According to Morgan Stanley, via Bloomberg, Australia’s economy is most at risk in the developed world from household debt reduction because of weak house prices and potential tax changes that could curb property investments.

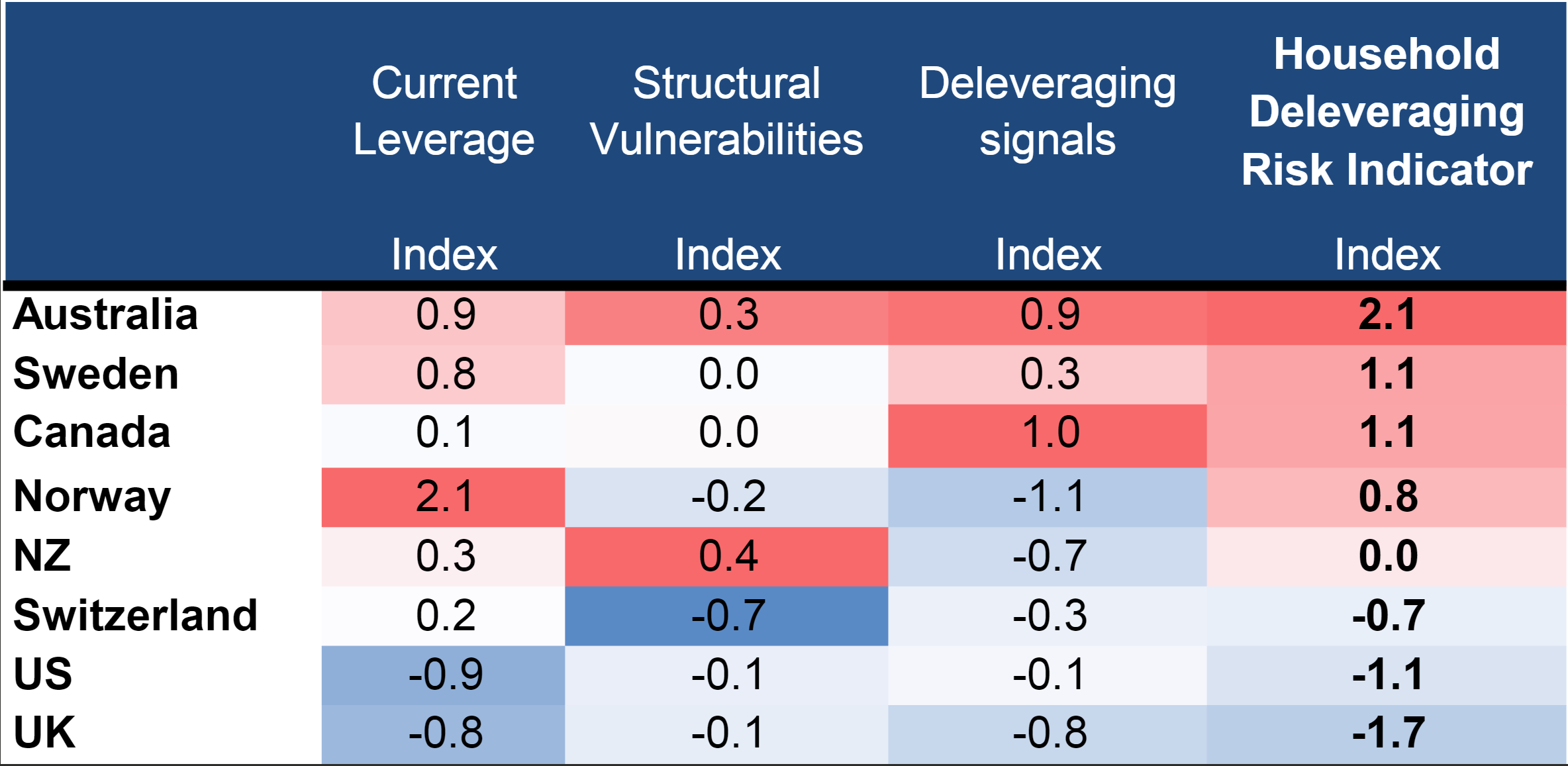

That’s the conclusion from the bank’s Household Deleveraging Risk Indicator, which looks at relative debt and structural weaknesses. The study of the world’s 10 leading developed economies puts Sweden and Canada as the second-most at risk, followed by Norway.

“These economies now face a crucial juncture as housing markets weaken, forcing a reappraisal of leverage and wealth, and global financial conditions tighten, increasing the consumption drag from debt service and rising savings,” the bank’s strategists said.