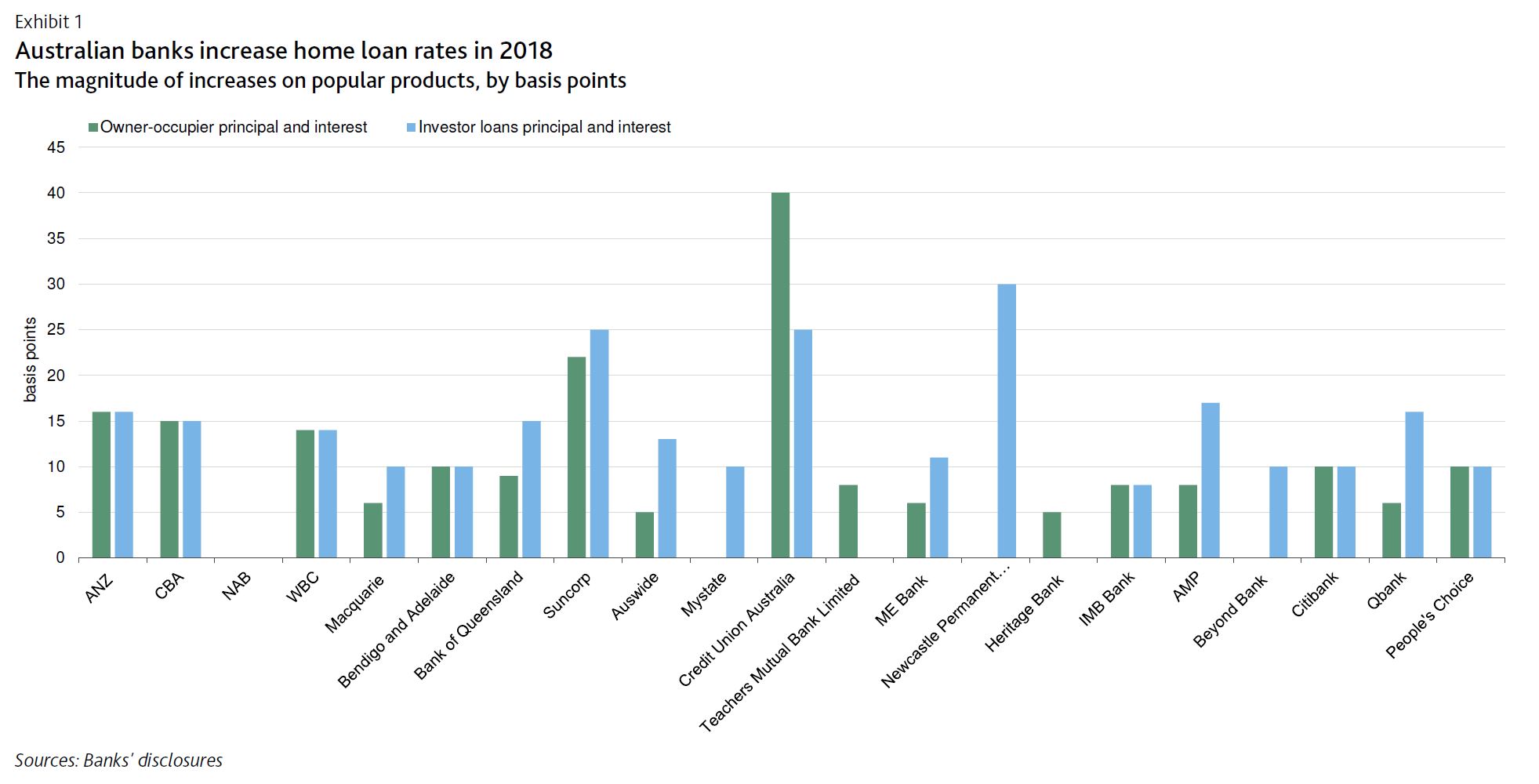

On 6 September, the Australia and New Zealand Banking Group (ANZ) and the Commonwealth Bank of Australia (CBA) raised their home loan rates by 16 and 15 basis points respectively, following a similar move by Westpac Banking Corporation (WBC), which raised its rates by 14 basis points on 29 August.

