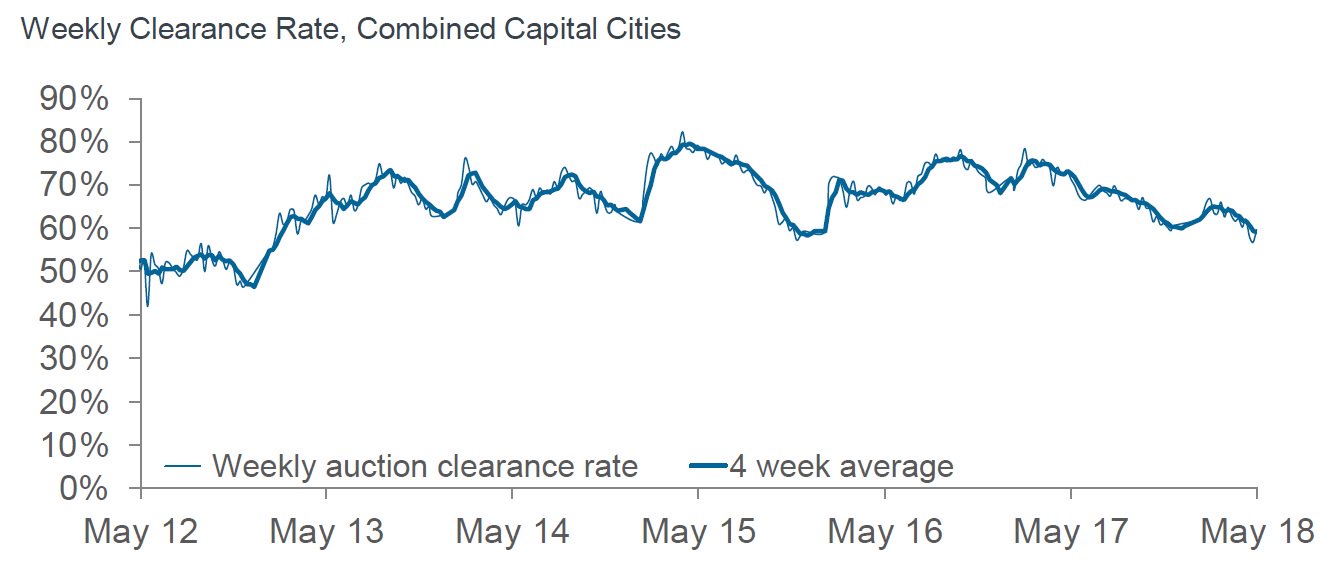

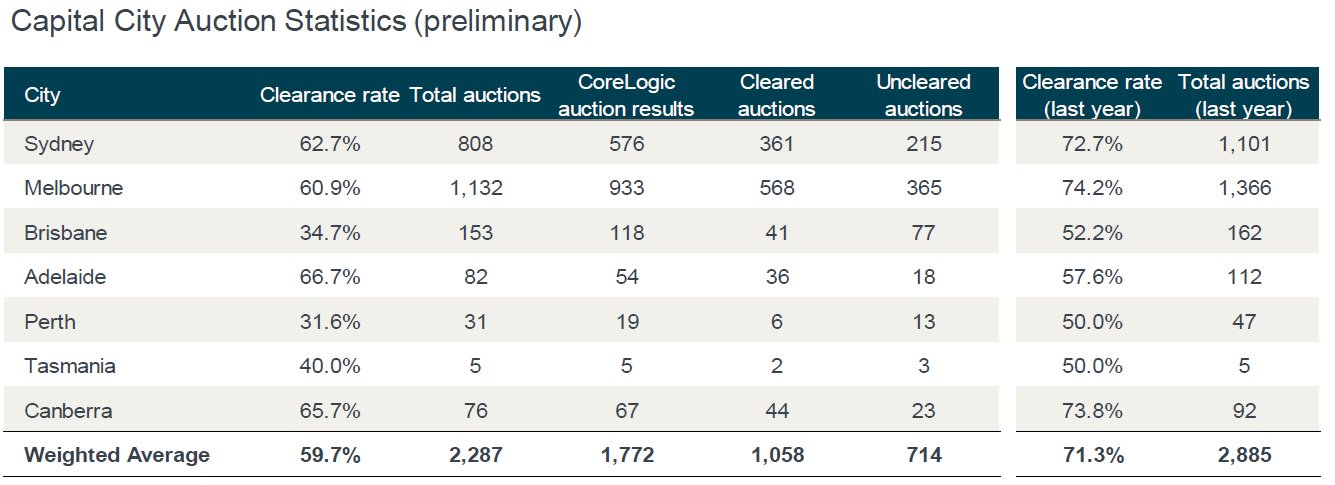

The preliminary data from CoreLogic, which will correct lower, reports a rate of 59.7% was recorded across Australia’s capital cities, which is below from 60.3% the previous week. Slightly more properties were up for auction than the previous week at 2,287.

But so far only 1,772 reported back and of that 1,058 cleared while 714 failed to sell. More than 500 are outstanding, and that could take the final rate down towards the 56.8% last week.

But so far only 1,772 reported back and of that 1,058 cleared while 714 failed to sell. More than 500 are outstanding, and that could take the final rate down towards the 56.8% last week.

Clearance rates for units continued to outperform those for houses, coming in at 64.9% and 57.6%.

Clearance rates for units continued to outperform those for houses, coming in at 64.9% and 57.6%.

Melbourne, Australia’s busiest auction market, drove the national decline last week where a preliminary clearance rate of 60.9% was recorded across 1,132 auctions held, falling from a preliminary reading of 64.2% in the prior week when 1,033 properties went under the hammer. They are predicting a final rate below 60%, compared with 62% last week.

Sydney may be a little higher this week, at 62.7% compared with improvement on the 60.8% last week on a preliminary basis. But again, there are a large number of auctions yet to report. Sydney last week achieved a final rate of 54%.

Sydney may be a little higher this week, at 62.7% compared with improvement on the 60.8% last week on a preliminary basis. But again, there are a large number of auctions yet to report. Sydney last week achieved a final rate of 54%.

Across the smaller capitals, preliminary clearance rates improved in Adelaide and Perth but fell in Brisbane and Canberra.

Michele Bullock, Deputy Governor of RBA, participated in the following forum in the Netherlands over the weekend… unfortunately the RBA is not supplying the paper or slide pack as the forum was held under “Chatham House rules” – shame, would be interesting to see what they say (admit) to internationally, rather than after the fact anecdotes about how central bank peers told Phil that we were crazy allowing 40+% of mortgages to be interest only…

https://www.dnb.nl/en/binaries/Hot%20property_tcm47-376013.pdf?2018052701

This actually goes to my greatest concern – just how does the RBA balance it’s responsibilities between their desire to sell “confidence” to the population AND as a publicly trusted provider of unbiased, quality economic research and opinion to a concerned public? As an independent, non-elected, and powerful institution, how is this judgement call made and how are they held to be accountable to this judgement?