The Australian Prudential Regulation Authority (APRA) has released a discussion paper proposing two options to improve the transparency, comparability and flexibility of Australia’s bank capital framework. Both options would be credit positive because each would improve the comparability of Australian banks’ capitalisation to global peers says Moody’s.

APRA’s proposals are not intended to change the quantum of bank capital, but to improve the comparability of reported capital ratios.

Australian banks’ reported capital ratios are generally lower than banks with comparable capital strength in other jurisdictions because of the regulator’s conservative implementation of Basel capital requirements. Banks using the internal ratings-based (IRB) approach to calculate capital ratios will be most affected. Investors’ better understanding of the true strength of Australian banks’ capitalisation will support the banks’ access to international capital markets where, in aggregate, they raise about two-thirds of their long-term debt. APRA’s first option would not change how Australian banks’ capital ratios are calculated. Instead, banks would use a regulator-endorsed methodology to report an additional “internationally comparable” ratio to facilitate comparison to global peers. This approach is broadly in line with current practice and IRB banks already disclose their own calculations of internationally comparable capital ratios, but the introduction of a regulator-endorsed methodology will add credibility and consistency to the calculation of the internationally comparable capital ratio.

APRA’s second option would remove aspects of conservatism in the definition of capital and banks’ calculation of risk-weighted assets (RWAs), making the calculation of capital ratios more consistent with global peers. Australian bank capital ratios would likely rise under this approach, so APRA would also lift minimum regulatory capital ratio requirements to ensure that banks retain the same level of capital. APRA also raised the possibility of increasing the size of the capital conservation buffer. APRA believes that increasing the spread before a bank’s capital ratio breaches this buffer will increase its capacity to begin a recovery action and for APRA to take supervisory action.

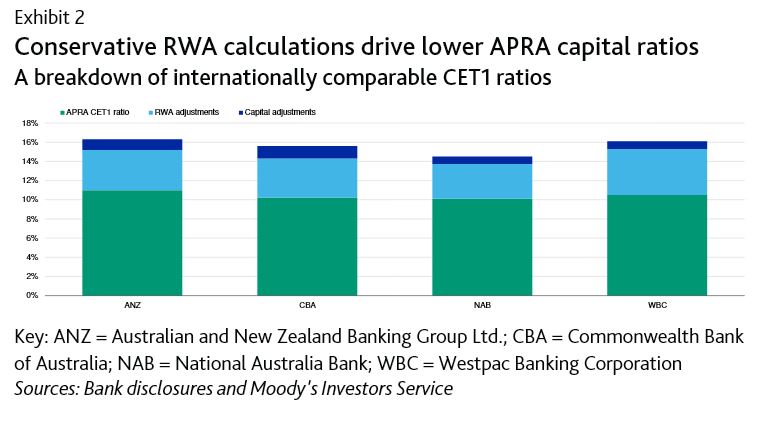

The key areas of conservatism within the current APRA capital framework largely relate to the calculation of RWAs. For example, APRA requires a minimum 20% loss-given-default assumption for residential mortgages, which is higher than in most jurisdictions. APRA also requires capital held at a Pillar I level for interest rate risk in the banking book, an approach that is not required under the Basel capital framework. The regulator’s definition of regulatory capital is also conservative in that it requires certain investments, tax assets and capitalized expenses to be deducted from capital.

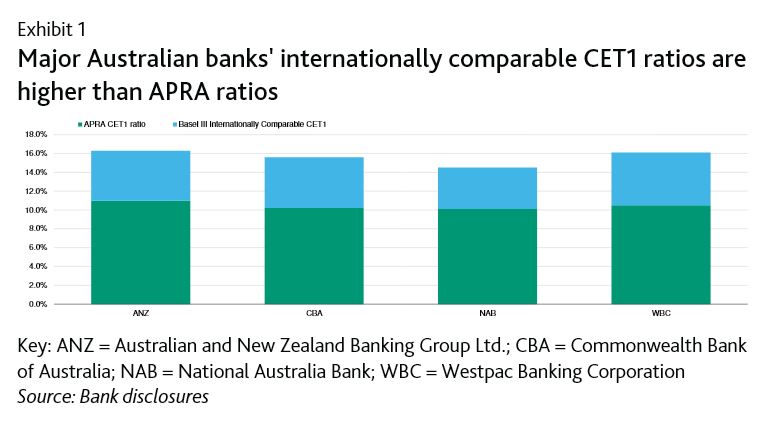

To facilitate comparison to their global peers, Australia’s four major banks – Australian and New Zealand Banking Group Ltd., Commonwealth Bank of Australia, National Australia Bank Limited and Westpac Banking Corporation – have begun reporting their own calculations of internationally comparable Common Equity Tier 1 (CET1) capital ratios. On average, these self-reported ratios are 520 basis points higher than their headline regulatory CET1 ratio.

Conservative RWA calculations are the biggest driver of the differences between APRA and internationally comparable capital ratios Major Australian banks’ internationally comparable CET1 ratios are higher than APRA ratios

We note that APRA’s proposals come at time when other regulators are also proposing changes to their capital frameworks following the finalization of the Basel III capital rules by the Basel Committee. For example, Sweden’s regulator has proposed moving mortgages’ 25% risk-weight floor to Pillar I from Pillar II, which will increase RWAs and lower Swedish banks’ reported CET1 capital ratios. As a result, the difference between Australian bank capital ratios and their global peers may start to narrow, irrespective of APRA’s proposals. Depending on the outcome of a consultation on the discussion paper , APRA expects to release draft prudential standards in 2019 and finalise the standards by mid-2020.

Note: The bank ratings shown in this report are the bank’s deposit rating, senior unsecured debt rating and Baseline Credit Assessment