The increases in home loan rates are credit positive for Australia’s major banks, which include ANZ, CBA, the National Australia Bank (NAB) and WBC, because they underline the strong pricing power of the banks, which is a key factor supporting their profitability. These interest rate rises will help mitigate the negative effects of rising wholesale funding costs, slower credit growth, and higher regulatory and compliance costs.

The rate increases by the major banks follow similar announcements earlier in 2018 by small and midsize Australian banks. The increases in home loan lending rates have been a response to higher wholesale funding costs, which have been rising since the start of 2018, for banks reliant on this type of funding.

The rate increases have been concentrated in variable-rate home loan products, which are more popular in Australia than fixed-rate loans. For banks with lower levels of wholesale funding than the majors, these have generally been around 10 basis points for owner-occupier principal and interest loans, and higher for riskier products such as investor and interest-only loans.

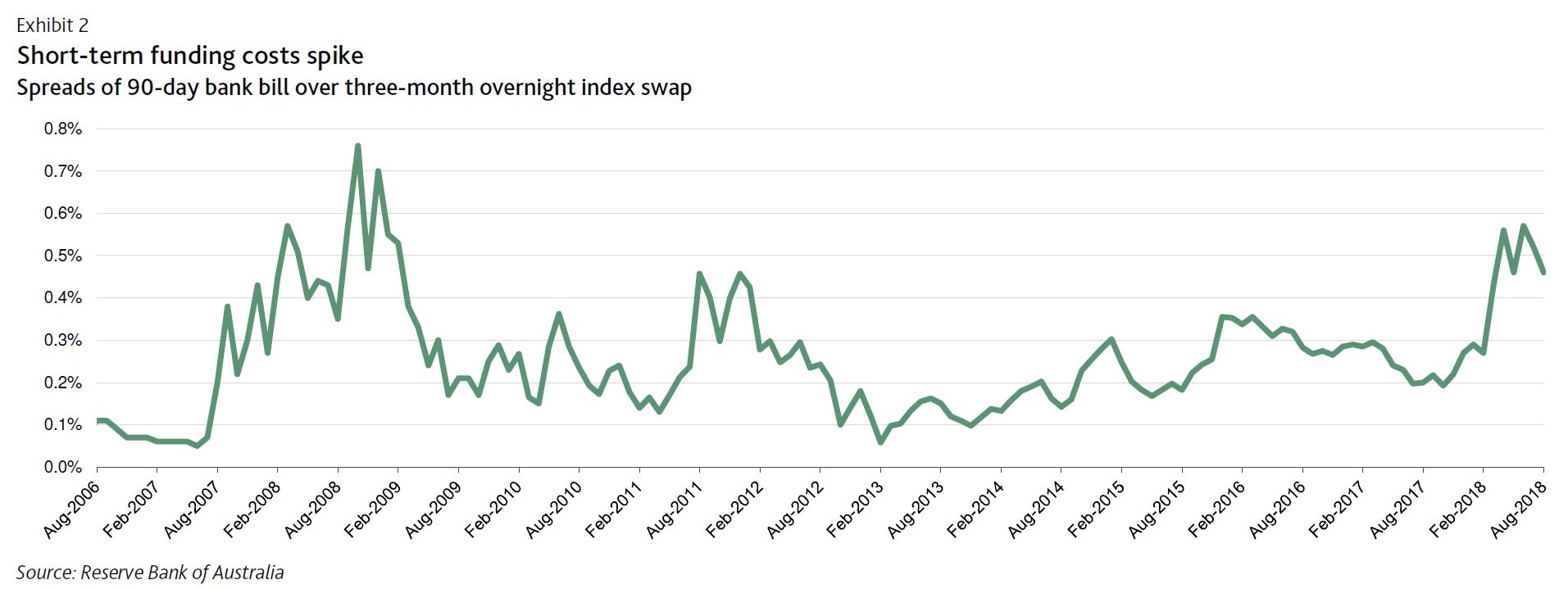

Higher home loan rates will offset higher wholesale funding costs, with short-term funding costs being particularly affected in 2018 (Exhibit 2).

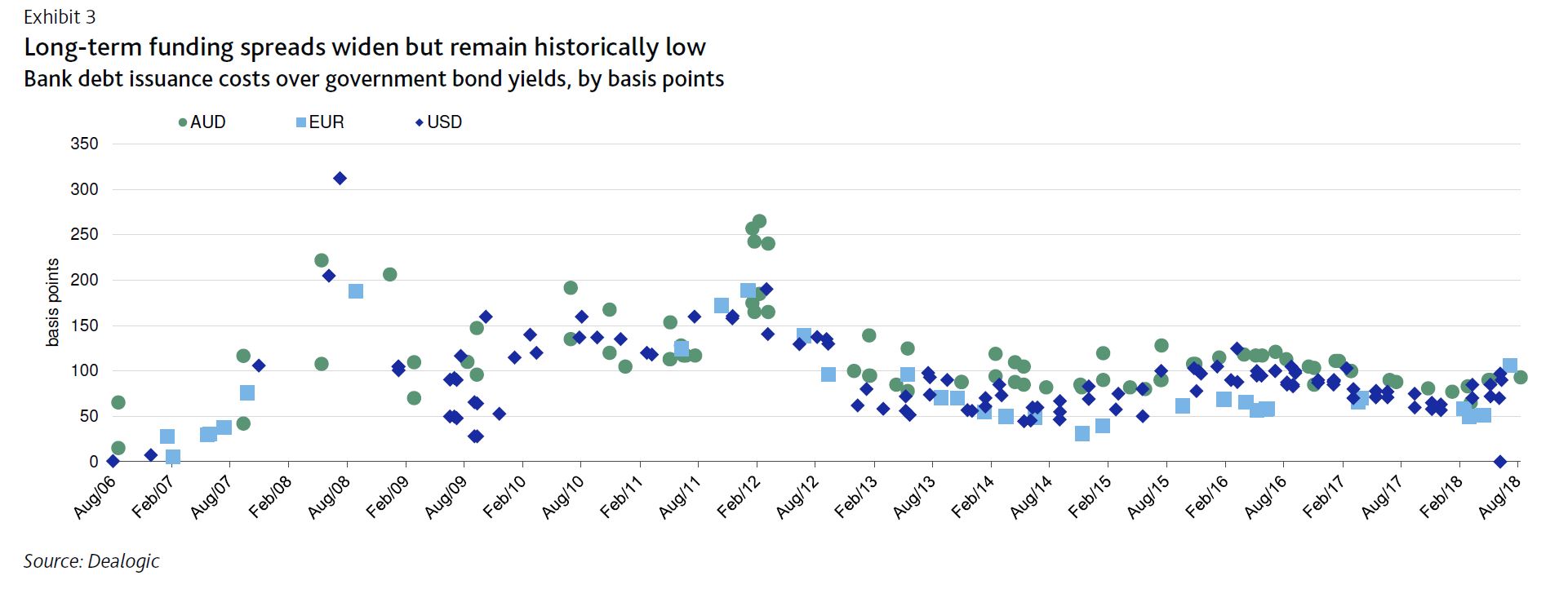

Long-term debt issuance costs have increased proportionally less and, importantly, remain low by historical comparison (Exhibit 3). That said, we expect debt issuance costs to continue to increase as global interest rates rise. This will increase banks’ overall cost of funding as banks replace cheaper, wholesale maturities with more expensive debt.

The rate increases demonstrate that, despite intense political scrutiny and Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, which had primarily fallen on the major banks, they still retain pricing power.

Before the rate increase announcements by the major banks, it appeared that their pricing power had been somewhat constrained while the Royal Commission was ongoing because, historically, they have been the first movers on home loan rates. However, in 2018 it has been mortgage rate increases by smaller banks that have paved the way for the major banks to follow.

From an asset-quality perspective, despite the very high level of household leverage in Australia, we do not expect the current round of home loan rate hikes to result in a significant increase in loan delinquencies or credit costs. That is because labour market conditions, which are a strong indicator of mortgage performance, are likely to remain favourable, underpinned by solid economic growth forecasts, trade tensions notwithstanding.

Additionally, the increases in home loan rates are small compared with buffers built into home-loan serviceability assessments.

Australian banks commonly assess borrowers’ repayment abilities based on a minimum interest rate of 7.25%, which is well above an average home loan rate of around 5.25% posted by Australian banks over the past three years.

Moreover, collateral quality will remain strong, despite ongoing house price corrections in Sydney and Melbourne. The average loan-value ratio for Australian bank home loan portfolios remains at around 50%.